Network Metrics Point to Seller Exhaustion

Bitcoin may be entering a recovery phase as key on-chain indicators suggest a cooling in speculative activity. According to Glassnode, the Short-Term Holder Realized Value to Transaction Volume (STH RVT) ratio has compressed to cycle lows. This signals that realized profits remain subdued, relative to Bitcoin’s overall network valuation—a trend that typically surfaces during “market detox” periods.

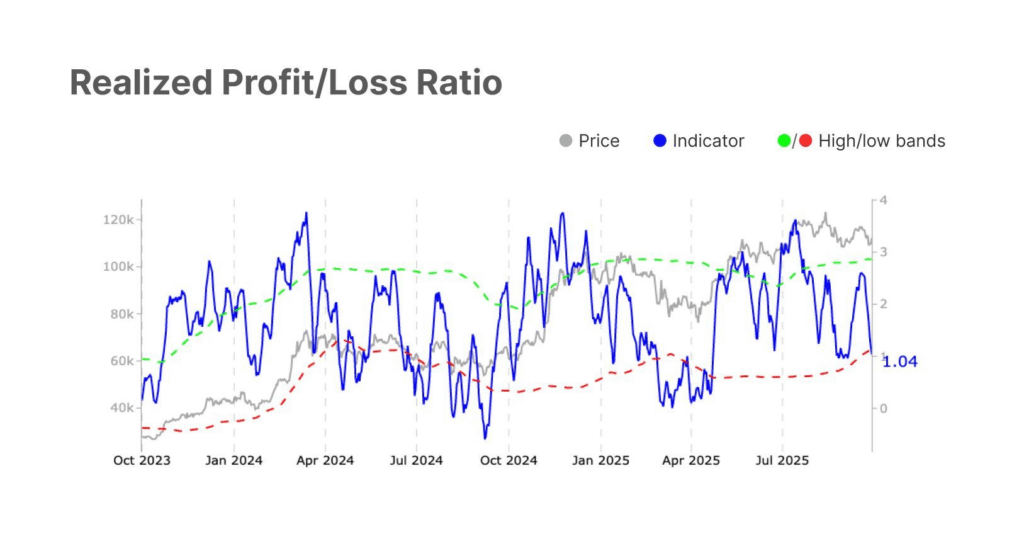

Such phases often mark the transition from aggressive speculation to consolidation, setting the stage for healthier price recoveries. Supporting this view, Glassnode also reports that the Realized Profit/Loss Ratio has declined from 2.2 to 1.0, suggesting a balance between gains and losses. This balance historically hints at seller fatigue, a condition where downward pressure eases and buying interest starts to re-emerge.

“Lower realized profits often reflect a market waiting for conviction,” — Glassnode analysts

Price Action Hints at Potential Breakout

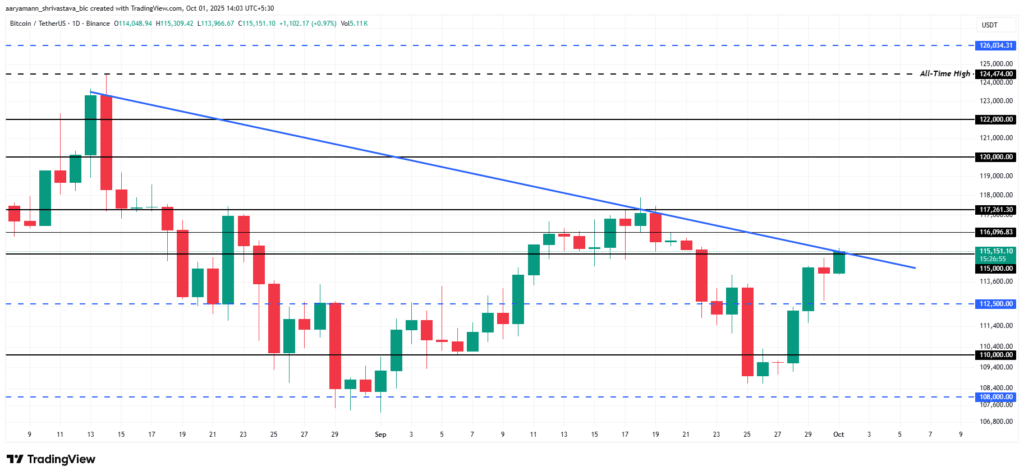

Bitcoin is currently trading near $115,151, holding a critical support at $115,000 while attempting to break free from a two-month downtrend. A move above $116,096 could spark a push toward $117,261, with bullish sentiment gaining traction if $120,000 comes into play.

However, failure to defend current levels could trigger a decline to $112,500 or even $110,000, potentially extending the bear cycle. For now, the market appears to be in a neutral zone, with both bulls and bears assessing the next move in Bitcoin’s ongoing cycle.

Comments are closed.