Bitcoin Rebounds From $88.4K as Rare On-Chain Signal Hints at Possible Bottom

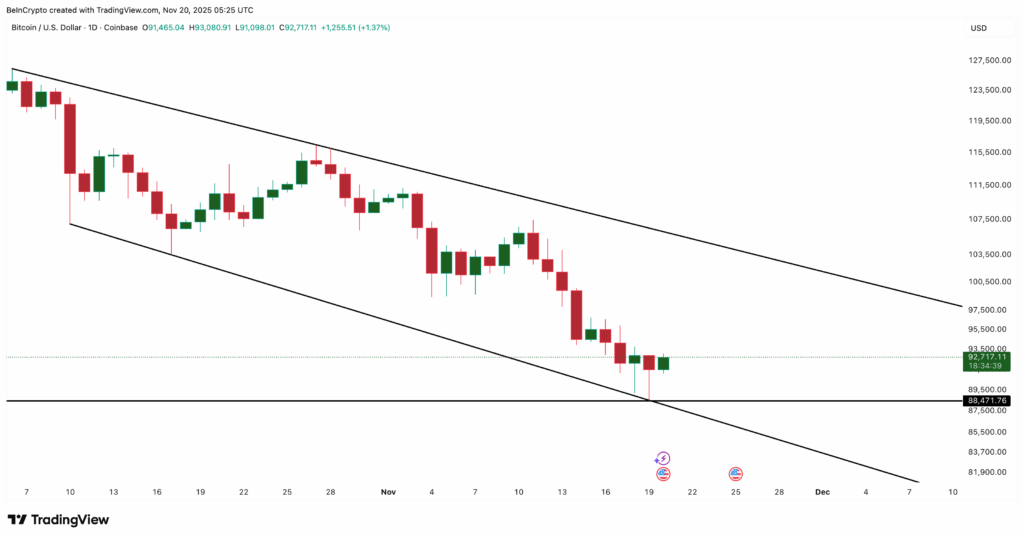

Bitcoin delivered a sharp intraday rebound on Wednesday, jumping nearly 5% from its low near $88,400, right at the edge of the key falling-wedge support. Despite the strength of the move, the daily chart shows only a modest 2% gain—an underrepresentation of the intensity behind the recovery.

Source: TradingView

A Falling-Wedge Bounce Meets a Rare On-Chain Signal

Bitcoin has been sliding within a falling wedge for weeks, and today’s reaction confirms the lower boundary remains active. What makes this particular bounce notable is the on-chain divergence that formed in the background.

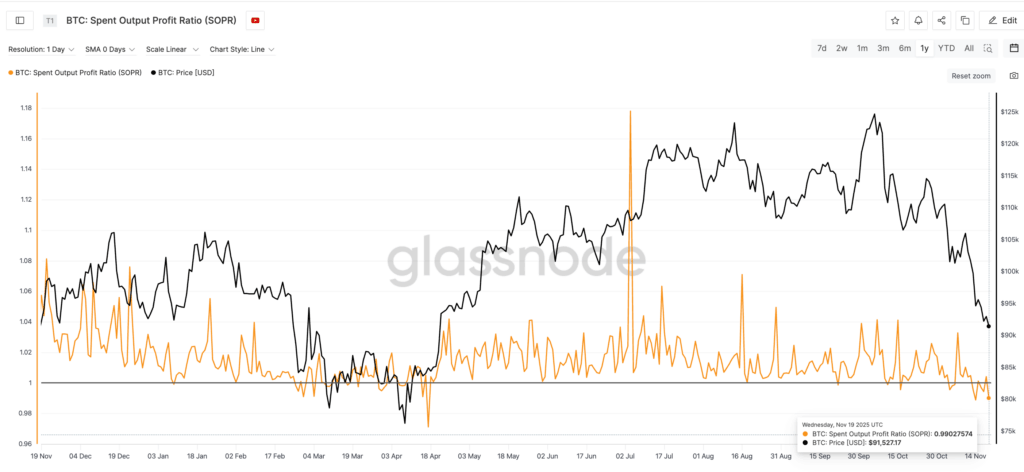

Between November 14 and November 19, Bitcoin formed a lower low, yet SOPR (Spent Output Profit Ratio) printed a higher low, rising from 0.98 to 0.99. Since SOPR under 1 indicates most coins are being sold at a loss, a rising SOPR during a price decline suggests holders are refusing to sell cheap—a sign of strong conviction rather than panic.

Source: Glassnode

A similar setup emerged between March 30 and April 8, when Bitcoin made a lower low while SOPR rose from 0.994 to 0.998. That divergence marked a bottom, followed by a rapid 46% rally from $76,270 to $111,695. Now, the same style of divergence is flashing again inside the wedge.

While technical divergences can fail during steep downtrends, on-chain divergences carry more weight because they reflect actual spending behavior, not just chart structure.

Major Supply Barriers Still Stand in Bitcoin’s Way

For this divergence to translate into a trend reversal, Bitcoin must clear two major URPD supply zones, according to Glassnode data. The first sits near $95,900, and the next clusters around $100,900—areas where large groups of holders last moved coins and may look to exit again.

Bitcoin must first reclaim $95,700, the same level that rejected the price on November 15 and aligns with the first URPD cluster. A break above that could allow BTC to target $100,200, a Fibonacci resistance just below the heavy supply at $100,900. Only a move above this region would fully confirm a bullish reversal in the falling wedge.

If, however, Bitcoin loses the wedge low near $88,400, the market risks additional downside. For now, the clean wedge bounce combined with a rare SOPR divergence increases the odds of a bottom—but the resistances at $95,700 and $100,200 remain the decisive battleground.

Comments are closed.