Bitcoin Recovery Brings Relief to ETFs After Steady Outflows

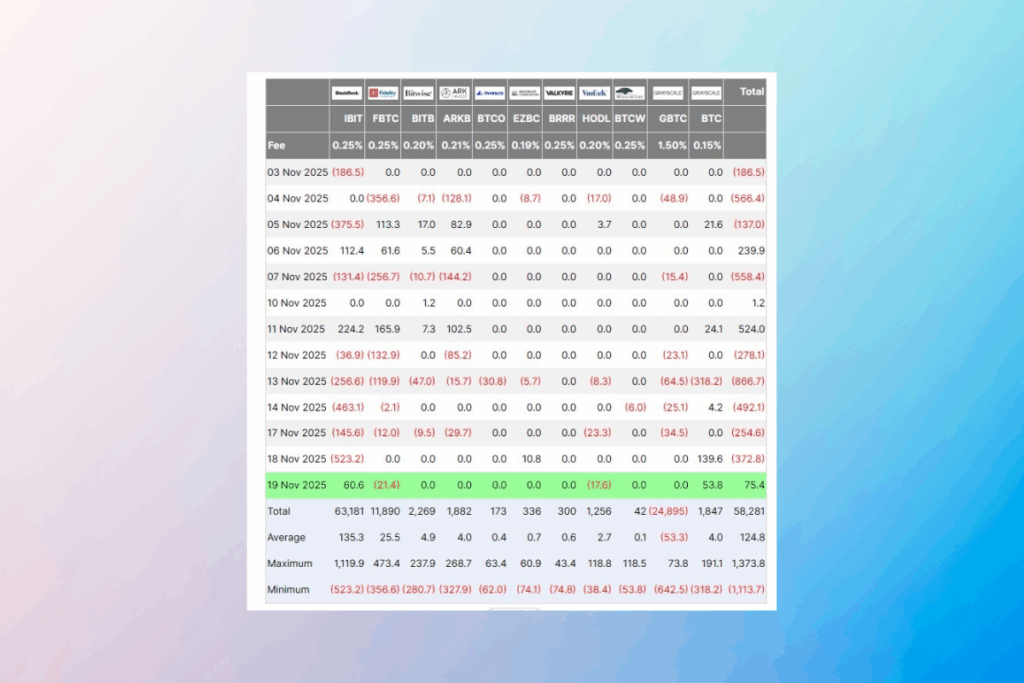

Spot Bitcoin ETFs listed in the US had $75.4 million in net inflows on Wednesday, ending a five-day outflow trend. This occurred as the price of Bitcoin returned to $92,000. According to data from Farside Investors, inflows totaled $60.6 million on Wednesday, with BlackRock’s iShares Bitcoin Trust (IBIT) leading the way. This amount, nevertheless, falls well short of the $523 million in outflows from the day before. With $53.8 million in inflows, the Grayscale Bitcoin Mini Trust ETF (BTC) also had a successful day.

However, on the same day, a total of $39 million was removed from Fidelity and VanEck’s spot Bitcoin ETFs. The rally coincided with Bitcoin recovering the $92,000 level. After a steady fall throughout the course of the week, this suggests a small stability.

Investors Re-Enter Market Amid Short-Term BTC Dip

The $75.4 million influx into US-listed spot Bitcoin ETFs on Wednesday provides a glimpse of selective investor confidence following a difficult five-day run of net outflows over $868 million. Leading the way were Grayscale’s Mini Trust and BlackRock’s IBIT, which demonstrated how institutional and retail players are deliberately reentering the market at the $92,000 BTC level. These targeted inflows indicate that some investors are taking advantage of short-term declines to prepare for possible end-of-year catalysts or market bounces, even though the overall sentiment is still cautious.

Spot Bitcoin ETFs Show Strong Participation Despite November Outflows

Despite November’s overall outflows approaching $3 billion, US spot Bitcoin ETFs experienced a strong spike in trading volume, reaching $6.89 billion on Wednesday. This is an 18% rise from the day before. This rise shows that certain market players are staying in the market. Ahead of possible year-end bullish catalysts, some are actively buying the drop or reallocating assets. The pattern highlights a complex market dynamic in which astute investors strike a balance between risk and opportunity, taking advantage of volatility in the $88,000–$92,000 BTC region to maximize entry possibilities.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.