Featured News Headlines

Bitcoin Faces Sharp Reversal as Liquidity Tightens, NYDIG Warns

Bitcoin’s explosive rally into October has now flipped into a sharp retreat, with the very forces that pushed it higher becoming the drivers behind its decline, according to NYDIG. In a recent note, NYDIG head of research Greg Cipolaro warned that a combination of crypto treasury reversals, ETF outflows, and shrinking stablecoin supply now point to “actual capital flight,” not just weak sentiment.

A Reflexive Loop in Reverse

Cipolaro explained that spot Bitcoin ETF inflows and strong digital asset treasury (DAT) demand were core contributors to Bitcoin’s previous cycle peak. But a major liquidation event in early October broke that momentum. ETF inflows swung into outflows, treasury premiums collapsed, and stablecoin supply began slipping — all indicators that liquidity is leaving the system.

“Once that loop breaks, the market tends to follow a predictable sequence,” he said. Liquidity tightens, leverage fails to rebuild, and once-powerful narratives stop converting into real money flows. According to Cipolaro, this pattern has appeared in “every major cycle.”

ETF Outflows Rise as Bitcoin Dominance Climbs

The blockbuster success of spot Bitcoin ETFs has now become a “meaningful headwind.” While flows have reversed, Cipolaro noted that broader forces — from global liquidity shifts to market structure stress — continue to shape Bitcoin’s price action.

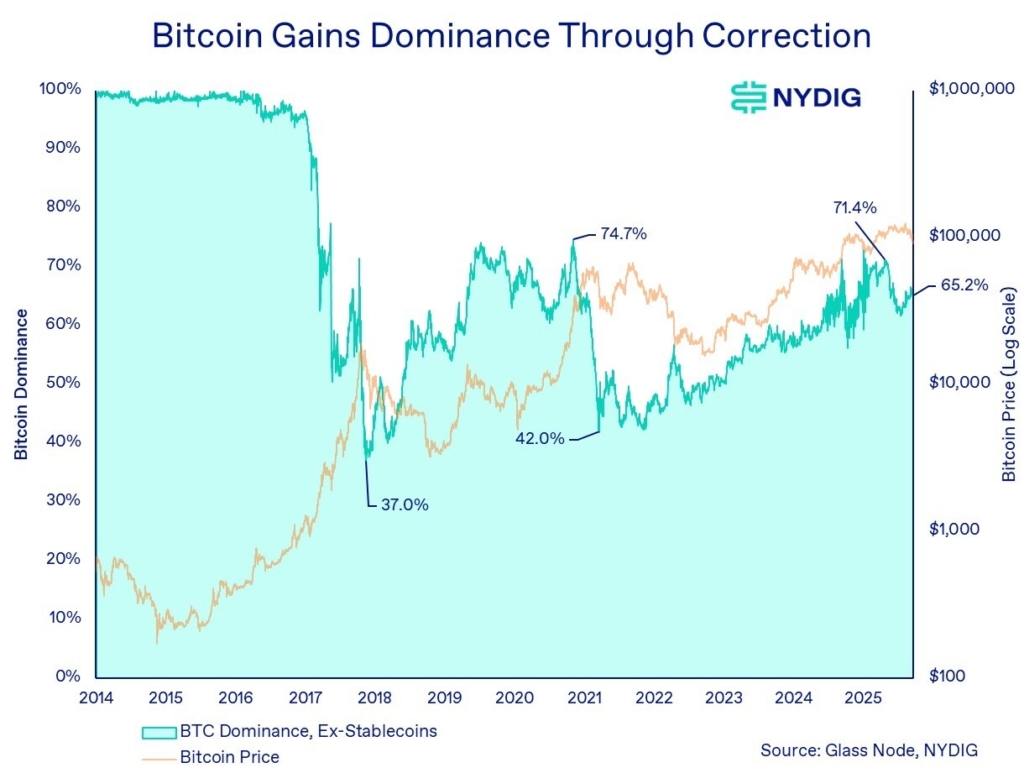

One clear trend is rising Bitcoin dominance, which surpassed 60% in early November before easing to around 58%. During drawdowns, he said, capital often consolidates into the most liquid asset, reinforcing Bitcoin’s position as the ecosystem’s anchor.

DAT and Stablecoin Demand Softens

Both DATs and stablecoins had been steady sources of structural Bitcoin demand. But Cipolaro pointed out that DAT premiums have compressed across the sector, while stablecoin supply has fallen for the first time in months — signs that liquidity is being pulled from crypto markets.

Still, he emphasized that no DAT has shown signs of distress. Leverage is modest, obligations remain manageable, and many structures can pause payouts if necessary.

Long-Term Outlook Unchanged

Despite short-term turbulence, Cipolaro reiterated that Bitcoin’s long-term thesis remains solid, supported by growing institutional interest and increasing recognition of Bitcoin as a neutral, programmable monetary asset.

“The cycle story is now asserting itself far more forcefully,” he said, adding that investors should brace for a path that may be “uneven, emotionally taxing, and punctuated by sudden dislocations.”

Comments are closed.