Featured News Headlines

- 1 Bitcoin Price Faces Critical Resistance Near $115,000

- 2 Resistance Mounts Around $115,000 — What’s Next?

- 3 What If Bitcoin Fails to Break Resistance?

- 4 Technical Indicators Hint at Bearish Pressure

- 5 Key Support and Resistance Levels to Watch

- 6 What Should Traders Expect Next?

- 7 Conclusion: Bitcoin at a Crossroads

Bitcoin Price Faces Critical Resistance Near $115,000

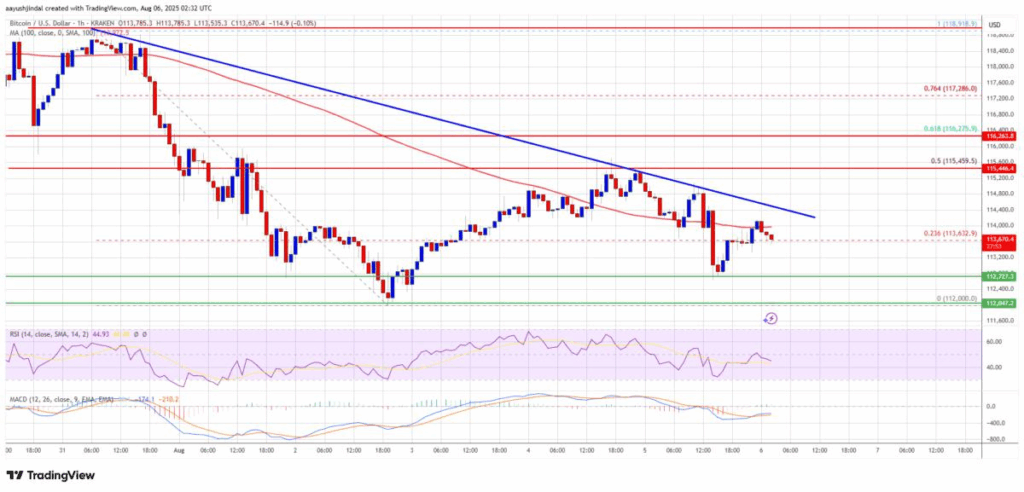

Bitcoin Price– Bitcoin (BTC) recently found solid support around the $112,000 level and initiated a recovery attempt, pushing prices above key resistance zones at $113,200 and $114,000. This rebound was promising, showing resilience after a recent dip, but the momentum is now facing stiff challenges ahead.

BTC climbed above the 23.6% Fibonacci retracement level from its recent swing high near $118,918 down to $112,000. However, bears are actively defending the $115,500 resistance, preventing Bitcoin from pushing further upward.

Resistance Mounts Around $115,000 — What’s Next?

On the hourly chart, Bitcoin is trading below the 100-period simple moving average (SMA) near $114,000, and a bearish trend line is forming with resistance around $114,400. This means Bitcoin’s upward moves are capped by strong selling pressure in this zone.

Immediate resistance sits at $114,000, but the critical levels to watch are $115,000 and $115,500. Breaking and closing above $115,500 could signal a strong bullish breakout, potentially accelerating BTC’s rally toward $116,500.

If bulls maintain control past this point, the next target is the $118,000 resistance zone, with the main psychological barrier and a possible peak at $120,000. Such a move would mark a decisive reversal from the recent downward momentum.

What If Bitcoin Fails to Break Resistance?

Failure to surpass the $115,000 resistance zone could cause Bitcoin to falter and enter a fresh corrective phase. The first support level to monitor is $113,200. If that cracks, $112,500 is the next key line defending Bitcoin’s downside.

Further losses could see Bitcoin testing the $112,000 support zone. A breakdown below this could accelerate selling pressure and push BTC toward $110,500 in the short term.

The ultimate bearish support to watch is near $108,500 — a critical level that has held as a floor in recent price action. If this level fails, BTC may resume a deeper decline.

Technical Indicators Hint at Bearish Pressure

- Hourly MACD: The Moving Average Convergence Divergence indicator is gaining momentum in the bearish zone, suggesting selling pressure remains dominant on short timeframes.

- Hourly RSI: The Relative Strength Index stands below the neutral 50 mark, reinforcing that bearish momentum currently outweighs bullish strength.

Key Support and Resistance Levels to Watch

- Major Support: $112,600, followed by $112,000 and then $110,500.

- Major Resistance: $115,000 and $115,500, with further targets at $116,500, $118,000, and psychological $120,000.

What Should Traders Expect Next?

Bitcoin’s near-term fate hinges on its ability to break above the $115,000-$115,500 resistance zone convincingly. Bulls need to push past these barriers to ignite fresh buying momentum and potentially trigger a larger rally.

Conversely, if bears hold firm at these resistance levels, expect a retest of lower support zones and the possibility of a continued downtrend.

Trading Tips:

- Monitor volume closely during any breakout attempts. Higher volume could confirm bullish strength.

- Keep an eye on the hourly MACD and RSI for shifts in momentum.

- Set stop-losses near key support levels ($112,500 or $112,000) to manage downside risk.

- Consider scaling into positions if Bitcoin breaks and sustains above $115,500 with strong conviction.

Conclusion: Bitcoin at a Crossroads

Bitcoin’s price action is currently battling a pivotal resistance zone between $115,000 and $115,500. A decisive breakout above this range could pave the way for gains back toward $120,000, rekindling bullish market sentiment.

However, failure to overcome this resistance will likely invite renewed selling pressure and potentially drag Bitcoin down toward the $108,500 support level. Traders and investors should stay alert for clear signals of direction before making major moves.

Stay tuned as Bitcoin navigates this crucial phase — the coming days will be key in determining whether bulls regain control or bears tighten their grip.

Comments are closed.