Featured News Headlines

BTC Price Action Surprises Traders with Late September Comeback

Bitcoin (BTC) is staging a dramatic late-September rebound as the monthly and quarterly close approaches, reigniting the tug-of-war between bulls and bears. After dipping near fresh lows last week, BTC price action surprised traders with a push back above $112,000, setting the stage for heightened volatility in the coming days.

Bulls Reclaim $112K, But Resistance Looms

Over the weekend, Bitcoin closed its weekly candle above $112,000, a level once considered out of reach just days ago. Data from Cointelegraph Markets Pro and TradingView confirmed the support holding into Asia’s Monday session, but analysts warn the move could be short-lived without stronger momentum.

Crypto investor Ted Pillows cautioned that the rebound mirrored Ethereum’s recovery, largely fueled by short liquidations:

“For a strong Bitcoin rally, a daily close above $113,500 is needed. Otherwise, BTC will most likely revisit its lows again.”

Popular trader Roman echoed the sentiment, forecasting sideways “ping pong” price action between $108,000 and $113,500 unless bulls retake the $118,000 zone with high volume.

Market watchers expect volatility to intensify with just 48 hours left before the monthly and quarterly close. At $112,000, BTC would secure 3% gains for September and 4.4% gains for Q3—numbers that fall in line with historical averages. As trader Daan Crypto Trades observed, Q3 has typically been Bitcoin’s weakest quarter, averaging around 6% gains. However, he noted the setup for a “very exciting” Q4 if history repeats itself.

Liquidity Games and CME Gaps

The move above $112K reshuffled exchange liquidity, liquidating over $350 million in positions—$260 million of which were shorts. According to CoinGlass data, liquidity clusters now hover near $113,000, with traders closely monitoring potential “magnet” zones both above and below.

Trader CrypNuevo suggested that bearish consensus may be misplaced:

“A drop below $100K seems to be the market consensus right now. So instead, I’m inclining more towards a recovery from here or the liquidity grab at $106.9K and then up.”

Current order-book data shows that a dip below $107,000 could trigger as much as $5 billion in long liquidations, amplifying caution among traders.

Meanwhile, CME Bitcoin futures opened with a new weekend gap—another liquidity magnet. Trader Killa noted that such gaps often fill within days:

“Since we have both monthly and quarterly closes, I believe they’re building long liquidity before taking out the weekend lows.”

Macro Spotlight: US Jobs Data and Fed Pressure

Beyond crypto-native factors, the macroeconomic stage adds another layer of uncertainty. US employment data headlines the week, with market participants eyeing its implications for the Federal Reserve’s rate-cut trajectory.

Fed Chair Jerome Powell, already under political fire from President Donald Trump to accelerate easing, is balancing dovish signals with cautious language. The Fed delivered a 0.25% cut in September, but divisions remain within the FOMC on how fast to proceed.

Trump, meanwhile, has ramped up his criticism, even sharing a now-deleted post depicting Powell being fired. The pressure underscores how closely Fed policy is tied to risk asset performance, including Bitcoin.

Gold Shines While Bitcoin Lags

While Bitcoin claws back ground, gold has stolen the spotlight, surging to an all-time high above $3,800 per ounce. The move reflects weakening US dollar strength and has reignited calls for Bitcoin to eventually follow.

Market insights firm Reflexivity Research pointed to the weakening Bitcoin/Gold ratio, suggesting investors currently prefer gold as a hedge. However, Andre Dragosch of Bitwise argued that Bitcoin’s lag is tied to its sensitivity to global growth expectations, while gold responds more directly to monetary policy shifts.

“Bitcoin will follow in gold’s footsteps with a significant rally,” Dragosch said, predicting BTC’s move will simply arrive with a delay.

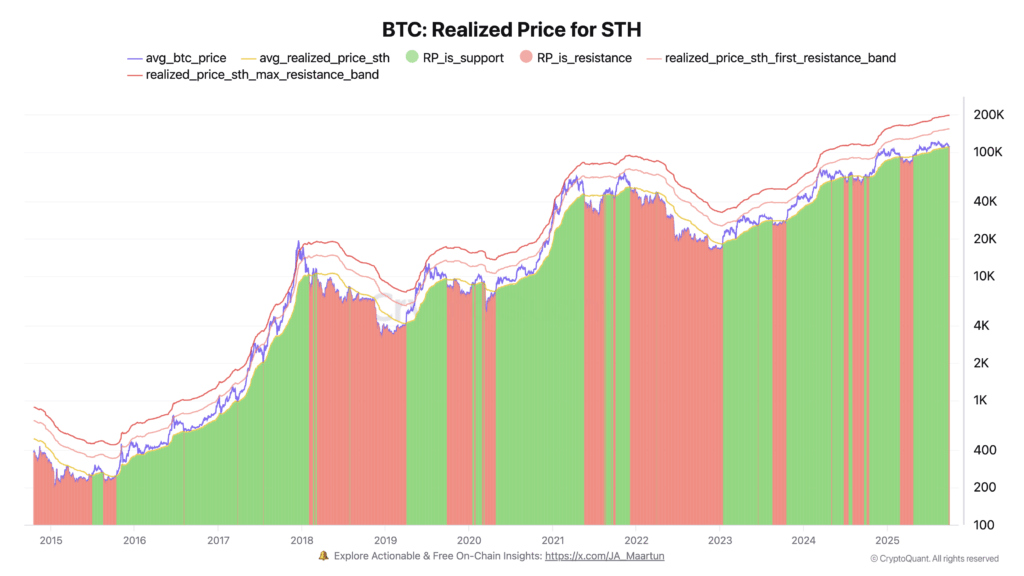

On-Chain Divide: Newbies Panic, Veterans Hold

On-chain data reveals a familiar split between market participants. CryptoQuant highlighted that short-term holders (STHs) panic-sold during the dip, often at a loss, while long-term holders (LTHs) held firm.

Analyst Woo Min-Kyu compared the setup to late 2024, when short-term capitulation preceded a major rebound:

“Historically, these low-ratio zones often align with price bottoms, marking the late stage of corrections.”

With the average STH cost basis at $109,800, Bitcoin’s rebound above $112,000 may be enough to relieve immediate pressure—but whether bulls can maintain control through the monthly close remains the big question.

Comments are closed.