Featured News Headlines

Bitcoin Holds Strong Above $100K as Whales Drive Massive Accumulation

Bitcoin has demonstrated remarkable resilience in recent days, holding strong above the crucial $100,000 support level despite turbulent market conditions. What many interpreted as a potential bearish phase has instead revealed the market’s underlying strength, signaling confidence among both retail and institutional investors.

Bitcoin Holds the Line at $100K Support

Even amid heightened volatility, Bitcoin has avoided a break below $100,000, maintaining a solid footing that underscores structural support within the market. Analysts suggest that this stability highlights the cryptocurrency’s robustness, with dips largely driven by minor profit-taking rather than widespread panic or capitulation.

The market’s ability to absorb selling pressure without a major breakdown points to a bullish foundation that may support further gains in the near term.

Realized Profit/Loss Ratio Confirms Investor Confidence

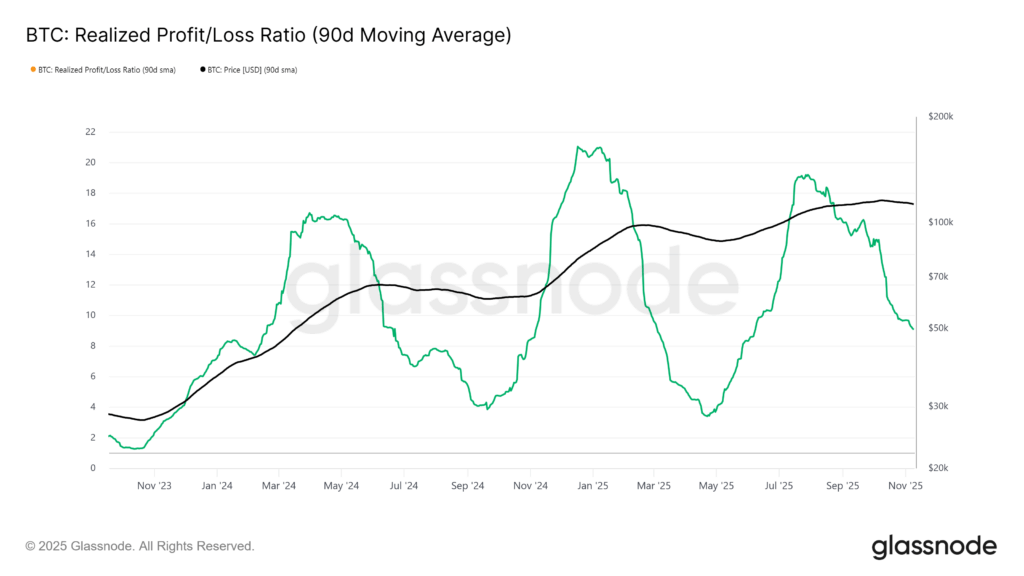

On-chain metrics provide additional insights into Bitcoin’s performance. The Realized Profit/Loss (P/L) Ratio, which measures net profitability among holders, currently shows a 90-day simple moving average (SMA) of 9.1. This represents a moderate cooldown from July’s peak but remains more than twice as high as previous mid-cycle bear phases, where the ratio dropped to 3.4.

This data suggests that investors are not panicking. Instead, recent price dips have been characterized by temporary profit-taking, rather than forced selling. The sustained profitability across Bitcoin holders reinforces long-term confidence in the market, indicating that participants remain optimistic despite short-term fluctuations.

Whales Accumulate Aggressively

A key factor behind Bitcoin’s recent resilience is the activity of large-scale investors, or whales. On-chain data shows that addresses holding between 10,000 and 100,000 BTC have purchased more than 300,000 BTC this week alone, following a brief dip to $101,000.

This massive accumulation, valued at nearly $32 billion, demonstrates strong conviction among whales, who appear to be taking advantage of temporary weakness to strengthen their positions. Their buying has been a major driver of Bitcoin’s recovery, pushing prices past $105,000 and reinforcing the bullish momentum.

BTC Price Recovery and Near-Term Outlook

At the time of reporting, Bitcoin trades at $106,148, comfortably above the $105,085 support level. The recent surge, fueled by whale accumulation, helped BTC surpass critical psychological resistance, signaling renewed investor optimism.

Market analysts note that if current trends continue, Bitcoin could rally toward $108,000 and potentially retest $110,000 in the coming days. Sustained demand and stable macroeconomic conditions would further bolster this momentum.

However, traders should be aware of potential short-term fluctuations. If profit-taking resumes, Bitcoin could slip below $105,000 and briefly retest support at $101,477, temporarily pausing the bullish trajectory.

Why This Matters for the Crypto Market

Bitcoin’s current resilience is significant for several reasons. Market sentiment shows that investors are maintaining confidence despite short-term volatility, suggesting underlying strength in the crypto ecosystem. Whale accumulation is another key factor, as large-scale holders are actively strengthening their positions, signaling sustained long-term bullish sentiment. Additionally, profit stability remains robust, with a high Realized P/L Ratio indicating that most holders are still in profit, which reduces the likelihood of panic-driven selling and supports a steady market outlook.

Together, these factors suggest that Bitcoin’s foundation remains robust, setting the stage for potential upward movements and highlighting the cryptocurrency’s enduring role as a key market leader.

Bitcoin Eyes Higher Ground

In summary, Bitcoin’s ability to maintain support above $100,000, combined with whale-driven accumulation and positive profitability metrics, indicates strong underlying market strength. While short-term corrections remain possible, the current trajectory points to potential upside, with BTC eyeing $108,000 and beyond if bullish momentum continues.

Investors and market observers will be watching closely as Bitcoin navigates these key levels, balancing short-term volatility with long-term structural support.

Comments are closed.