Featured News Headlines

Bitcoin Strengthens Despite Slower Institutional Buying

Bitcoin (BTC) continues to signal improving market confidence as the world’s largest cryptocurrency gradually strengthens after weeks of consolidation. Yet, investor hesitation remains, with many questioning whether current conditions justify renewed accumulation despite improving macroeconomic sentiment.

Economic Data Supports Bitcoin’s Positive Outlook

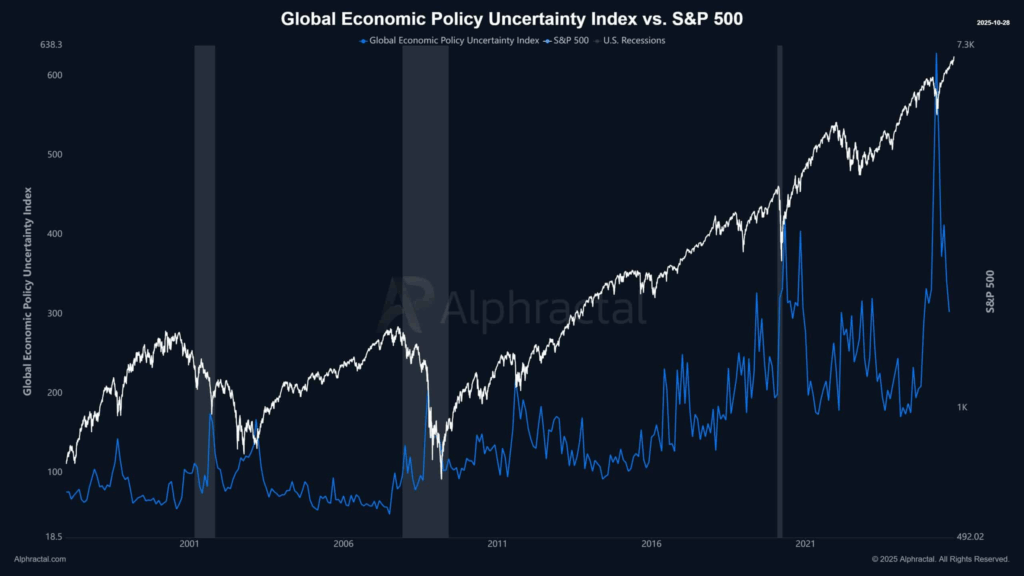

Recent findings from Alphractal reveal that the Global Economic Policy Uncertainty Index has been declining—an indicator historically aligned with stronger risk appetite and capital returning to the market.

Data also show that Bitcoin has outperformed traditional equities, with Curvo reporting a 69.5% return compared to just 10.1% for the S&P 500. This pattern mirrors previous cycles, suggesting that Bitcoin could continue to outperform major indices if current trends persist.

In Asia, Korean investors appear to be leading the charge, as shown by the Korean Premium Index, which reflects renewed buying interest following a brief slowdown in trading activity. Sentiment across the region has shifted bullish, signaling growing optimism among retail traders.

Expansion Signals Emerge, But Growth May Be Slow

On-chain data highlights potential expansion in the short term. The Short-Term Holder Spent Output Profit Ratio (STH-SOPR), when aligned with Bollinger Bands, indicates that Bitcoin’s price has moved above its middle band—traditionally a bullish signal. Analysts interpret this as an early sign of upward momentum, with short-term gains possibly capped near 1.02.

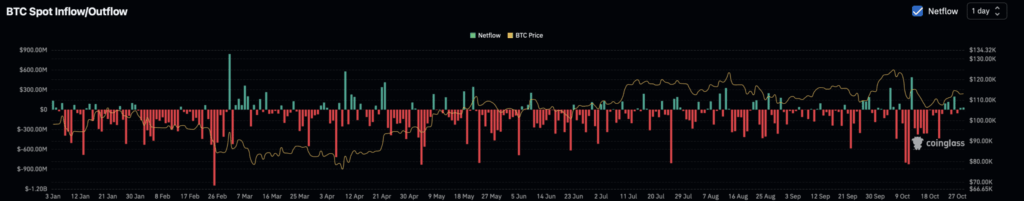

Still, institutional participation remains muted. According to Glassnode, daily purchases from large investors have dropped from over 2,500 BTC to below 1,000 BTC, which could slow Bitcoin’s upward trajectory in the near term.

Fed’s Next Move Keeps Markets on Edge

Investor focus now shifts to the Federal Reserve’s upcoming FOMC meeting, where markets expect a 25 basis point rate cut. Such a move could stimulate liquidity and potentially benefit risk assets like Bitcoin.

However, caution prevails. Retail spot traders have reportedly sold around $56 million in BTC over the past two days—an adjustment that analysts view as neutral rather than bearish.

Shawn Young, Chief Analyst at MEXC, told AMBCrypto, “Muted institutional and retail participation in Bitcoin, despite the widely anticipated Federal Reserve rate decision, signals growing liquidity caution in today’s volatile macro landscape.”

While optimism is building, Bitcoin’s next major rally may depend on whether institutional demand returns and the Fed delivers the expected boost to market confidence.

Comments are closed.