Featured News Headlines

Bitcoin Options Flows Hint at Mild Bullish Sentiment, Not Full Throttle Rally

Bitcoin Options – Bitcoin’s recent move above $120,000 has sparked renewed interest in the options market, but not with the kind of conviction typically seen in full-blown bull runs. According to on-chain analytics firm Glassnode, traders are taking modest long positions, signaling cautious optimism for further upside in what many call “Uptober.”

BTC Options Cluster Between $100K–$120K, Light Interest Above

Glassnode’s latest insights, shared Friday on X, show that call options are clustered between $100,000 and $120,000, reflecting a bullish but conservative outlook. These options give traders the right to buy Bitcoin at a set price, so increased volume here typically implies confidence in a continued rally — albeit not one expected to soar far beyond the current range.

The lack of significant call interest at $130,000 underscores that sentiment. The market seems unconvinced that Bitcoin will push much higher in the near term.

Strategic Bets on a Distant Moonshot: $300K Calls

Interestingly, some investors are making long-dated bets with Out-of-the-Money (OTM) call options at the $300,000 strike price. While seemingly extreme, these are “cheap convexity bets” — low-cost wagers that offer massive upside if Bitcoin sees a major breakout in the future.

ETH Options Reflect Caution Amid BTC Dominance

Meanwhile, the Ethereum options market tells a different story. Traders are reportedly selling ETH puts expiring October 10, along with BTC $120K calls, signaling an expectation of sideways consolidation rather than a breakout. This move helps them earn premiums while betting on price stability.

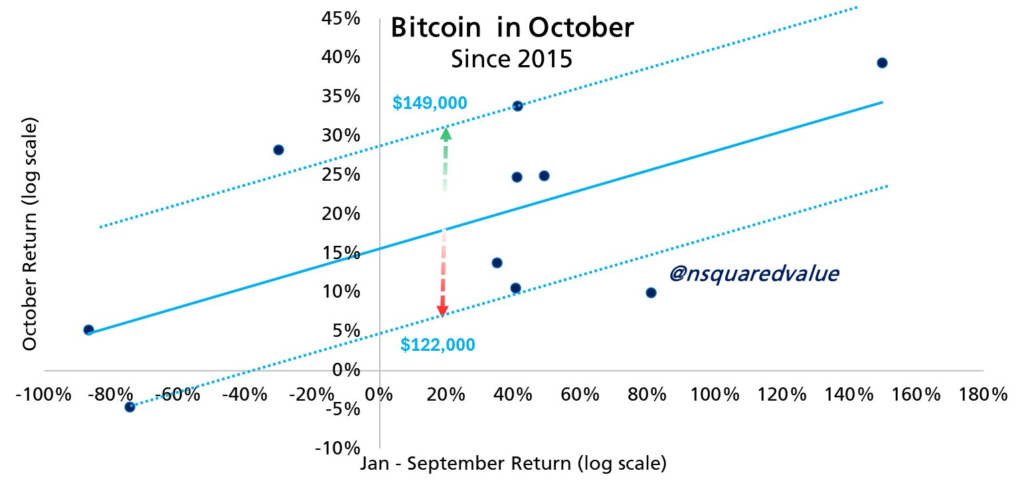

Analyst Predicts Uptober Range: $122K–$149K

Crypto analyst Timothy Peterson adds historical context, forecasting a +7% to +31% price increase for Bitcoin this October. With Bitcoin up 20% year-to-date, he expects BTC to land between $122,000 and $149,000, marking a potentially softer Uptober than in past bull years.

Despite the breakout, it seems cautious optimism is the dominant theme this October.

Comments are closed.