Featured News Headlines

Bitcoin Seasonal Trends Under Pressure While Whales Accumulate Slowly

Bitcoin (BTC) is challenging its historic strong November trend, with analysts warning that the cryptocurrency may close the month in the red, but some indicators hint that demand could rebound soon.

November’s Seasonal Edge Under Threat

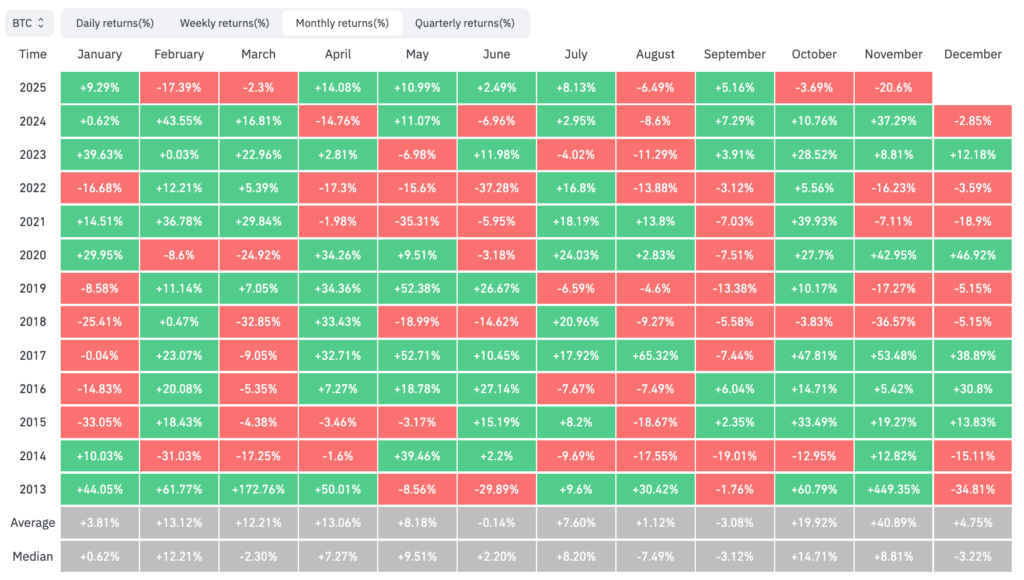

Historically, November has been Bitcoin’s strongest month, delivering an average return of 40.82%, according to CoinGlass. October, however, defied its usual performance, closing down 3.69%, despite typically yielding gains of around 19.92%. As of publication, Bitcoin trades at $87,305, roughly 20.60% below its price at the start of November, signaling a rare deviation from its seasonal patterns.

Bitfinex analysts noted that “historic seasonality metrics have failed to hold up” this quarter, highlighting the unpredictability that traders now face.

Whale Activity Shows Early Signs of Life

Despite the recent downturn, some market participants see opportunity. Analyst Merlin The Trader highlighted earlier this month that low sentiment combined with bullish seasonality could create a favorable setup for November. Bitfinex analysts also pointed out that this is only the third time since early 2024 that Bitcoin’s price has fallen below the lower band of the short-term holders’ cost-basis model, with these holders having an average realized price of $86,787.

The recent decline, attributed to excessive buying around $106,000 and $118,000, has forced some holders to capitulate at a loss. Yet, whale activity appears to be slowly rebounding: crypto sentiment platform Santiment reported that wallets holding at least 100 BTC have risen by 0.47% (91 wallets) since Nov. 11.

Outlook for December

Even if November underperforms, December historically tends to be calmer, with average returns of 4.75% since 2013. Analysts see two possible paths for Bitcoin: either a meaningful resurgence in demand or a longer accumulation phase as the market absorbs the recent volatility.

As Bitcoin navigates these conflicting signals, traders are watching closely for early signs of a seasonal rebound or deeper market consolidation.

Comments are closed.