Featured News Headlines

U.S. Selling Pressure Eases After a Prolonged Decline

Bitcoin’s market structure is showing signs of its first coordinated improvement since early November, according to multiple analysts monitoring institutional behavior.

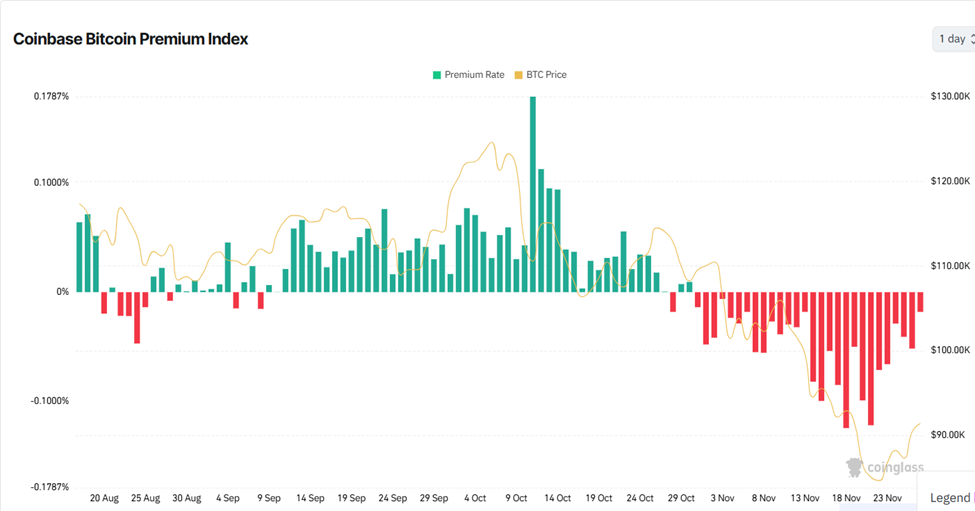

For most of the month, U.S.-based entities exerted persistent selling pressure. The Coinbase Premium Index, which tracks the price gap between Coinbase Pro—commonly used by U.S. institutions—and global exchanges, stayed negative for 22 consecutive days, the longest discount streak of 2025.

Analyst Crypto Goos noted that historically, “every time this indicator turns deeply red, Bitcoin dumps,” emphasizing that the shift seen this week marks a notable cooling of U.S. selling.

Market observer Dark Fost, who tracks the index daily, reported a sharp reduction in selling activity from institutions, professional traders, and U.S. whales following the peak fear level on November 21:

“The selling pressure from these actors has significantly decreased… if the trend continues, it should give the market some breathing room.”

Whales Go Long as Retail Stays Hesitant

Analysts say the most meaningful shift is occurring in derivatives and position data. For the first time on record, whales are opening more aggressive long positions than retail traders.

With the Coinbase Premium returning to positive territory, funding rates turning negative, and smaller investors remaining cautious, analysts argue that this market structure typically precedes more sustainable upward movements.

Analyst Para Mühendisi commented:

“The uptrend will probably continue for a while longer. Maybe until the end of the year.”

Likewise, Daan Crypto Trades confirmed that spot market conditions are improving beneath the surface, driven by a gradually re-emerging premium and falling funding costs. He added that even modest improvements are meaningful after the “extreme” sell pressure seen earlier in November.

Macro Environment Turns Favorable: Dollar Softens, Yields Drop, ETF Flows Recover

Macro conditions are also shifting in Bitcoin’s favor. Analyst MV Crypto highlighted several broad market signals pointing to a risk-on environment, including a weakening U.S. dollar, declining bond yields, and renewed optimism across global markets.

Large-scale flows support this narrative. SpaceX transferred $105 million in Bitcoin to Coinbase Prime for custody, indicating increased institutional-grade activity.

After one of the most significant outflow periods on record, U.S. spot Bitcoin ETFs finally posted positive inflows on November 25 and 26, offering further signs of stabilization.

However, analyst Ted urged caution, stating that although the Coinbase Premium is recovering, rallies may still be vulnerable:

“Until this trajectory stabilizes in favor of the upside, most BTC rallies will be sold.”

A Market No Longer Falling—But Not Fully Recovered

Analysts broadly agree that the market is transitioning from prolonged weakness toward a potential recovery window. This view aligns with a recent BeInCrypto analysis pointing to ongoing liquidity concerns despite Bitcoin trading above $90,000.

With whales increasing long exposure, U.S. selling pressure easing, funding rates flipping negative, macro conditions improving, and ETF inflows returning, experts say Bitcoin is entering its first realistic opportunity for upside momentum since early November.

Comments are closed.