Featured News Headlines

Bitcoin Near $117K: Key Level Could Trigger New Rally

July brought renewed volatility to the Bitcoin [BTC] market, as a sudden spike in Coin Days Destroyed (CDD) signaled that long-dormant coins—worth over $421 million—had re-entered circulation. This surge in activity caught traders’ attention, yet the market remained impressively resilient.

Dormant Coins Move, But No Panic Selling

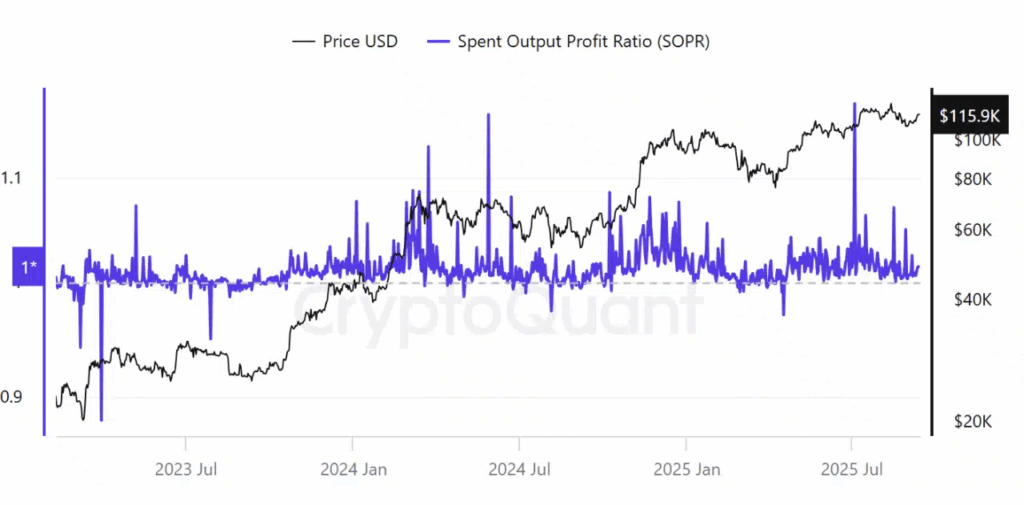

When large amounts of inactive BTC suddenly move, it often raises concerns of long-term holders (LTHs) exiting near a cycle top. However, this time, the data points to profit-taking, not panic. The Spent Output Profit Ratio (SOPR) climbed to 1.17 in July—up significantly from lows of 0.88 in March 2023 and 0.97 in April 2025—indicating that sellers were locking in gains.

“This isn’t fear-driven selling; it’s strategic profit-taking,” on-chain analysts suggested.

Despite this, Bitcoin maintained its bullish market structure, showing strength even amid heavy sell-side activity.

Miners Shift from Distribution to Restraint

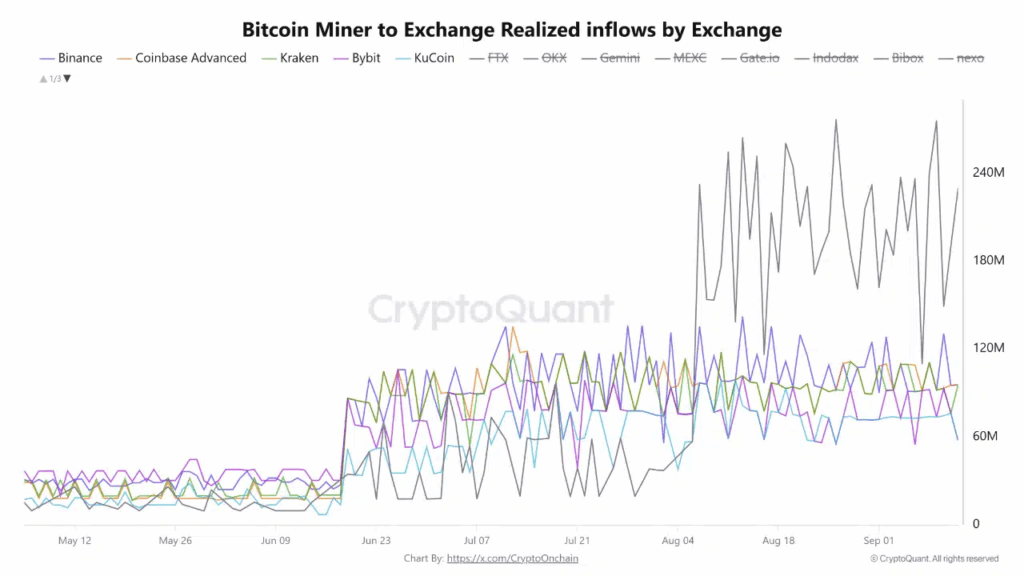

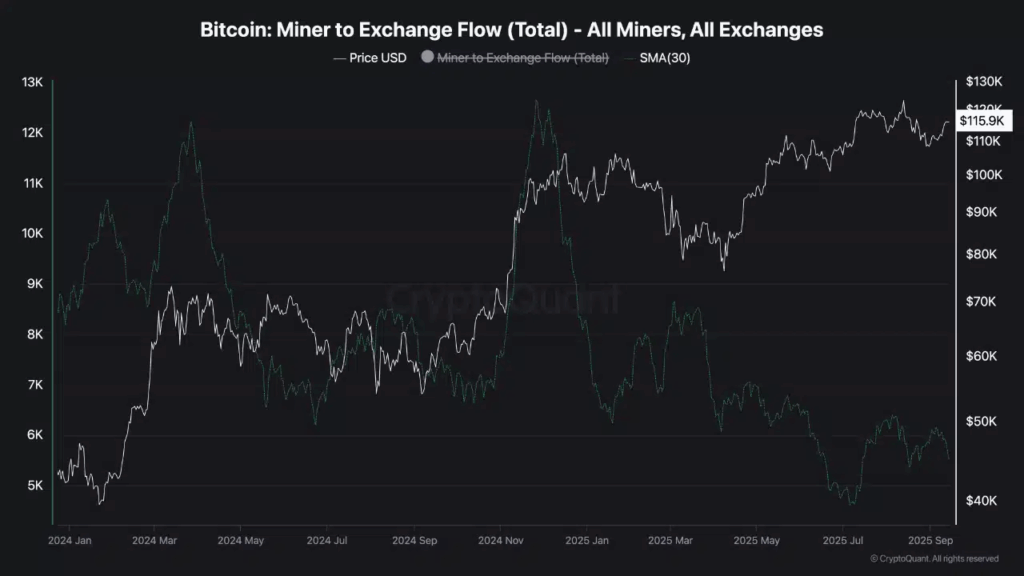

Miners also made headlines this summer. Large-scale transfers from ViaBTC on June 19 and F2Pool on August 7pushed miner inflow realized price to new highs. Most of these transactions were directed to major platforms like Binance and Coinbase Advanced, fueling short-term volatility.

But that trend has cooled. The 30-day average of Miner-to-Exchange Flow has now dropped to multi-month lows, hinting at reduced selling pressure—and possibly even early accumulation.

$117K: A Key Resistance Zone

Bitcoin is now hovering just below $117,000, a historically significant level marked by both the CVDD Channel and Fibonacci-Adjusted Market Mean Price. Past cycles show that this zone often acts as either a launchpad or a ceiling.

“A confirmed breakout above $118K could signal the next leg up,” analysts note.

For now, traders are watching closely as Bitcoin approaches this critical threshold.

Comments are closed.