Featured News Headlines

Price Action Shows Bulls Still in Control

Bitcoin continues trading near $116,565 after successfully reclaiming the crucial $115,000 level. The digital asset remains in a consolidation phase below $120,000, but technical indicators suggest buyers maintain control of the market momentum.

Recent price movement shows Bitcoin breaking above key moving averages on the 4-hour chart, including the 50-day, 100-day, and 200-day simple moving averages. These technical levels now cluster around $116,000 and could provide strong support if retested.

The $115,724 support zone has proven significant, matching horizontal resistance from late July trading sessions. This level has become a key battleground for bulls and bears, with successful defense potentially setting up further upside moves.

Stock Market Connection Reaches Historic Levels

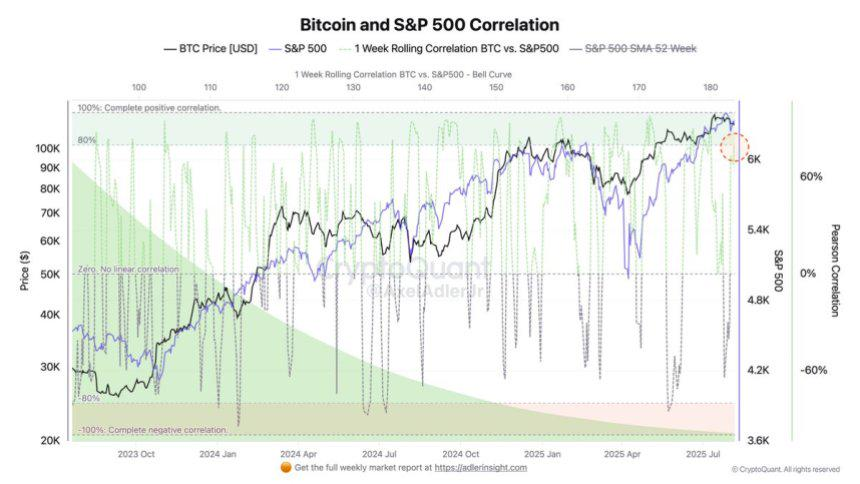

Bitcoin’s correlation with the S&P 500 has jumped to 80%, creating an unusually strong link between crypto and traditional equity markets. This connection means Bitcoin’s price movements increasingly mirror stock market performance, making macroeconomic factors more important than ever.

When equity markets rally, Bitcoin tends to follow suit. Conversely, stock market selloffs now trigger similar reactions in crypto markets. This relationship has transformed Bitcoin from a purely alternative asset into something that behaves more like a risk-on investment.

The correlation reading comes from a one-week rolling metric, which tends to be volatile by nature. Historical data shows such extreme correlation levels rarely persist for extended periods, typically reverting to lower levels within weeks.

Market Analysts Point to Macro Drivers

Top analyst Axel Adler notes that the current correlation highlights how macroeconomic forces now drive crypto markets. Interest rate expectations, liquidity conditions, and general risk appetite directly impact Bitcoin’s price action in this environment.

Federal Reserve policy decisions have become increasingly important for Bitcoin traders. When central bank signals suggest easier monetary policy, both stocks and crypto tend to benefit. Tighter policy expectations create headwinds for both asset classes.

Corporate adoption and institutional products like exchange-traded funds have strengthened the connection between traditional and crypto markets. Treasury allocations and mainstream investment vehicles have made Bitcoin more sensitive to broader financial conditions.

Technical Levels Signal Next Moves

The immediate resistance target sits at $122,077, matching levels last tested in mid-July. However, Bitcoin faces selling pressure around $117,000, suggesting short-term consolidation may continue before any significant breakout attempt.

Trading volume has decreased slightly following the recent breakout above moving averages. This reduction in volume suggests buyers may need additional momentum to push prices decisively higher toward resistance levels.

The moving average cluster near $116,000 represents a critical support zone. If Bitcoin holds above this level and the $115,724 horizontal support, bulls could target the $118,000 to $122,000 range for their next objective.

Risk Factors Could Reverse Gains Quickly

High correlation with stock markets creates both opportunities and risks for Bitcoin holders. A continued rally in U.S. equities could provide tailwinds for crypto prices, but any equity market pullback might amplify Bitcoin’s downside volatility.

Macroeconomic downturns pose particular risks in the current environment. Tightening liquidity conditions or unexpected Federal Reserve policy shifts could rapidly reverse market sentiment across both traditional and digital assets.

The short-term nature of correlation spikes means current relationships may change without warning. Traders monitoring both equity and crypto charts know that shifts in risk appetite could quickly alter Bitcoin’s price trajectory.

What Traders Are Watching

Market participants closely monitor traditional market indicators alongside crypto-specific metrics. Stock market opening sessions, Federal Reserve communications, and economic data releases now carry equal weight with Bitcoin-focused news.

Volume patterns remain crucial for confirming price moves. Higher volume on breakouts suggests stronger conviction, while lower volume rallies may prove less sustainable over time.

Support and resistance levels continue providing trading frameworks, but macro factors increasingly override technical considerations in short-term price movements.

Outlook Depends on Multiple Factors

Bitcoin’s near-term direction likely depends on continued stock market performance and broader economic conditions. Sustained equity rallies could support crypto prices, while market corrections might trigger synchronized selloffs.

The $115,724 support level remains the key line in the sand for bulls. Breaking below this area could trigger deeper pullbacks toward lower support zones and potentially end the current consolidation pattern.

Long-term adoption trends support bullish outlooks, but short-term price action has become increasingly tied to traditional market performance. This relationship creates both opportunities and challenges for crypto traders navigating current market conditions.

Comments are closed.