Featured News Headlines

Bitcoin and Inflation: Real Price Data Tells a Different Story

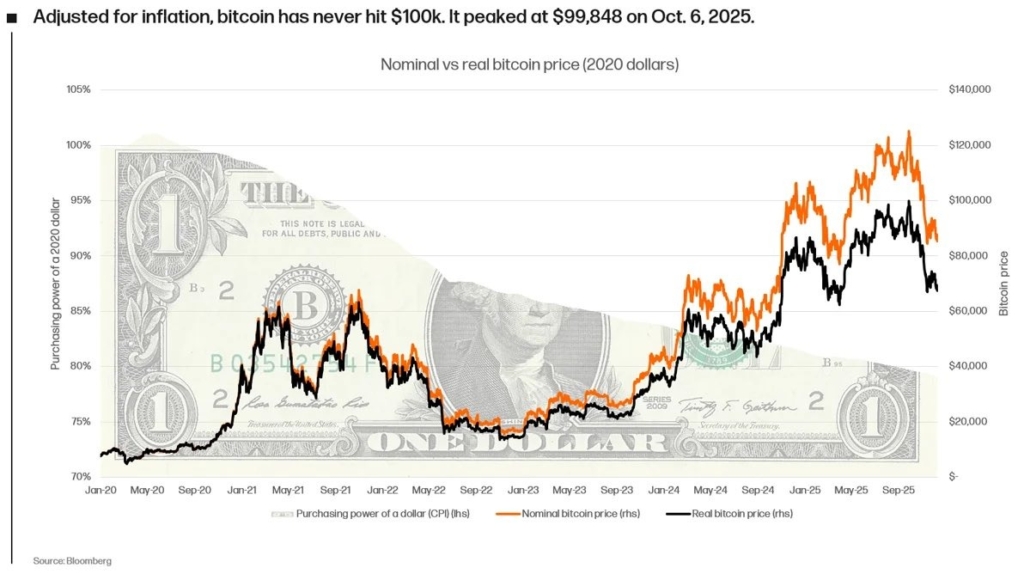

Bitcoin may have grabbed headlines after surging to a record above $126,000 in October, but when inflation is taken into account, the cryptocurrency narrowly missed a historic six-figure milestone. That’s according to Alex Thorn, head of research at Galaxy, who highlighted how rising prices have eroded the real value of Bitcoin’s gains.

Bitcoin and Inflation: A Different Perspective

Speaking on Tuesday, Thorn explained that when Bitcoin’s price is adjusted using 2020 dollars, it never truly crossed the $100,000 mark. “If you adjust the price of Bitcoin for inflation using 2020 dollars, BTC never crossed $100,000,” he said, noting that it peaked at $99,848 in real terms.

Thorn’s calculation factors in the Consumer Price Index (CPI), accounting for the gradual decline in purchasing power across every inflation report from 2020 to the present. CPI data, produced by the US Bureau of Labor Statistics, tracks inflation based on changes in the prices of a basket of goods and services.

CPI Data Highlights Ongoing Inflation Pressure

According to the Bureau’s November report, CPI rose 2.7% over the past 12 months, reducing the dollar’s buying power. Since 2020, the US dollar has lost around 20% of its value, with prices today roughly 1.25 times higher than they were five years ago. In practical terms, a dollar now buys only about 80% of what it could in 2020.

US inflation surged above 9% in mid-2022 during the COVID-19 pandemic and remains above the Federal Reserve’s 2% target, underscoring persistent economic pressure.

Dollar Weakness Fuels the “Debasement Trade”

Meanwhile, the US Dollar Currency Index (DXY) has continued to slide. The index is down 11% year-to-date, falling to 97.8, and reached a three-year low of 96.3 in September, according to TradingView. The DXY has been trending downward since October 2022 as the dollar weakens against other major currencies.

This backdrop has fueled interest in the so-called “debasement trade,” where investors look to assets perceived as better stores of value amid declining fiat purchasing power.

Comments are closed.