Featured News Headlines

“Dead Cat Bounce” Returns Bitcoin to $85K

Bitcoin’s price returned to its pre-Thanksgiving range, displaying a classic “Bart Simpson” chart pattern at the start of December. BTC/USD dropped as low as $85,616 on Bitstamp before a modest rebound. During this period, 24-hour liquidations exceeded $600 million, according to CoinGlass.

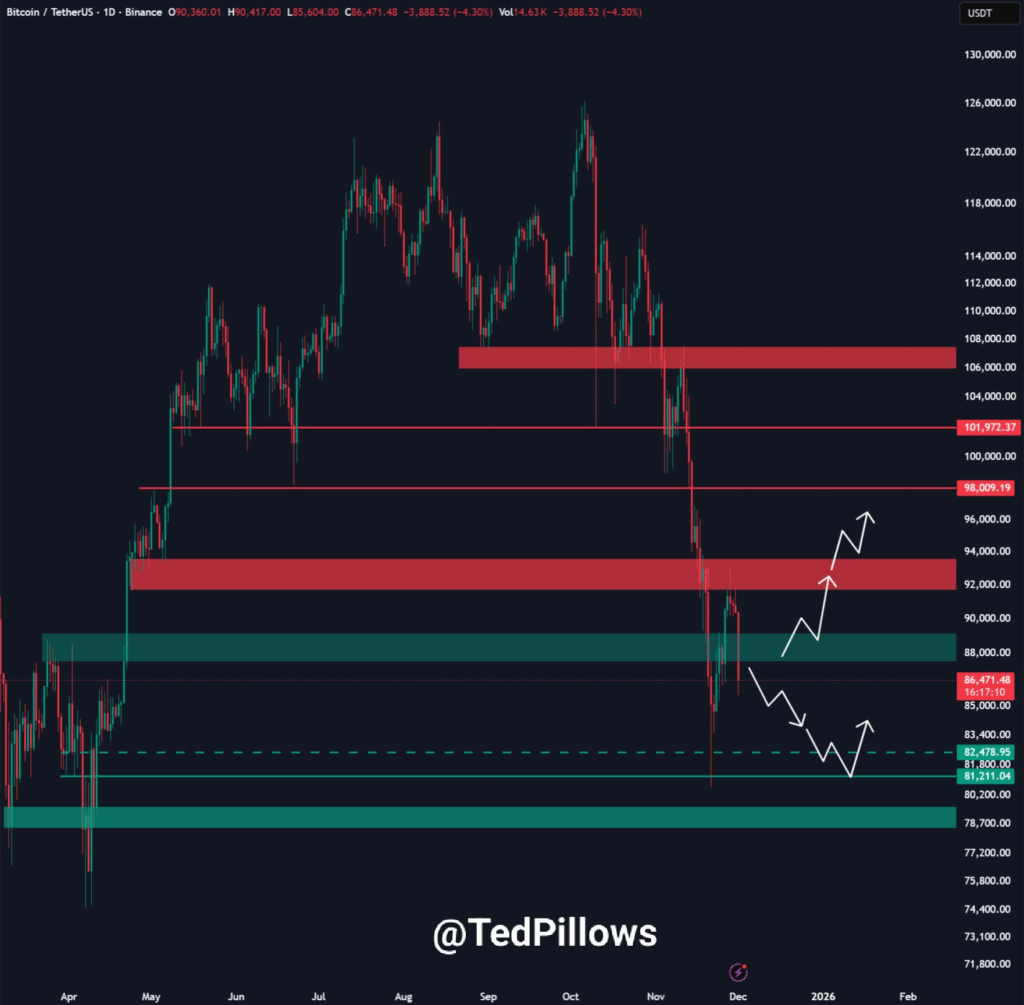

Some traders remain bearish on the outlook. Roman called a return to $50,000 “inevitable,” while investor Ted Pillows noted on X:

“Bitcoin needs to reclaim the $88,000-$89,000 level here; otherwise, it’ll drop towards the November low.”

Veteran trader Peter Brandt also revived the discussion of sub-$40,000 levels, warning that last week’s recovery above $90,000 may have been a “dead cat bounce.”

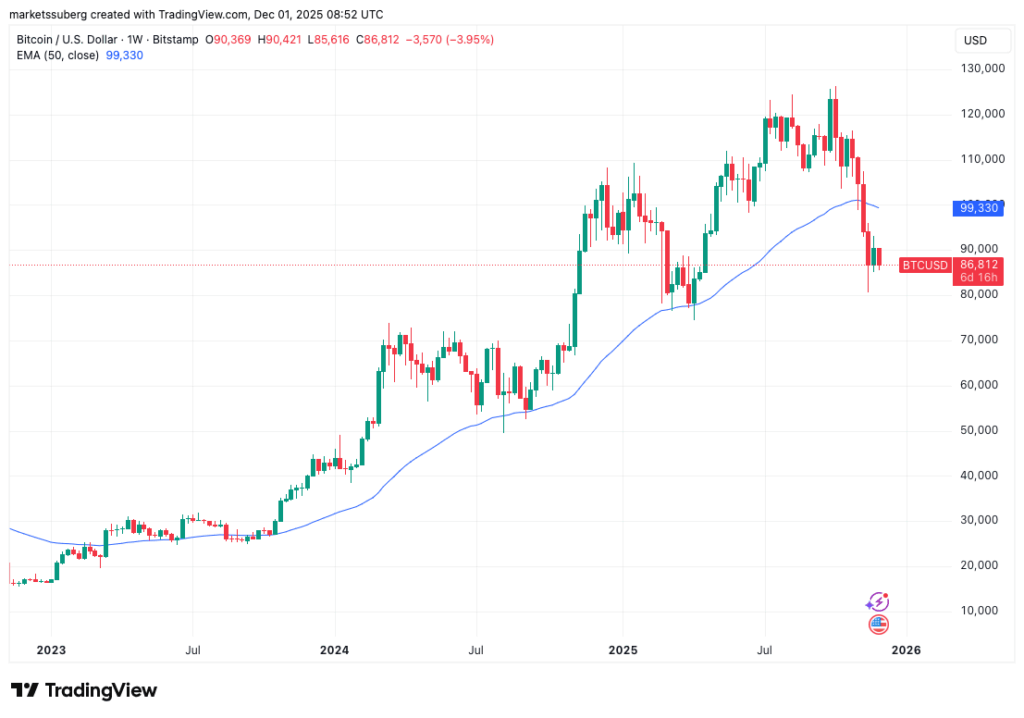

Meanwhile, some analysts see BTC/USD stabilizing within a range of $80,000–$99,000, citing key levels such as the 50-week EMA and 2025 yearly open as critical for trend confirmation. Trader CrypNuevo explained:

“Technically, I can’t support the bullish case until price is back above it ($99.8k).”

November Close Reflects Structural Bear Market, Not Fundamental Decline

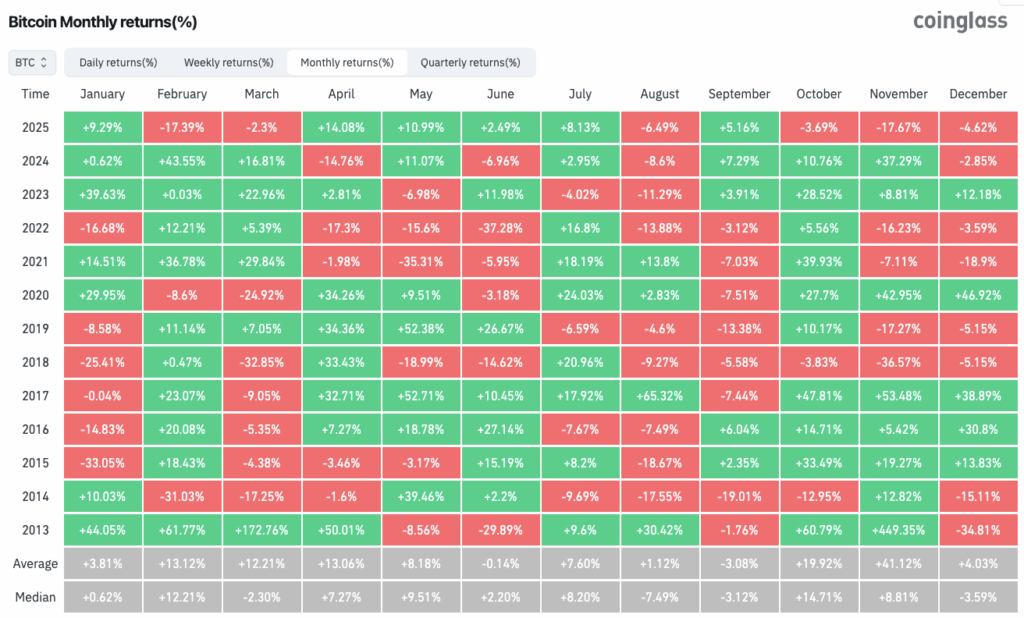

Bitcoin finished November down 17.7%, marking its worst monthly performance since 2018. Q4 losses now total 24.4%, comparable to the decline from $20,000 highs seven years ago.

The Kobeissi Letter highlighted system market weakness and thin liquidity, noting:

“As seen countless times this year, Friday night and Sunday night often come with LARGE crypto moves. Just now, we saw Bitcoin fall -$4,000 in a matter of minutes without ANY news at all.”

Despite the downturn, analysts stress this is structural rather than fundamental, reflecting the ongoing technical bear market.

Global Factors: Japan and Federal Reserve Impact Markets

Japan’s 10-year government bond yield surged to 1.84%, its highest since April 2008. Former BitMEX CEO Arthur Hayes linked Bitcoin volatility to the Bank of Japan’s hawkish stance, explaining that a December rate hike could influence USD/JPY dynamics.

Meanwhile, US markets monitor the Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, ahead of its next rate decision. CME’s FedWatch Tool shows over 87% probability of a 0.25% cut, reflecting markets’ optimism despite global uncertainties.

Coinbase Premium and Stablecoin Liquidity Signal Potential Turnaround

After Thanksgiving, attention shifts to US trading demand for Bitcoin below $90,000. The Coinbase premium, which reflects buying pressure during US market hours, has turned positive, hinting at accumulation despite declining prices.

CryptoQuant contributor Cas Abbe noted:

“Some good signs of bottom are emerging now. Coinbase Bitcoin premium has been positive, despite BTC prices going down.”

Stablecoin liquidity is also at record levels, with Binance holding the highest ratio of stablecoins versus BTC reserves in over six years. As CryptoOnChain explained:

“This freefall indicates an unprecedented accumulation of ‘buying power.’ History shows such lows often precede powerful Bitcoin rallies, as liquidity is fully available on the exchange.”

Comments are closed.