Featured News Headlines

Bitcoin Weakens as BoJ Rate Hike Expectations Shake Markets

Bitcoin (BTC) is showing visible strain ahead of next week’s Bank of Japan (BoJ) policy meeting, where a 25 basis point rate hike is widely expected. With the decision scheduled for December 19, traders appear to be positioning early, trimming risk before the headline hits and reviving talk of a classic “sell the rumor, buy the fact” scenario.

History Weighs on Bitcoin Sentiment

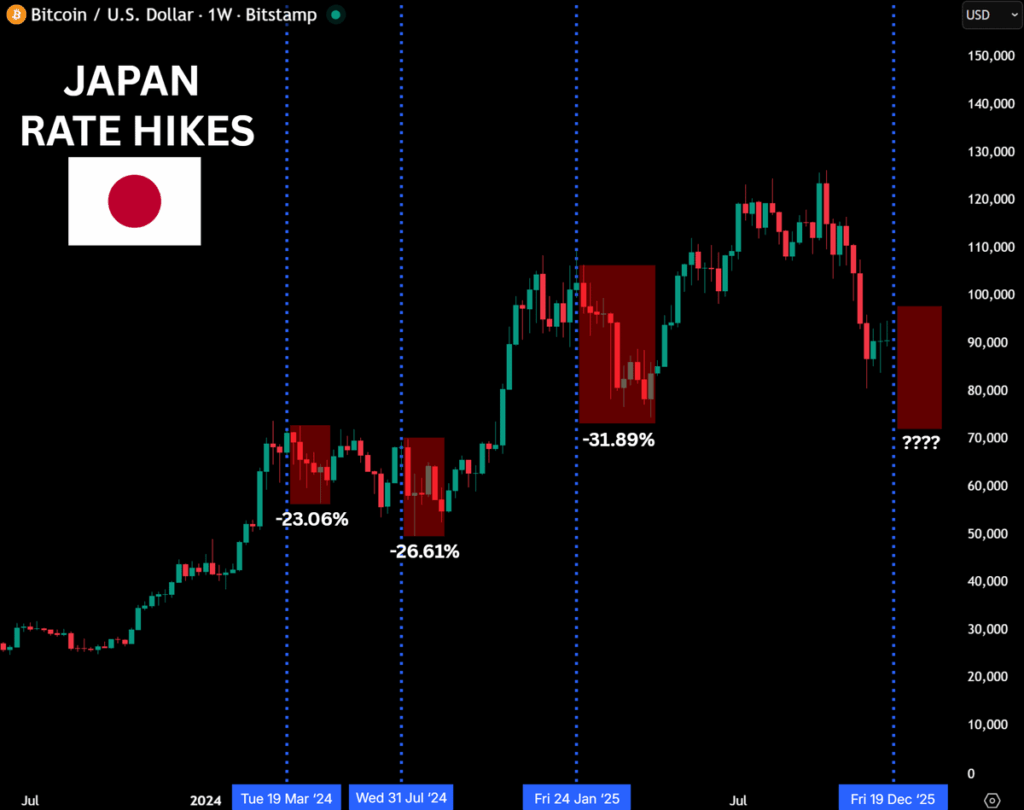

The anxiety is rooted in precedent. Previous BoJ rate hikes have closely coincided with sharp Bitcoin drawdowns, as tighter yen liquidity dampened risk appetite. In March 2024, BTC slid roughly 23% following a hike. A similar move in July 2024 triggered another 26% drop, while January 2025 saw an even steeper decline of nearly 31%.

While history doesn’t guarantee repetition, these episodes help explain why markets are increasingly on edge as the next decision approaches.

Signs of Selling Before the News

Unlike past events, the current bout of selling appears to be starting before the policy announcement. During earlier hikes, Bitcoin Exchange Inflows spiked after the decision, signaling panic-driven spot selling. This time, Exchange Netflows are already showing rising inflows ahead of December 19, pointing to early de-risking by investors.

Derivatives data tells a similar story. In previous cycles, Funding Rates collapsed after the BoJ acted. Now, funding has already drifted lower and turned unstable, suggesting leverage is being unwound in advance as expectations become fully priced in.

Why the Aftermath May Matter More Than the Hike

With the BoJ’s shift discussed for months, much of the impact may already be reflected in price. The key variable post-meeting will be the yen’s reaction. A stronger yen could keep pressure on risk assets like Bitcoin. If the currency response is muted, however, markets may find little left to sell, leaving room for a short-term relief move.

As the decision nears, attention is shifting from the rate hike itself to how markets respond once it’s finally out of the way.

Comments are closed.