Bitcoin Struggles for Stability as Market Leverage Builds

On December 16, Bitcoin (BTC) recorded a sharp pullback, declining 4.5% to touch $85.7K during early trading hours. The move came amid broader weakness in global markets. Asian equities opened lower, with Japan’s Nikkei 225 sliding 784 points, or 1.56%, a development that added pressure to risk assets, including cryptocurrencies.

The wider crypto market mirrored this decline, with total market capitalization falling by 4.4% before managing a modest rebound later in the session. In the short term, buyers managed to defend the $85.7K level, allowing BTC to recover slightly toward $86.5K. Despite this bounce, sentiment remains fragile and volatility elevated.

According to CoinGlass data, liquidations across the crypto market reached $652 million over the past 24 hours. Notably, Ethereum (ETH) experienced heavier liquidations than Bitcoin. ETH saw $233.5 million in liquidations—$205.1 million from long positions—while BTC liquidations totaled $184.8 million, with $168.8 million attributed to longs.

In a CryptoQuant Insights post, XWIN Research Japan explained that the recent drawdown was not primarily driven by spot selling. Instead, they pointed to excessive leverage built up below key short-term support levels. As stated in the report, “Liquidated long positions are forced to sell, creating taker sell orders that can trigger more liquidations, forming a cascade.” The firm characterized the decline as a leverage reset rather than a structural breakdown, arguing that it may help restore healthier market conditions.

Rising Leverage Signals Continued Uncertainty

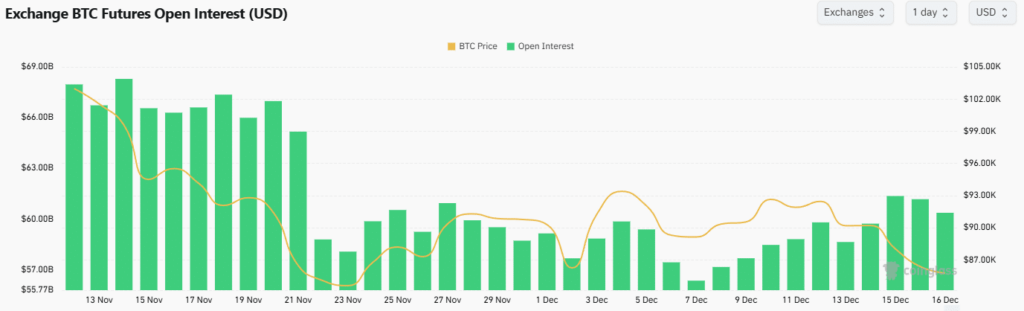

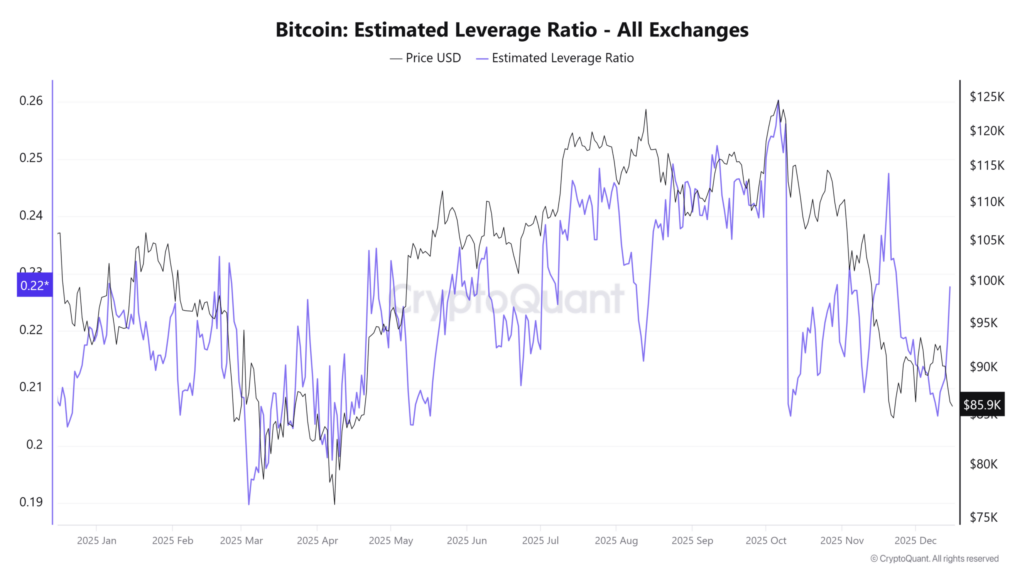

Data reviewed by AMBCrypto suggests that volatility risks remain. Since December 7, Bitcoin’s Open Interest (OI) has trended higher overall, despite a brief pullback. At the same time, the Estimated Leverage Ratio (ELR) surged from December 10, reflecting either increased OI, declining exchange reserves, or both.

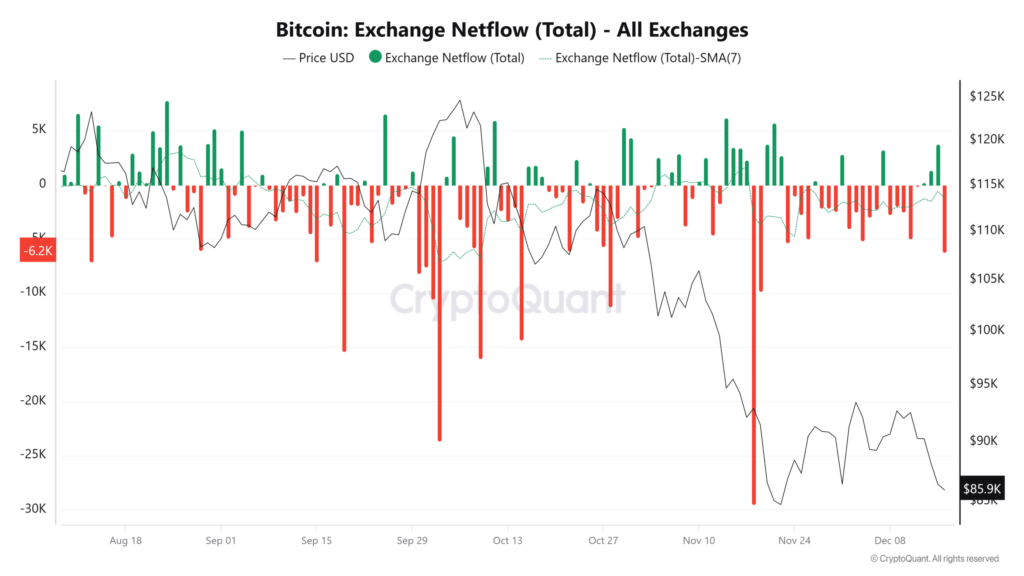

On-chain analysis shows sustained Bitcoin outflows from exchanges over the past month, supporting the ELR increase. Meanwhile, rising OI alongside falling prices suggests growing short-selling activity, which can heighten the likelihood of sharp price swings.

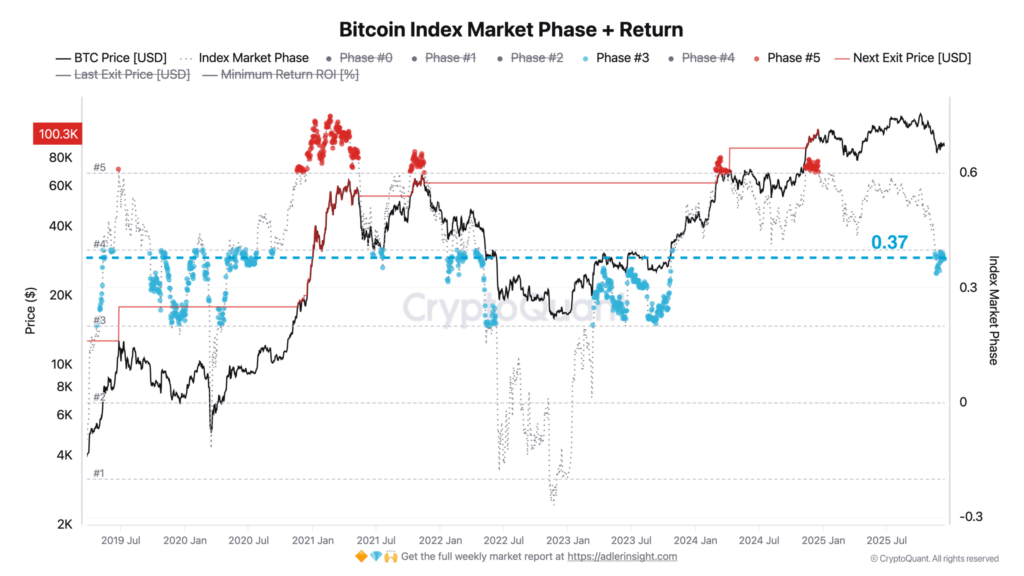

On-chain analyst Axel Adler noted that the Market Phase Index remains near 0.38, describing it as a “preservation of the transitional regime.” He added that a move above 0.43 would be needed to signal renewed strength. Until then, uncertainty is likely to persist.

Comments are closed.