Bitcoin Price Analysis: Bearish Signals Amid Neutral Market Sentiment

Bitcoin (BTC) was trading around $112,100, marking a modest 0.36% gain over the past 24 hours. Despite this slight increase, short-term price action showed bearish tendencies, with potential resistance looming near the $115,000 level.

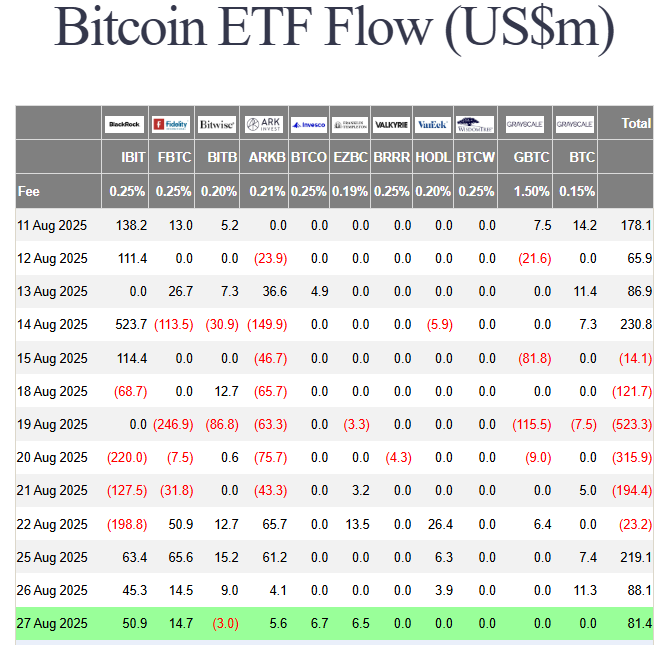

Market sentiment remains largely neutral to mildly bullish. The Fear and Greed Index sits at 46, indicating a balanced investor mood. Since August 25th, spot ETF inflows have been positive, suggesting growing institutional interest. However, some analysts emphasize that sustained bullish momentum may depend on increased activity in derivatives markets.

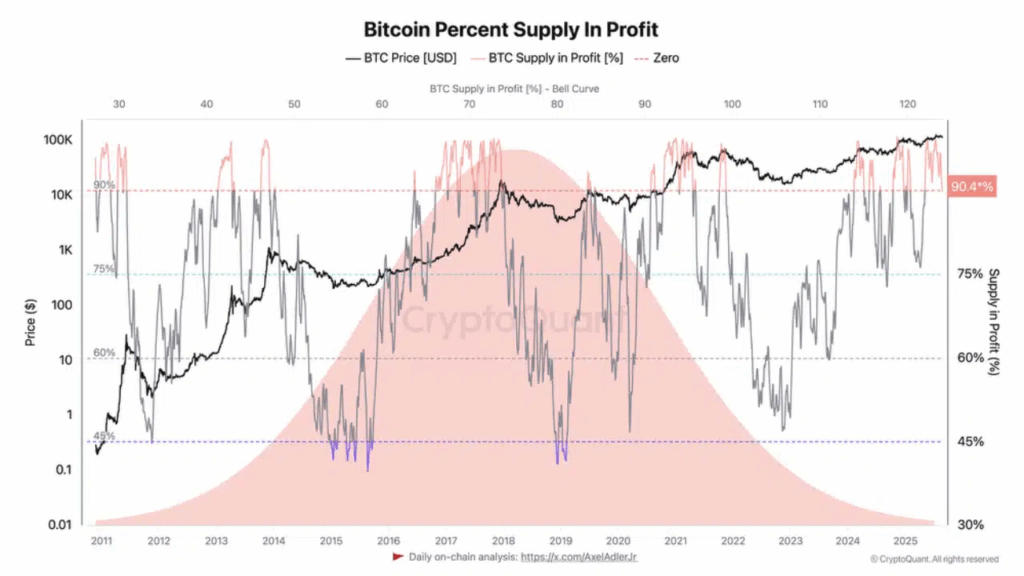

CryptoQuant analyst Darkfrost highlighted that 90% of Bitcoin’s supply was currently in profit—a critical benchmark often associated with bull markets. He noted, “A high percentage of supply in profit need not be all negative. Rather, it fuels price rallies and market euphoria.” This suggests that long-term holders should stay patient as short-term volatility continues.

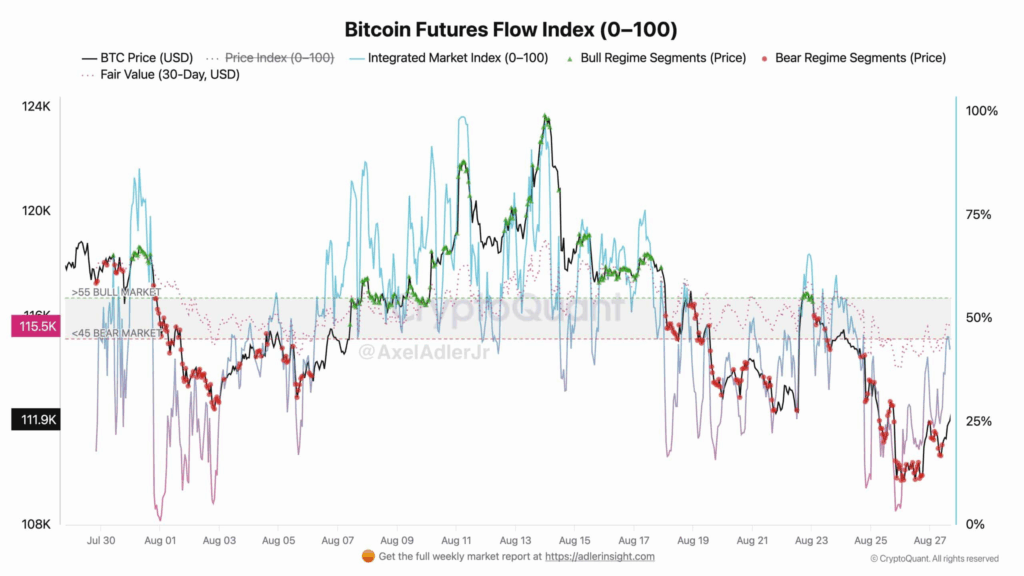

On the flip side, crypto analyst Axel Adler Jr observed that the market teeters on the edge of bearishness. At the time of writing, the integrated market index registered 43%, indicating mild bearish pressure but remaining close to neutral territory.

Derivatives flows may be the deciding factor. Without a consistent influx of positive momentum in this segment, any attempt to break above $115,000 could prove temporary rather than signaling a full bullish reversal.

Technical indicators reflect the cautious mood. On the 4-hour chart, Bitcoin’s price approached the 50-period moving average near $113,000, which acts as a dynamic resistance point. The Accumulation/Distribution (A/D) indicator reveals weak buying volume recently, while overall trading volume has declined during this week’s price dip.

In summary, Bitcoin faces a delicate balance: holding above the 90% supply-in-profit threshold keeps recovery possible, but without stronger derivatives activity and buying volume, the path to sustained bullish momentum remains uncertain.

Comments are closed.