Bitcoin ETF Trend Reversal Signals Possible Recovery

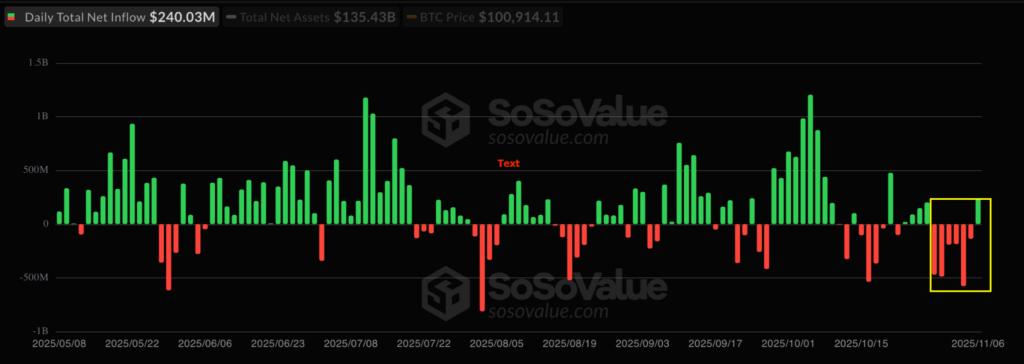

Spot Bitcoin exchange-traded funds (ETFs) in the U.S. experienced a return of inflows on Thursday, ending a six-day streak of net outflows. The development has led market observers to anticipate a potential recovery, as long as Bitcoin continues to hold key technical support.

$240 Million Inflows Reverse Trend

Thursday marked a significant reversal for spot Bitcoin ETFs, with $240 million in daily inflows recorded. The outflow streak had begun on October 29 and continued through Wednesday, peaking with $577.74 million in withdrawals on Tuesday.

The period of outflows followed a broader Bitcoin market correction, during which BTC briefly fell below the $100,000 level—the first time since June. On Tuesday, the BTC/USD pair reached a four-month low of $98,900, before recovering approximately 3% by Friday.

The largest inflows came from BlackRock’s IBIT ETF at $112.4 million, followed by Fidelity’s FBTC with $61.6 million, and ARK Invest’s ARKB adding $60.4 million. Bitwise’s BITB recorded smaller inflows of $5.5 million and $2.48 million, while the remaining ETFs reported no net changes.

Cumulative net inflows remain robust at $60.5 billion, with total net assets across all spot Bitcoin ETFs now standing at $135.43 billion—representing roughly 5.42% of Bitcoin’s total market capitalization.

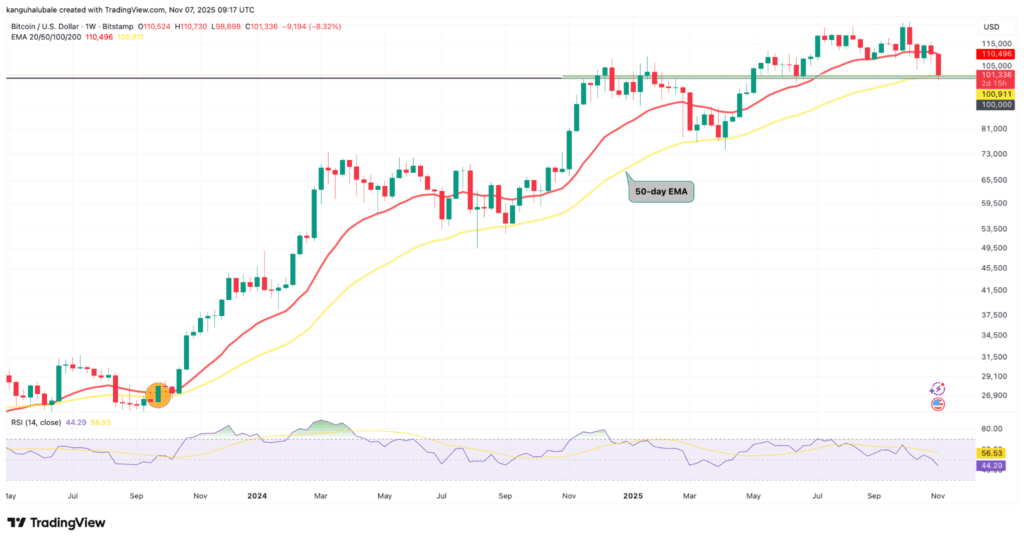

Technical Levels in Focus

Bitcoin’s recent price movements have highlighted the importance of its 50-day exponential moving average (EMA). After dipping to $98,000 on Tuesday, BTC quickly reclaimed the $100,000 mark, aligning with the 50-day EMA. This suggested strong defensive action from market participants.

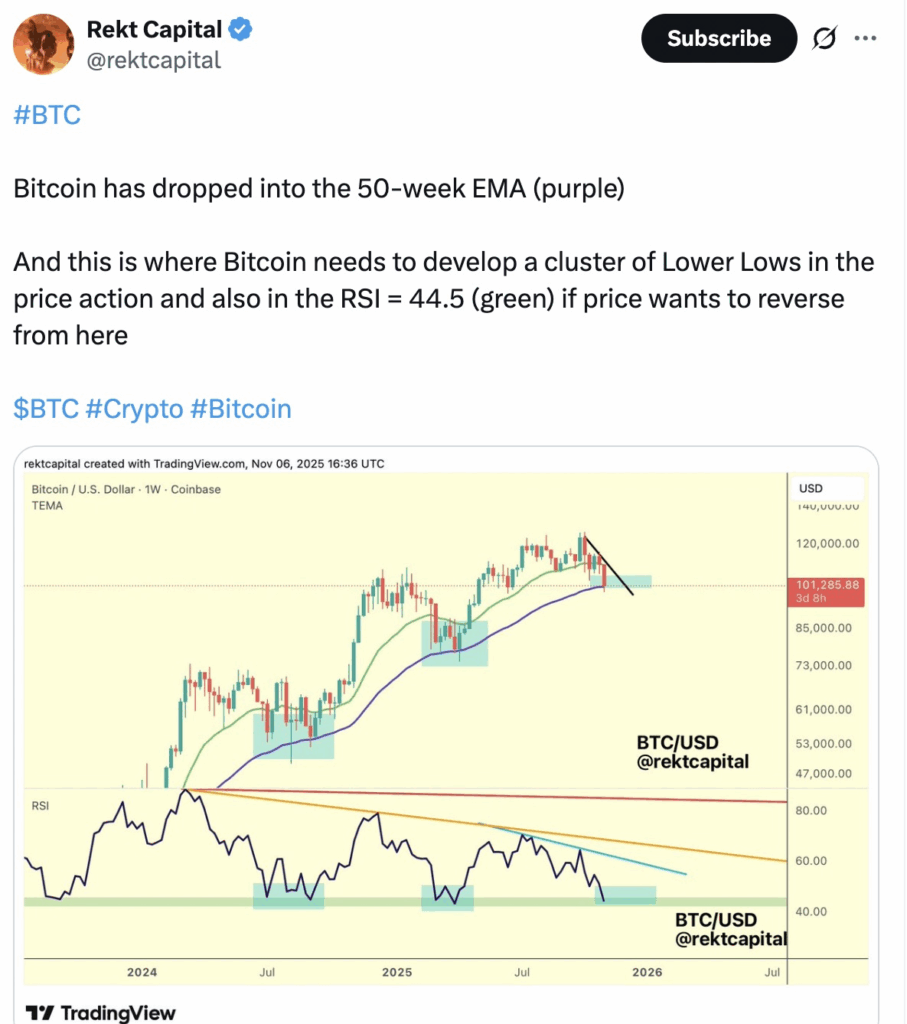

Pseudonymous analyst Chad noted, “So far Bitcoin is still holding the 50-week EMA,” emphasizing that closing the week above this level is crucial. Fellow analyst Rekt Capital added that Bitcoin appears to be bottoming around the 50-day EMA, stating it “must make a cluster of lower lows at this level to establish a bottom.”

Data from Cointelegraph also highlighted the MVRV ratio, which indicated that $98,000 may have acted as a local bottom, pointing to potential recovery as selling pressure eases.

Comments are closed.