Featured News Headlines

What Bitcoin’s Market Pause Means for Altcoins This Cycle

Bitcoin dominance (BTC.D) remains stuck below the key 60% resistance level, now ten days and counting. Meanwhile, Bitcoin (BTC) has shed roughly $230 billion in market cap, pulling back 8% from its $124,000 all-time high.

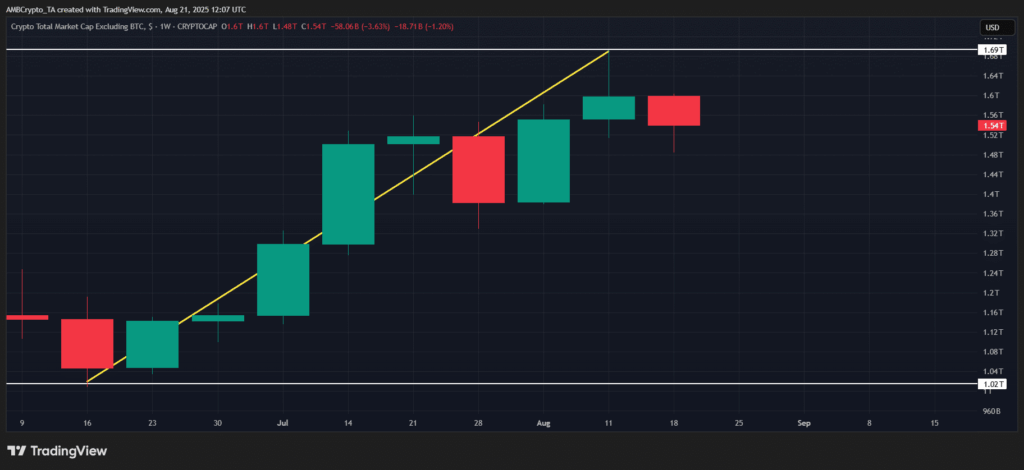

This pause in Bitcoin’s momentum may be opening the door for altcoins. Historically, similar setups have led to strong altcoin performance. In late June, BTC.D hit 65% before a sharp 6% decline. At the same time, the altcoin market cap (TOTAL2) jumped from $1 trillion to $1.7 trillion in just two months.

BTC Pauses, Altcoins Wait

BTC recently failed to reclaim the $117k resistance level, and with investor risk appetite still muted, capital could shift toward altcoins seeking better short-term returns. Supporting this idea, the Altcoin Season Index has climbed from 22 to 50—its highest level since the election period. However, it hasn’t crossed the 75 mark, which historically signals a full altcoin season.

Sentiment Isn’t There Yet

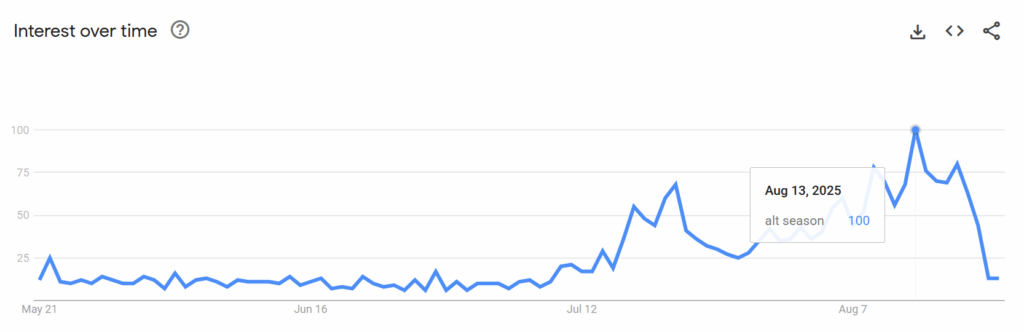

Search interest for “alt season” dropped 50% in just one week, falling from a peak score of 100 on August 13 to just 13 now. This shows that retail enthusiasm is still low, creating a divergence from the previous cycle, where FOMO played a major role.

What’s Next?

So far, this isn’t a textbook alt season. BTC.D and TOTAL2 are showing early signs of rotation, but sentiment and momentum are lagging. For investors, it’s a time to watch closely—not chase.

Comments are closed.