Fed Cuts Rates but Market Reacts Cautiously

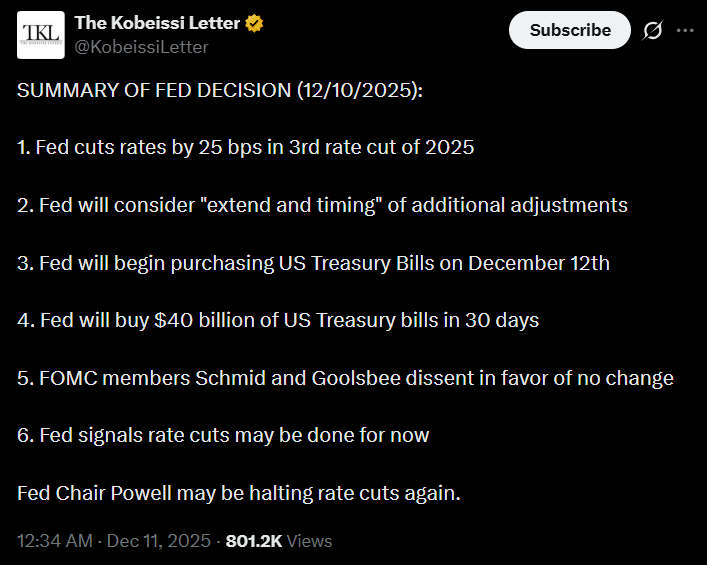

The Federal Reserve’s latest policy decision is being met with measured optimism across financial markets. On 10 December, the Fed delivered its third rate cut of 2025, trimming interest rates by 25 bps to 3.50–3.75%. Alongside the cut, officials confirmed they would begin purchasing $40 billion in U.S. Treasury bills over the next 30 days, a move aimed at injecting short-term liquidity back into the banking system.

By expanding T-bill purchases, the Fed is effectively releasing a fresh stream of liquidity into the U.S. economy. The strategy signals an effort to counter rising labor-market risks and ensure cheaper capital continues flowing through financial institutions.

Bitcoin Falls Despite Liquidity Tailwinds

Yet Bitcoin’s reaction has been anything but enthusiastic. Shortly after the announcement, BTC slipped 2.14%, falling below the $90,000 threshold. The move underscores a growing divide between short-term liquidity boosts and longer-term macro uncertainties.

Markets are beginning to price in a pause in rate cuts heading into 2026, raising questions about how durable the Fed’s support may be. As a result, risk appetite in crypto remains limited.

Selling Pressure Builds Ahead of FOMC

Investors appeared prepared for volatility. Major players—from mining companies to asset managers like BlackRock—had already offloaded significant BTC positions ahead of the FOMC meeting. With inflation still elevated and policymakers split on next year’s pace of cuts, caution continues to dominate sentiment.

This aligns with recent patterns: across the last four FOMC meetings, Bitcoin has consistently pulled back. After the October meeting, BTC even dropped nearly 30% to $80,000, marking one of 2025’s sharpest declines.

A new report from Glassnode points to weak bid support near the $90K level, while “smart money” selling suggests the market remains supply-heavy, leaving BTC vulnerable to additional downside.

Whether Bitcoin can establish a foundation for a Q1 2026 recovery remains unclear. With macro volatility lingering and limited FOMO, traders are watching closely to see whether BTC repeats its post-FOMC breakdown and tests deeper support zones.

Comments are closed.