Featured News Headlines

Why Bitcoin Isn’t Rallying Despite Global Monetary Expansion

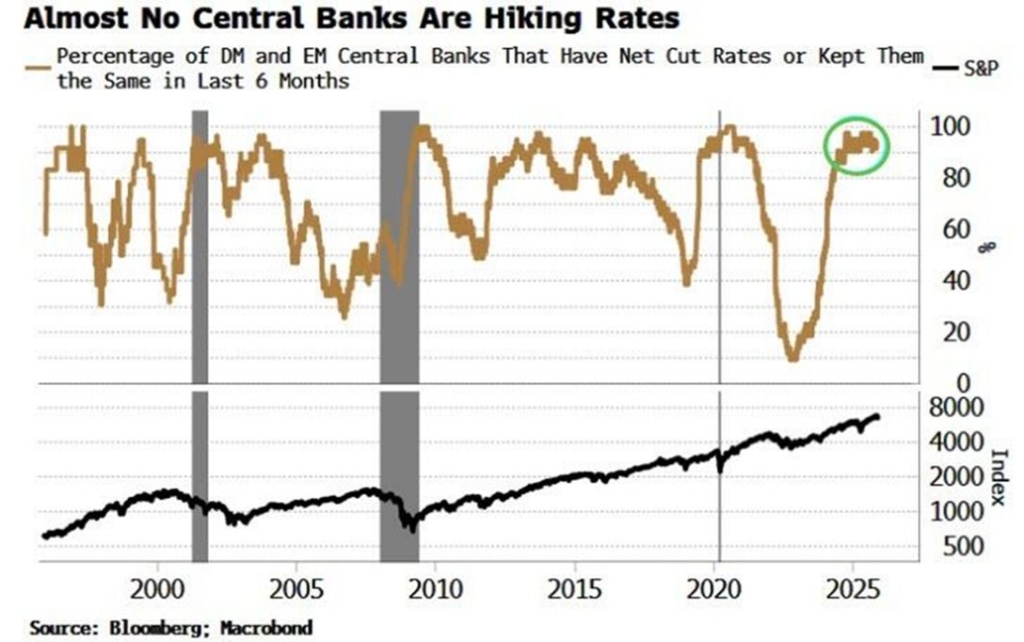

Bitcoin Decouples from Global Liquidity Amid Historic Central Bank Easing – More than 90% of central banks worldwide have either cut interest rates or held them steady for a full year—a pattern rarely seen in the last 35 years. This monetary easing cycle has produced 316 rate cuts over two years, surpassing even the 313 cuts during the 2008–2010 financial crisis. Yet, despite this unprecedented liquidity, Bitcoin has remained largely unmoved since mid-2025, raising questions about its next move.

Unprecedented Monetary Easing Since the Pandemic

According to The Kobeissi Letter, global monetary policy has entered its most aggressive easing phase since COVID-19. Less than 10% of central banks have raised rates, with the rest cutting or maintaining policy. Historically, coordinated easing has often preceded rallies in risk assets like stocks and cryptocurrencies. However, Bitcoin’s price response has been muted, deviating from the strong 0.94 correlation observed between Bitcoin and global M2 money supply from May 2013 to July 2024.

Timing and Market Drivers

Analysts note that Bitcoin often lags global liquidity increases by 60–70 days. If this historical trend holds, the current liquidity wave might delay a Bitcoin rally until late 2025 or 2026. This decoupling could be linked to factors such as regulatory uncertainty, institutional activity, and strong technical resistance.

2026 Financial Shock Scenario

Looking further ahead, some analysts foresee 2026 as a potential turning point, aligned with the historical Benner Cycle. Possible triggers include US Treasury funding issues, Japan’s yen carry-trade risk, and China’s credit leverage. A coordinated shock could lead to a systemic crisis, followed by central bank interventions, liquidity injections, and asset recoveries—creating an environment where Bitcoin, gold, and commodities could surge.

Bitcoin’s Lag as a Potential Opportunity

The cryptocurrency’s recent sideways trading amid abundant liquidity highlights a rare decoupling. Historically, these lags have presented buying opportunities, as Bitcoin often rallies shortly after major M2 supply increases.

This unusual period emphasizes that Bitcoin’s price dynamics are influenced by both global liquidity and timing, making the coming months a critical phase to watch for the market’s next significant move.

Comments are closed.