Featured News Headlines

Will Bitcoin Reclaim $98K? CME Gap and Liquidity Levels Could Decide

Bitcoin (BTC) $95,026 starts the week under intense scrutiny as traders wrestle with diverging predictions and a market at a critical juncture. BTC/USD has returned to its yearly open level, leaving traders torn between optimism and capitulation, while analysts keep a close eye on both technical and sentiment indicators.

BTC Roundtrips 2025 Gains Amid Mixed Trader Reactions

Bitcoin closed the weekend just under $93,000, retracing gains from earlier in 2025. According to Cointelegraph Markets Pro and TradingView, this return to the yearly open level has sparked sharply contrasting reactions. Some traders are calling for local bottoms, while others caution that BTC could dip further.

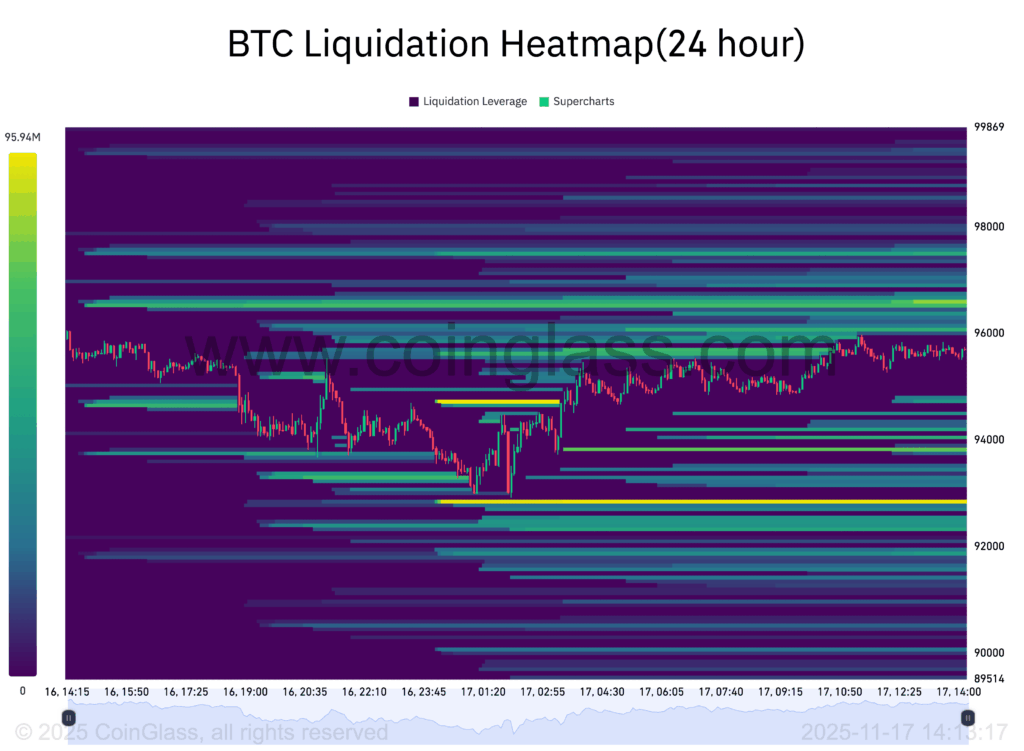

Trader BitBull highlighted that “Binance whales have placed big buy orders between $88,500–$92,000,” suggesting a temporary support zone. Meanwhile, Michaël van de Poppe emphasized liquidity as a key factor shaping future price action, noting that sweeping lows over the weekend could pave the way for higher lows and a potential short squeeze.

Crypto investor Ted Pillows added that reclaiming $98,000 would increase the likelihood of a local bottom, reinforcing the delicate balance between hope and fear in the market.

CME Futures Gap Emerges as a Key Technical Magnet

One of the market’s short-term targets lies in the CME Bitcoin futures gap from April, spanning roughly $91,800–$92,700. Historically, such gaps act as technical magnets, often pulling price back to “fill” the void.

Trader Hardy noted on X that whales are likely waiting to have their orders executed, suggesting that volatility may increase before a potential bounce. Similarly, QCP Capital pointed out that while the gap could trigger a short-term rebound, dense overhead supply may limit gains.

Despite nearing this technical magnet, the gap remains unfilled more than half a year after its formation, keeping traders cautious and market sentiment tense.

50-Week Moving Average Breakdown Sparks Bearish Comparisons

Adding to the uncertainty, Bitcoin has lost its 50-week simple moving average (SMA), a historically strong support line that has rarely been breached during bull cycles. This breakdown has drawn comparisons to previous bear markets.

As noted by The Swing Trader, losing the 50-week SMA is a rare event—BTC has only done so four times in history, signaling potential medium-term bearish pressure. QCP Capital echoed this sentiment, warning that while short-term bounces may occur, the path of least resistance currently points lower, with critical support zones at $88,000 and $74,500.

Bitcoin Diverges From Broader Risk Assets

Interestingly, Bitcoin’s recent downturn has occurred independently of traditional risk assets. While US stock futures remained green and gold traded above $4,100/oz, Bitcoin fell over $100 billion in value.

Analysts describe this as a leverage- and liquidation-driven crypto bear market, where BTC behaves more like a “leveraged tech stock” than a traditional hedge or safe-haven asset. Correlation with gold has disappeared, and recent data shows BTC moving more closely with US technology stocks, with a 30-day correlation to the Nasdaq 100 Index around 0.80, the highest since 2022.

Extreme Fear Dominates Crypto Sentiment

The Crypto Fear & Greed Index confirms the intense market caution, falling to 10/100, marking the lowest reading of 2025 and deep within the “extreme fear” zone. Just six weeks ago, the Index stood at 74/100, on the cusp of “extreme greed.”

Trader Daan Crypto Trades compared the current sentiment to the FTX collapse in 2022, highlighting how quickly market psychology can swing between fear and greed in crypto.

Meanwhile, Santiment flagged a potential bullish signal: a surge in Bitcoin social dominance during Friday’s dip, hitting a four-month high and reflecting severe retail panic and FUD. While not a guaranteed bottom indicator, rising social attention often precedes market reversals.

Comments are closed.