Featured News Headlines

Traders Prepare for Turbulence as Bitcoin and Ethereum Options Expire Today

Bitcoin and Ethereum – As the crypto market rides a strong bullish wave, traders and investors are bracing for significant volatility triggered by the imminent expiry of large Bitcoin (BTC) and Ethereum (ETH) options contracts.

Bitcoin and Ethereum Options Expiry Could Shake Markets

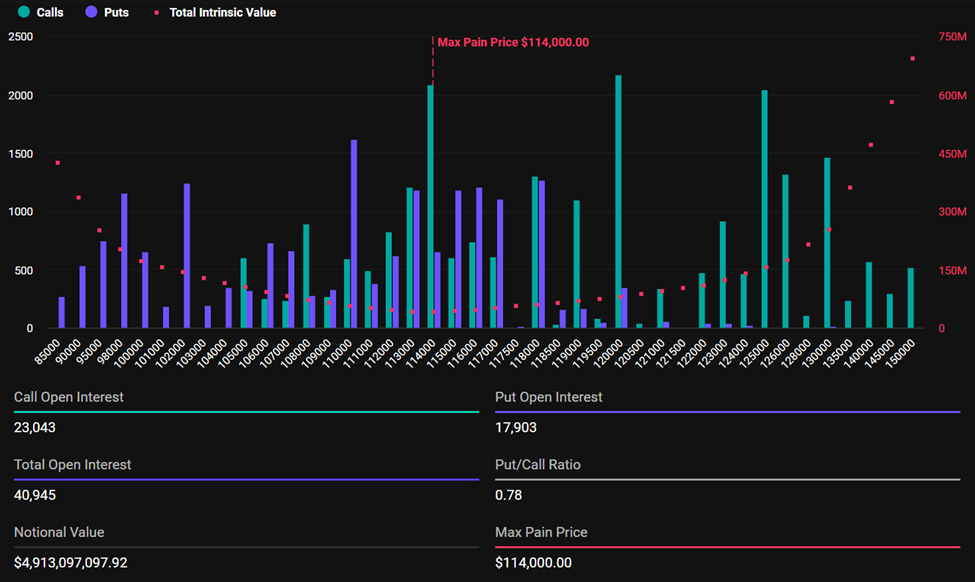

Today marks the expiry of over $5.76 billion worth of Bitcoin and Ethereum options, potentially shaking up price dynamics as traders adjust positions. Data from derivatives exchange Deribit reveals Bitcoin’s open interest at 40,945 contracts, valued at around $4.91 billion. The so-called max pain price for BTC options stands at $114,000, notably below Bitcoin’s current trading price of $120,259.

Meanwhile, Ethereum’s options market presents a more balanced outlook with 237,466 contracts open and a notional value of $851 million. Ethereum’s max pain level is around $2,950, again below its current price, signaling possible downward pressure near expiry.

Mixed Sentiment Amid Bullish Optimism

Market sentiment remains mixed, according to analysts at Greeks.live. While some traders anticipate a market peak after recent rallies, others remain optimistic about higher valuations before the end of the year. Strategies like risk reversals, involving buying calls and selling puts, indicate a bullish stance with cautious hedging against sudden drops.

Volatility and Price Pullbacks Expected Before Stabilization

Both Bitcoin and Ethereum are currently trading above their max pain levels, hinting at potential price pullbacks as options expire. However, markets typically stabilize shortly after expiry, as traders settle into new positions and recalibrate expectations.

With Ethereum’s implied volatility hovering near 70%, opportunities for volatility-based trading strategies are increasing. Market watchers will keep a close eye on how this pivotal expiry influences crypto price action heading into the weekend.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.