Bitcoin and Ethereum ETFs Hit by $900M Withdrawals in One Day

Bitcoin and Ethereum ETFs – Spot Bitcoin ETFs suffered a major setback on Friday, recording $812.25 million in net outflows, the second-largest single-day loss in the history of the asset class. The sharp pullback erased an entire week of steady gains and brought cumulative net inflows down to $54.18 billion. Total assets under management (AUM) dropped to $146.48 billion, representing 6.46% of Bitcoin’s market cap, according to SoSoValue.

Fidelity’s FBTC led the exodus with $331.42 million in redemptions, closely followed by ARK Invest’s ARKB, which recorded a $327.93 million outflow. Grayscale’s GBTC also saw losses totaling $66.79 million, while BlackRock’s IBIT held relatively firm with a minor $2.58 million outflow.

Despite the withdrawals, trading volume remained strong, with a total of $6.13 billion traded across all spot Bitcoin ETFs. Notably, IBIT alone accounted for $4.54 billion, highlighting sustained interest even amid bearish sentiment.

Ethereum ETFs Break 20-Day Inflow Streak

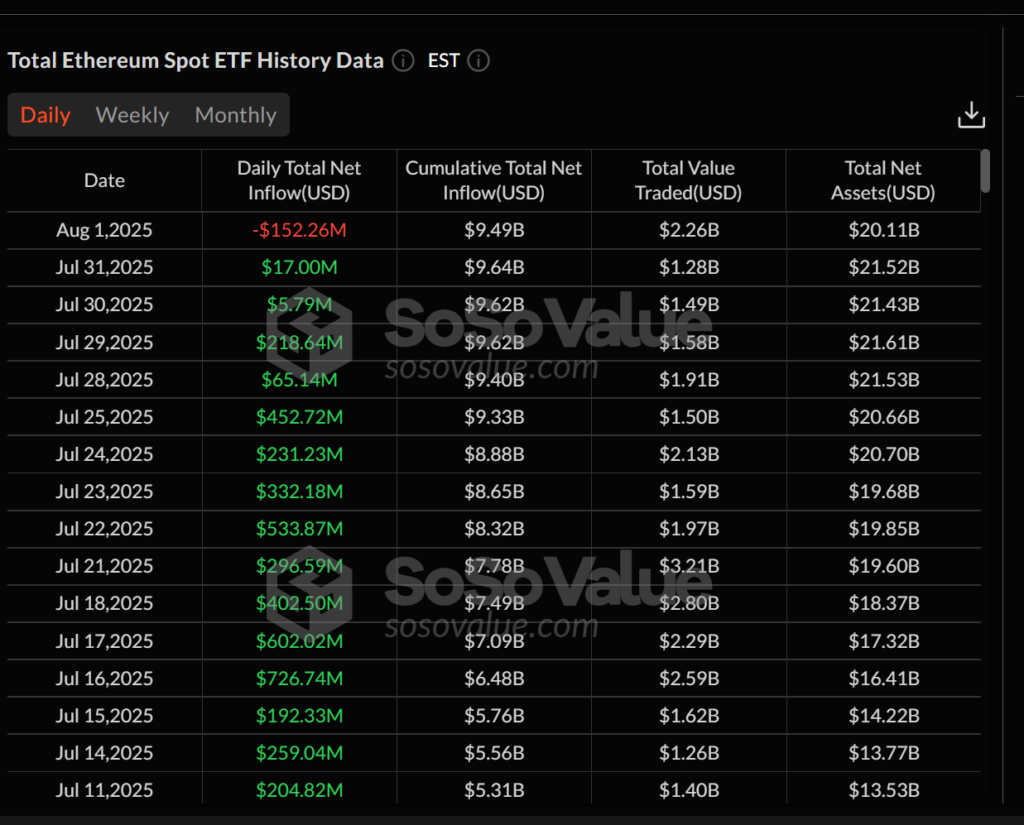

Ethereum ETFs also took a hit, ending a historic 20-day streak of net inflows. On Friday, the sector posted a $152.26 million outflow, bringing total AUM to $20.11 billion, or 4.70% of Ether’s market cap.

Grayscale’s ETHE led the losses with a $47.68 million outflow, followed by Bitwise’s ETHW with $40.30 million and Fidelity’s FETH at $6.17 million. BlackRock’s ETHA remained unchanged, holding steady at $10.71 billion.

Ethereum ETF trading was still active, totaling $2.26 billion, with Grayscale’s ETH product contributing $288.96 million in daily trades.

According to Standard Chartered, corporations are now acquiring Ethereum at twice the pace of Bitcoin. Since early June, crypto treasury firms have accumulated nearly 1% of ETH’s circulating supply, fueling bullish momentum.

The bank suggests this institutional demand, along with benefits from staking and DeFi, could push ETH above $4,000 by year-end and potentially grow corporate holdings to 10% of the total supply.

Comments are closed.