Bitcoin’s October Slump: Analysts Highlight Local Bottom Formation

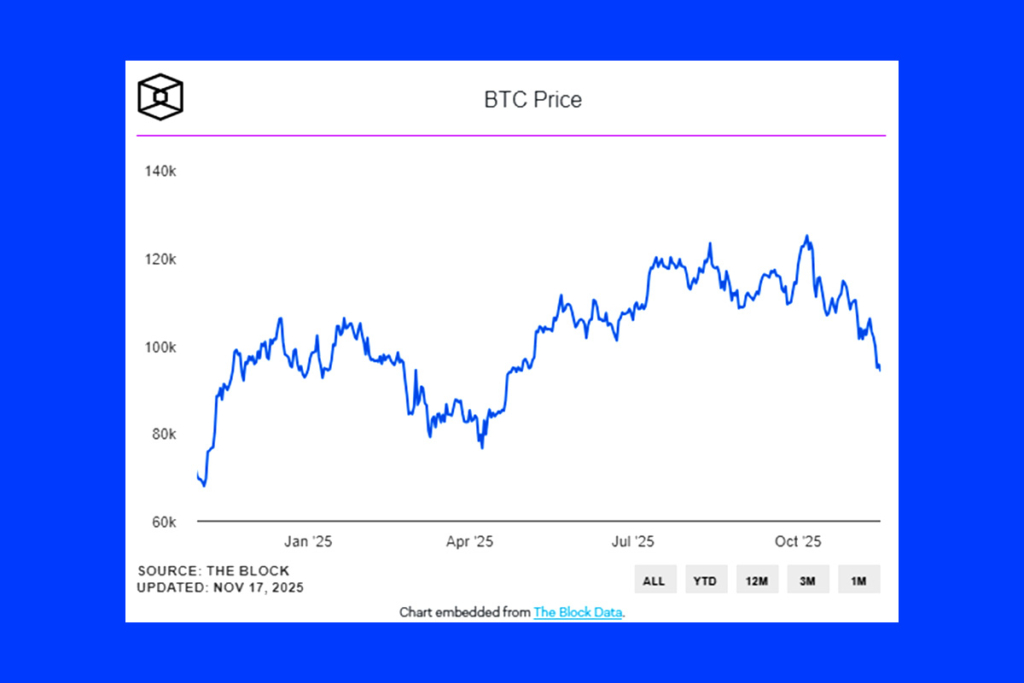

The price of Bitcoin dropped by about 25% from its peak in October, which was close to $126,000. Instead of seeing this decline as the start of a significant market slump, Bernstein analysts see it as a temporary correction. However, the market is effectively absorbing supply, as evidenced by the robust fundamentals. This implies that rather than experiencing the severe 60–70% drawdowns observed in earlier cycles, Bitcoin might be creating a local bottom.

Stable Institutional Holdings Reduce the Likelihood of a Bitcoin Crash

According to Bernstein, throughout the past six months, long-term holders have sold almost 340,000 BTC. However, inflows of about $34 billion into corporate treasuries and Bitcoin ETFs have mostly absorbed this supply. By the end of 2024, institutional ownership of Bitcoin ETFs was 20%. Today, it is at 28%. These ETFs now have $125 billion in total assets under management. This more stable and superior ownership, according to analysts, lessens the possibility of a harsher sell-off.

Market Fundamentals Keep Bitcoin Stable Despite Recent Pullback

According to Bernstein, worries about Strategy selling off Bitcoin assets are unjustified. With $8 billion in debt compared to $61 billion in assets, Strategy has declared that it is not selling any Bitcoin. During this correction, analysts predict that the corporation will keep buying Bitcoin. Sustained institutional participation is also indicated by broader structural tailwinds like expected Clarity Act legislation, governmental support for cryptocurrency, and falling interest rates. These elements support the idea that the present decline in Bitcoin is not a cycle peak but rather a mild, healthy correction.

According to Bernstein, the cryptocurrency market is still following a multi-year trend marked by frequent, mild declines and robust institutional involvement. The current decline in Bitcoin, other digital assets, and cryptocurrency stocks could be an attractive entry time for long-term investors.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.