Featured News Headlines

Arthur Hayes Declares End of 4-Year Crypto Cycle, Cites USD and Yuan Flows

Arthur Hayes – The era of predictable crypto cycles is over, according to BitMEX co-founder Arthur Hayes, who believes that Bitcoin’s market rhythms are no longer tied to the famed four-year halving schedule. In a bold new blog post released Thursday, Hayes dismantled the traditional narrative, pointing instead to monetary policy shifts in the U.S. and China as the real drivers of Bitcoin’s price action.

Why the Four-Year Cycle “Will Fail This Time”

While the four-year cycle has historically aligned with Bitcoin halving events and retail-driven hype, Hayes asserts that these patterns are no longer reliable. “The four-year pattern worked in the past, but it is no longer applicable and will fail this time,” he wrote.

Instead, macro liquidity conditions—particularly the flow of U.S. dollars and Chinese yuan—are what really fuel Bitcoin bull markets. Hayes emphasized that past crypto rallies have ended when global monetary conditions tightened, not because of arbitrary timelines.

A New Liquidity-Driven Cycle

This current cycle, Hayes argues, is fundamentally different. The U.S. Treasury is flooding markets with liquidity, having released $2.5 trillion from the Fed’s Reverse Repo program. At the same time, the Federal Reserve has resumed rate cuts—despite inflation remaining above its target—with two more cuts likely by year-end, according to CME futures.

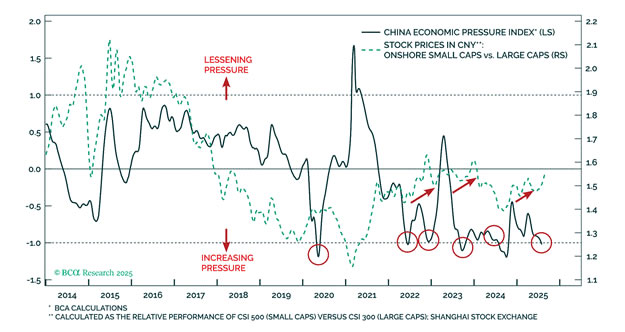

On the Chinese front, Hayes noted that while Beijing may not be actively fueling this cycle, it is also no longer a deflationary drag, as policymakers move to counter deflation rather than drain liquidity.

The Real Catalyst: Monetary Expansion

“Listen to our monetary masters in Washington and Beijing,” Hayes wrote. “They clearly state that money shall be cheaper and more plentiful. Therefore, Bitcoin continues to rise in anticipation of this highly probable future.”

Despite skepticism from some analysts who still see value in cycle-based models, Hayes is clear: liquidity is king, not calendar cycles.

Comments are closed.