Andrew Tate Takes Heavy WLFI Loss But Refuses to Back Down

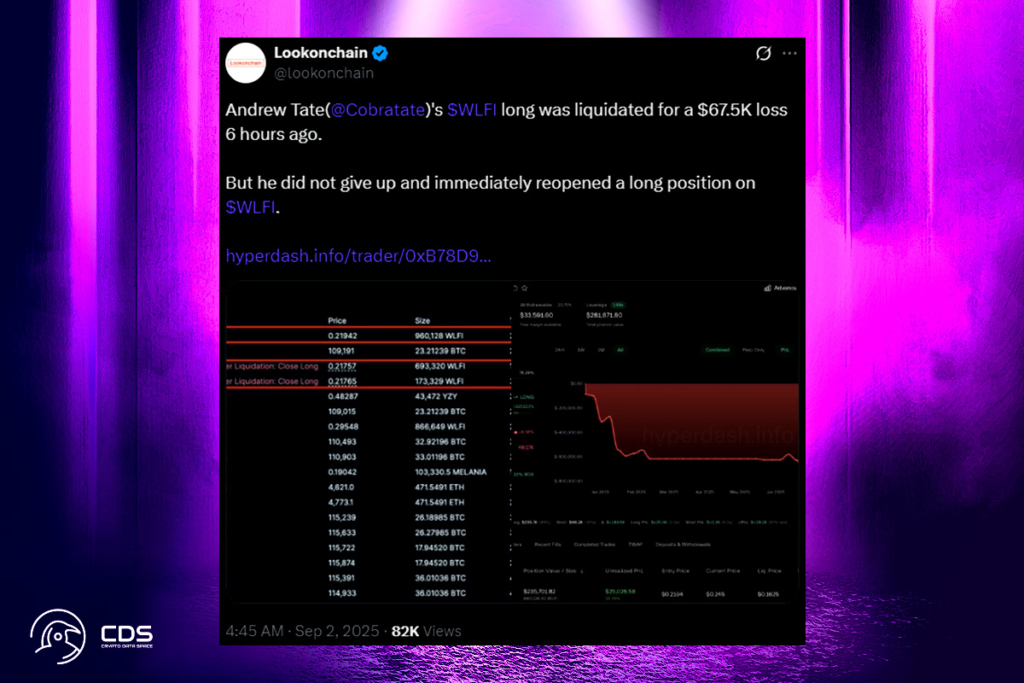

Following WLFI’s recent launch, which saw a period of volatility, trade data now indicates losses for Andrew Tate, a well-known holder. The social media influencer’s wallet was liquidated hours ago on a long position in World Liberty Financial token, resulting in a $67,500 loss, according to Lookonchain’s on-chain statistics. Tate, who is accustomed to losing money, launched a new long position right away, placing 960,128 WLFI, in spite of the setback. This indicates that despite recent volatility and sell pressure, there is still faith in the Trump-affiliated initiative.

WLFI Launch Turns Chaotic With Early Investors Cashing Out Fast

The loss occurred soon after WLFI‘s tumultuous debut, which was followed by significant sell-offs within hours of the market opening. Since its debut on the market, WLFI has been under close examination. Soon after the token went live, major holders started selling, raising accusations of insider trading. Large wallets were found to be dumping substantial amounts of WLFI minutes into trade, according to several on-chain reports. This trend was similar to several other well-known token launches in which early investors sold out tokens to the general public.

New WLFI Proposal Targets Long-Term Growth With Token Burn Strategy

A new measure to support the token’s value has been presented by the World Liberty Financial team in reaction to the unfavorable opinion. All protocol-owned liquidity fees will be redirected to the acquisition and permanent burning of WLFI coins as part of the plan. The goal of the idea is to take tokens out of circulation that belong to users who aren’t dedicated to the long-term development and course of WLFI. In effect, this would raise the relative weight for holders who stick with it over time. 100% of WLFI’s treasury liquidity fees would be used to buy back and permanently burn tokens if the plan were to be implemented.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.