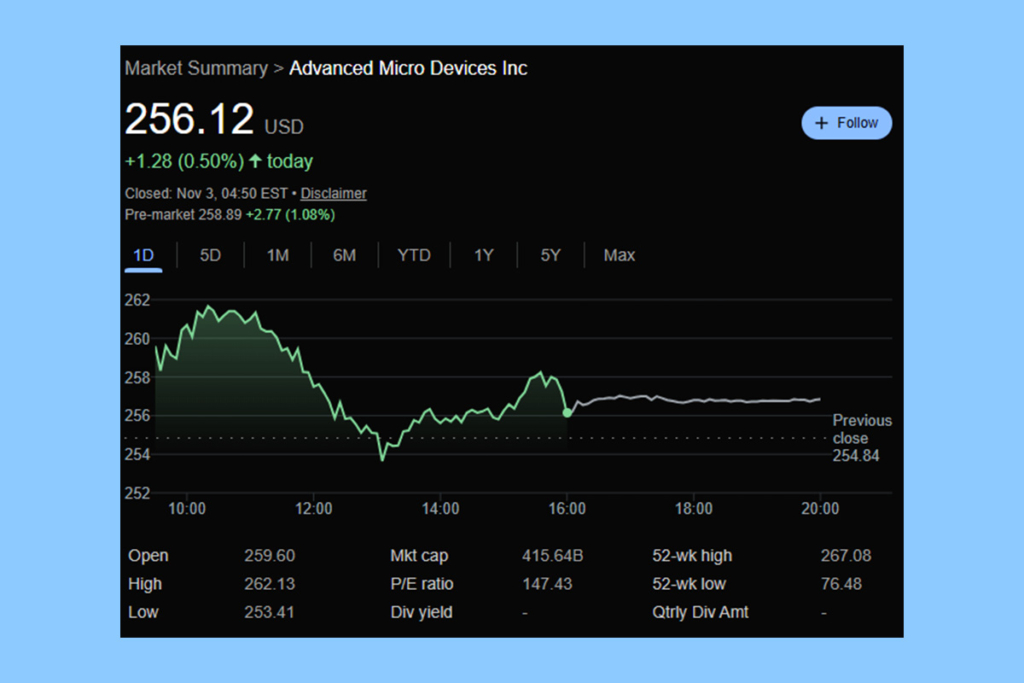

AMD’s Growth Trajectory Hints at a Future Trillion-Dollar Valuation

With shares of Advanced Micro Devices (AMD) up more than 114% so far this year, the company has had an outstanding 2025. Even if this is already impressive, AMD’s growth story may only be getting started. AMD may overtake Broadcom in market capitalization by 2030, a bold but realistic forecast, according to its demonstrated track record of innovation, strategic execution, and astute placement in the AI and data center markets.

AMD’s Data Center Ambitions Threaten Nvidia’s AI Dominance

AMD has been gaining ground in the AI infrastructure market, going head-to-head with Nvidia by providing powerful GPUs at more affordable prices. AMD’s expanding presence in the highly sought-after field of artificial intelligence computing is exemplified by the forthcoming MI400X GPU, which is anticipated to be out in 2026, and its agreement with OpenAI to deploy six gigawatt chips. If this pace keeps up, AMD’s data center division alone might bring in a sizable sum of money, propelling yearly growth rates that could reach a market valuation of $1 trillion.

The AI Race Heats Up: AMD’s Strategy to Challenge Nvidia

In addition to AI, AMD’s CPU and GPU divisions are still gaining market share in PCs and game consoles. With the development of edge computing and driverless vehicle technologies, its embedded processor segment also exhibits long-term potential. By the end of the decade, AMD may overtake Broadcom due to its varied income sources.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.