Amazon’s Growth Story: High Risks Behind the Gains

From its beginnings as an online bookshop to its current status as a global leader in technology and e-commerce, Amazon has long been a pillar for growth-oriented investors. However, recent developments—from labor reductions to AI-driven investments—raise concerns that astute investors shouldn’t dismiss despite its market domination. Even though the company has seen significant gains in the last year, you might want to take a deeper look before adding more AMZN to your portfolio due to its premium valuation, operational changes, and regulatory challenges.

AI Investments vs. Layoffs: Amazon’s Balancing Act

Amazon recently declared that it would eliminate 14,000 jobs in an effort to minimize expenses while rapidly advancing its AI capabilities. These layoffs demonstrate the company’s continuous efforts to strike a balance between expansion and efficiency. They are a part of a larger trend that may eventually impact up to 30,000 positions. Amazon is simultaneously making significant investments in enormous data center infrastructure and AI-driven services, which come with hefty upfront costs and unclear near-term returns. This calls into doubt the operational stability of the business for investors. While personnel cutbacks and automation rollouts might cause short-term disruptions in logistics and retail operations—two essential pillars of Amazon’s business model—AI promises long-term efficiency advantages.

Amazon Faces Regulatory and Valuation Pressure

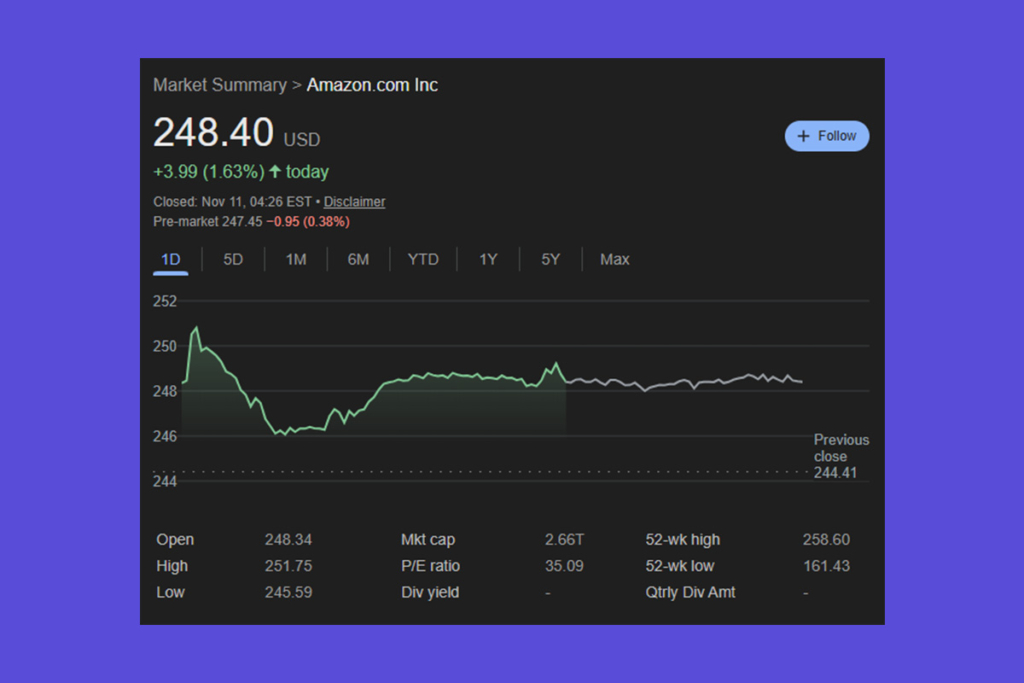

With a price-to-earnings ratio of 34, AMZN is significantly higher than the industry average. This suggests that the price of the stock is set for perfection. Although Wall Street analysts are still optimistic, with many giving “Strong Buy” ratings and price targets close to $300, the truth is that premium values don’t allow for many mistakes.

On the other hand, investor sentiment has also started to suffer due to legal and regulatory issues. Amazon and the Federal Trade Commission have reached a $2.5 billion settlement on Prime membership policies. These events, along with founder Jeff Bezos‘s warning remarks about the AI industrial bubble, imply that investor excitement may already be beyond the boundaries of caution.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.