Altcoin Market Heats Up as Bitcoin Dominance Slips and TOTAL3 Hits New High

Altcoin Season Incoming? With Bitcoin (BTC) setting a new all-time high on October 5 and Ethereum (ETH) testing a major supply zone at $4,700, analysts say the crypto market may be standing at the edge of a full-fledged altcoin season — a period where altcoins significantly outperform Bitcoin.

According to multiple crypto analysts, key conditions for an altseason appear to be aligning. One major signal: Bitcoin Dominance (BTC.D) is nearing a potential drop, especially as BTC price action flattens, a dynamic last seen in March–May 2021, when BTC.D plummeted from 62.9% to 40.87%. In that same window, the altcoin market cap (excluding ETH) more than doubled from $406.8B to $857B.

Traders Begin Rotating from BTC to Altcoins

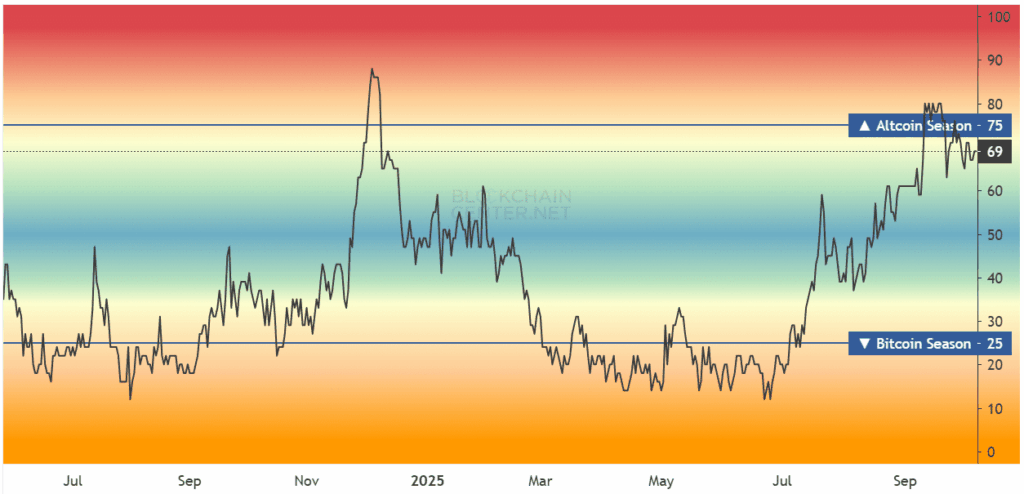

Crypto trader Mags recently shared on X that they’ve begun rotating some BTC profits into altcoins, citing stronger return potential, even with the added volatility and risk. The Altcoin Season Index hovered near 75 at press time — a level often associated with the early stages of altseason.

Analyst Jackis also pointed to record-low BTC volatility on the monthly timeframe as a precursor to a potential explosive move — one that could push Bitcoin higher but open the door for altcoins to outperform as the capital rotation cycle accelerates.

TOTAL3 Breakout Signals Increased Risk Appetite

Another compelling signal is the TOTAL3 index (total crypto market cap excluding BTC and ETH), which recently printed a new all-time high. This suggests that investors are increasingly willing to take on risk, positioning for potential outsized gains in the broader altcoin market.

As volume returns and narratives build, analysts say we may be witnessing the early stages of a true altseason — but only select altcoins are likely to lead the charge in today’s more mature and competitive market.

Comments are closed.