Featured News Headlines

Bitcoin Retreats From $124K ATH as Whales Dump $722M on Binance

Bitcoin has pulled back from its latest milestone, declining 3.5% in the past 24 hours after establishing a fresh all-time high (ATH) of $124,474. The digital asset’s retreat appears linked to increased selling activity from large holders, commonly known as whales.

Whale Activity Drives Market Pressure

Recent data from CryptoQuant reveals significant whale movement that’s impacting Bitcoin’s price trajectory. The analytics firm has identified substantial selling pressure from major holders following the cryptocurrency’s record-breaking performance.

Binance, one of the world’s largest cryptocurrency exchanges, recorded a notable influx of Bitcoin deposits within the last 24 hours. The exchange saw 6,060 BTC worth approximately $722 million added to its balance, with whales being the primary contributors to this surge.

Economic Events Influence Trader Behavior

CryptoQuant analyst JA Maartunn attributes the recent whale activity to broader economic factors. The analyst points to key U.S. economic reports, including Jobless Claims, PPI, and Retail Sales data, as catalysts for the repositioning.

“It likely a reaction to the increased prices and positioning ahead of this week’s economic events,” Maartunn explained to BeInCrypto.

Long-Term Holders Show Resilience

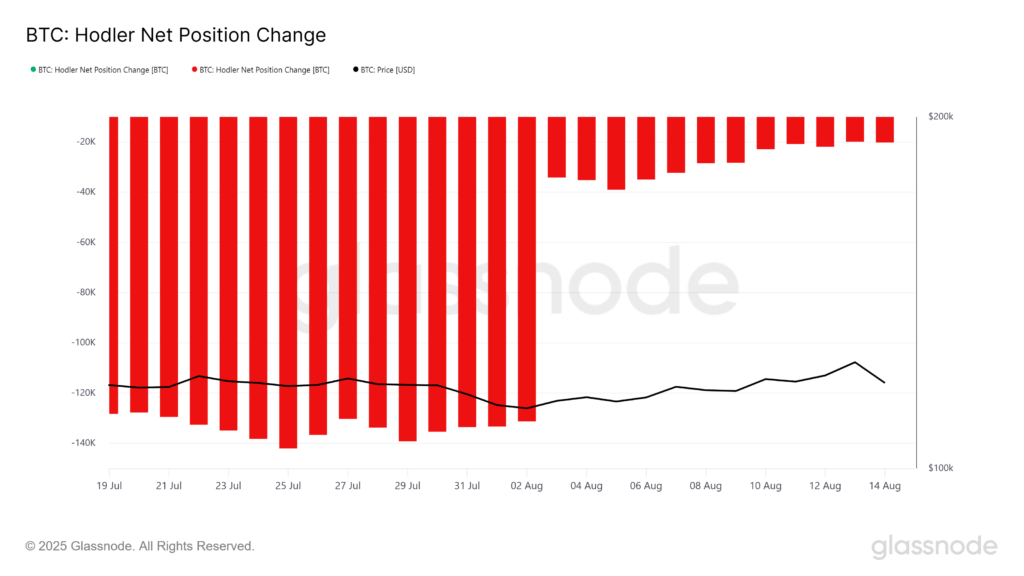

Despite the selling pressure from whales, long-term holders (LTHs) are demonstrating commitment to their positions. The HODLer Net Position Change metric indicates a shift away from bearish territory, suggesting reduced selling pressure from dedicated Bitcoin supporters.

Price Action and Support Levels

Bitcoin currently trades at $119,186, having slipped below the psychological $120,000 threshold. The cryptocurrency maintains support above the $119,000 level, indicating the recent decline may represent a temporary correction rather than a sustained downturn.

Market observers are watching whether Bitcoin can reclaim $120,000 as solid support, potentially enabling a recovery toward $122,000. However, intensified selling could push the price through the $117,261 support level, potentially targeting $115,000 or lower levels.

Comments are closed.