Is AERO’s Rally Real? Trading Volume and Open Interest Say Otherwise

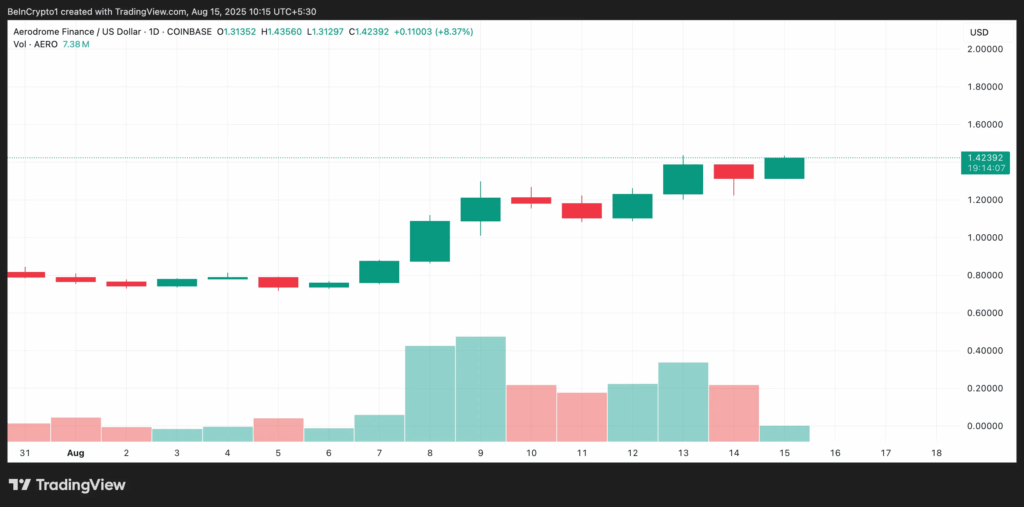

AERO has posted a 4% price gain in the last 24 hours—but on-chain data suggests the move might not be as strong as it appears.

Despite the price uptick, AERO’s trading volume has dropped 23% during the same period, falling to $162.41 million. This kind of volume-price divergence typically signals a weakening trend. In healthy market rallies, rising prices are often supported by growing trading activity, reflecting genuine buying interest. In AERO’s case, the opposite is happening.

When price increases while volume shrinks, it often means fewer participants are behind the move. This suggests that short-term traders, not long-term investors, are driving the rally. If broader demand doesn’t return soon, AERO could face a sharp pullback.

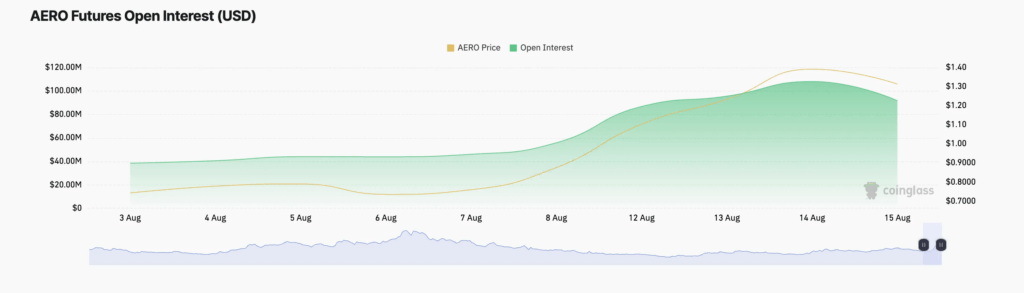

Futures Data Signals Weak Conviction

Adding to the caution, AERO’s futures open interest has dropped 16% in the past 24 hours, currently standing at $97 million, according to Coinglass data. Open interest tracks the total number of open futures contracts. A rising open interest typically means new capital is entering the market, often a bullish sign.

However, a decline in open interest—especially during a price increase—suggests traders are closing positions instead of adding new ones. This shows a lack of conviction in the rally’s sustainability.

Taken together, the falling volume and shrinking futures interest raise concerns that AERO’s latest move may be temporary. Unless broader market support emerges, the altcoin could struggle to maintain its recent gains.

Comments are closed.