Featured News Headlines

ALT5 Sigma Secures Massive Funding for WLFI Tokens

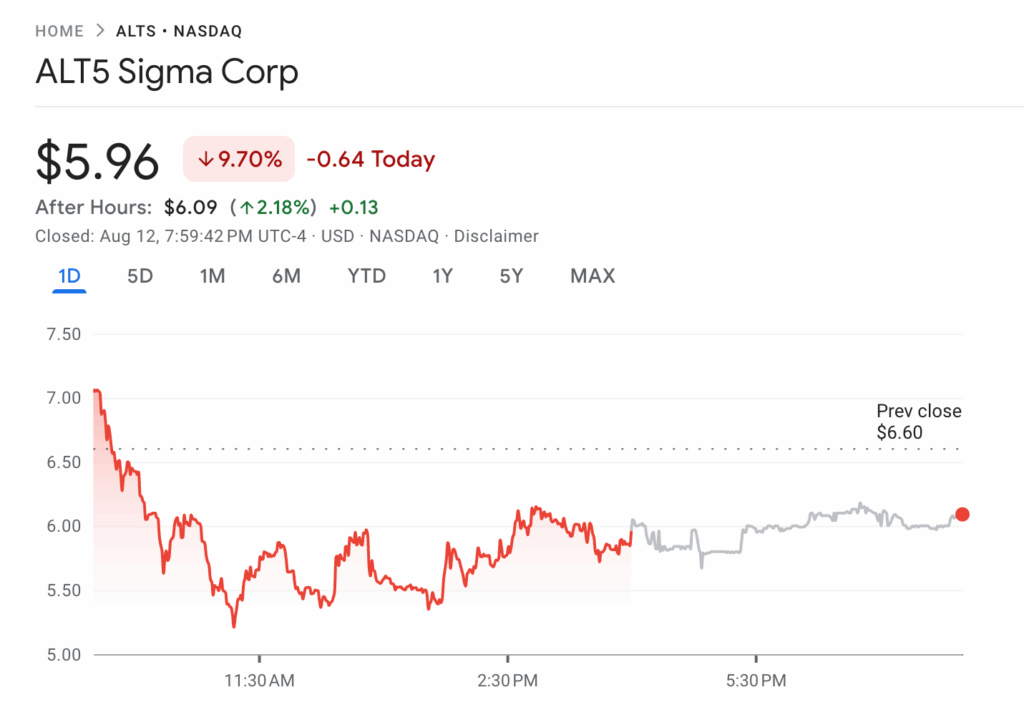

ALT5 Sigma Corporation completed a groundbreaking $1.5 billion funding round on August 12, 2025, marking one of the largest crypto-related investments in recent history. The transaction involved selling 200 million shares at $7.50 each through two separate offerings.

World Liberty Financial, backed by President Trump, led the private placement as the primary investor. This partnership signals growing institutional acceptance of cryptocurrency assets within traditional finance.

Strategic Token Holdings and Leadership Changes

ALT5 Sigma plans to hold 7.5% of the total WLFI token supply as part of its treasury strategy. The remaining funds will address existing litigation, pay outstanding debts, and support ongoing operations.

The deal brought significant leadership changes. Zach Witkoff, CEO of World Liberty Financial, became Chairman of ALT5’s Board of Directors. Eric Trump joined as a board member, expressing enthusiasm for the company’s digital asset approach.

“I am excited to join the Board of ALT5 Sigma and help lead the way in revolutionizing the digital asset space,” Eric Trump posted on social media.

WLFI Token Launch Approaches

Despite current non-tradable status, WLFI tokens are expected to debut on major exchanges soon. Token holders previously approved proposals to make WLFI tradable, though only a portion of tokens from public sales at $0.015 and $0.05 will initially unlock.

Donald Trump Jr. confirmed the team’s ambitious plans: “Once live, we expect that the WLFI token will be available on both major centralized exchanges and decentralized platforms, ensuring global governance reach and liquidity.”

Market Impact and Future Outlook

The $1.5 billion investment represents a significant milestone for Trump-backed crypto ventures. Eric Trump expressed confidence that WLFI’s impact will be unprecedented in the crypto space.

While exact timing remains unconfirmed, industry watchers anticipate the token’s retail debut could happen within months. This development continues the trend of traditional finance embracing cryptocurrency investments.

Comments are closed.