Buterin Backs ETH Treasury Trend: Is This the Future of Corporate Crypto?

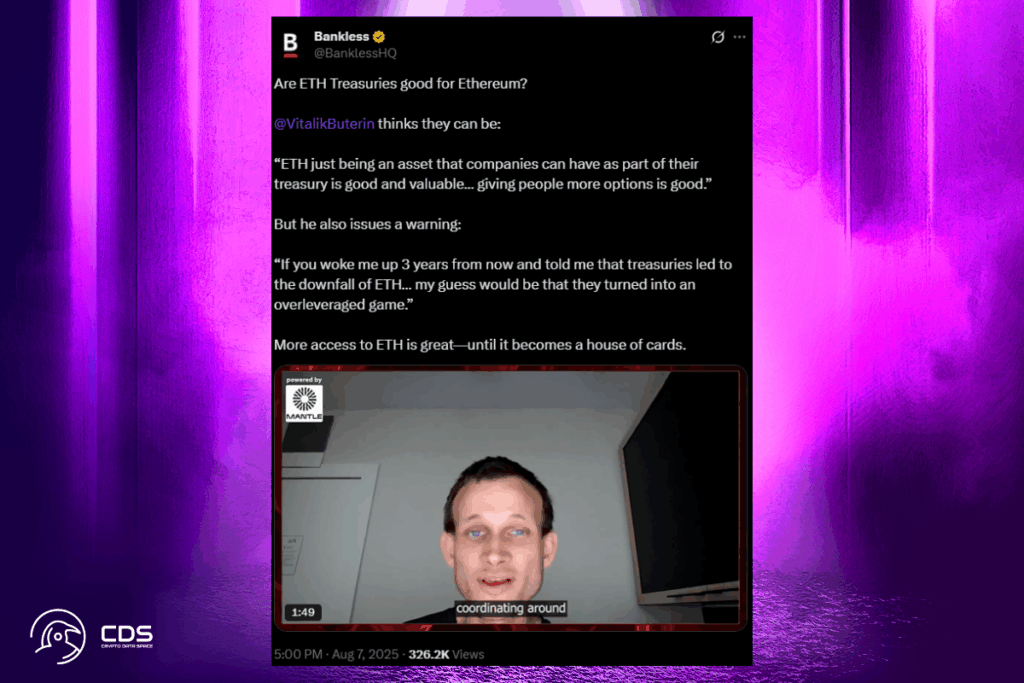

Vitalik Buterin, a co-founder of Ethereum, endorsed Ether treasury enterprises. But he cautioned that if the trend is not managed properly, it may turn into an overly leveraged game. Buterin stated that the increasing number of publicly traded firms purchasing and holding Ether is beneficial since it exposes the token to a wider spectrum of investors in an interview with the Bankless podcast that was made public on Thursday. He also mentioned that people, particularly those with varying financial situations, have more options when businesses invest in ETH treasury corporations rather than owning the token directly.

Buterin Warns: Overleveraged ETH Treasuries Could Trigger Ethereum’s Downfall

However, Buterin was cautious in his support, emphasizing that undue leverage must not be the price of ETH’s future.

If you woke me up three years from now and told me that treasuries led to the downfall of ETH, then, of course, my guess for why would basically be that somehow they turned it into an overleveraged game.

Buterin

In his worst-case scenario, he described how a decline in the price of Ethereum may lead to forced liquidations, which would further depress the value of the token and damage its reputation. Buterin is certain that ETH investors are disciplined enough to avoid such a crash, nevertheless.

Ethereum Rebounds Strongly as Public Firms Pour Into ETH Treasuries

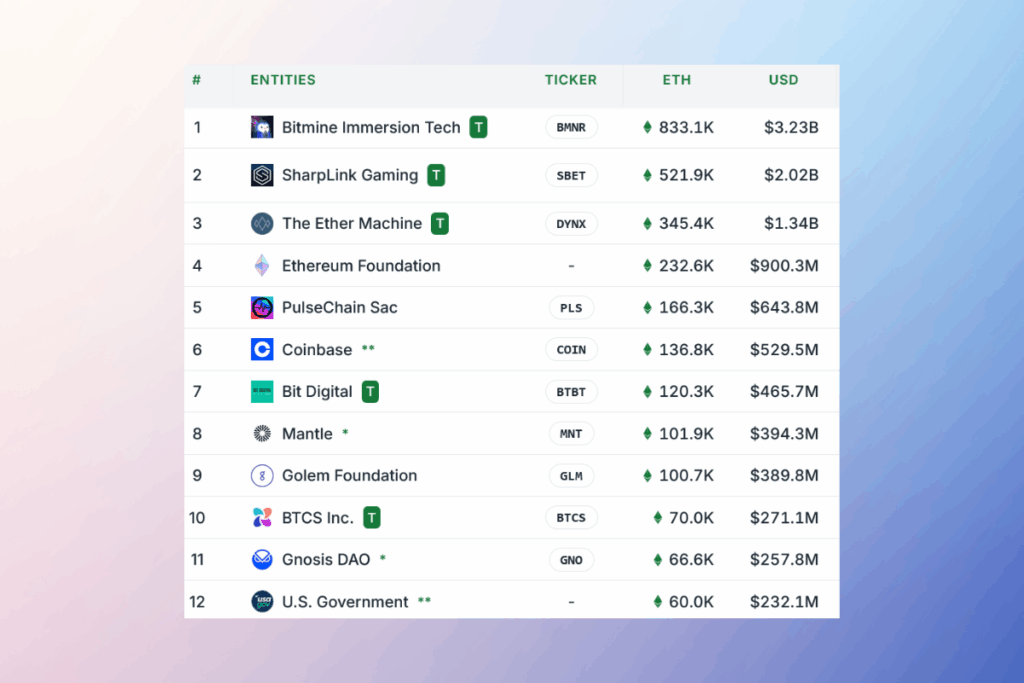

BitMine Immersion Technologies and SharpLink Gaming now control the majority of the $11.77 billion market for publicly traded corporations that own Ether. The price of Ethereum has fluctuated throughout the year, dropping from about $3,685 in January to a low of $1,470 on April 9 before rising more than 163% to its current level of $3,918. An important driving force behind the token’s comeback has been the development of ETH treasury firms. The current bull cycle has been driven by Bitcoin and Solana, but ETH has closed the gap on both with its price surge.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.