Featured News Headlines

ETH Price- Will ETH Break $3,950 or Drop Further?

ETH Price– Ethereum (ETH) just recorded its second-largest daily sell imbalance ever, with a Net Taker Volume of -$418.8 million—a massive 116,000 more ETH sold than bought in a single day, according to CryptoQuant.

Historically, such sell-offs often mark local tops and precede corrections. Yet, despite the pressure, ETH is holding near $3,643, signaling that buyers are still absorbing the sell-side heat—for now.

Bullish Structure at Risk: Can ETH Break Resistance?

ETH recently formed a textbook cup and handle pattern—typically a bullish signal. However, the price failed to reclaim the $3,950 neckline resistance, now consolidating within a descending channel.

The RSI sits at 57, indicating neutral momentum and limited breakout strength. If bulls don’t reclaim $3,950 soon, the pattern may break down, leaving ETH vulnerable to further losses.

On-Chain Activity Shows Strength Beneath the Surface

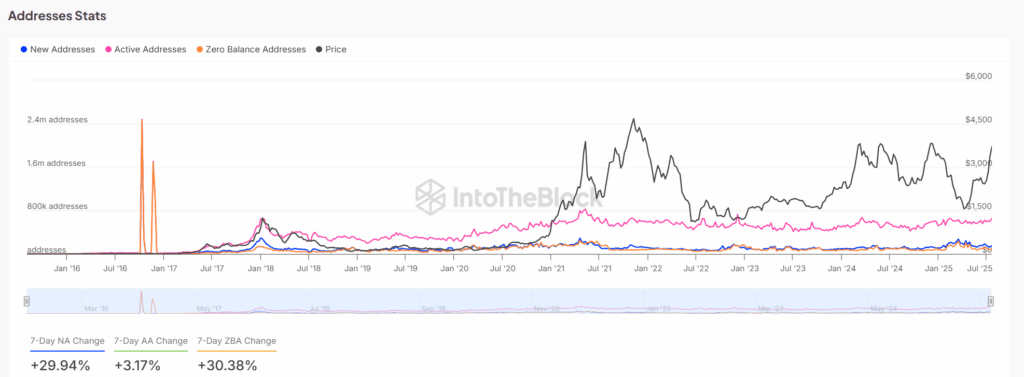

Despite price pressure, Ethereum’s network growth tells a different story. New addresses are up nearly 30%, and active addresses climbed over 3%, according to IntoTheBlock.

Such on-chain strength often precedes rebounds. This divergence between price action and network activity suggests Ethereum’s foundation remains solid—even if the charts look shaky.

Long-Term Holders Still Confident

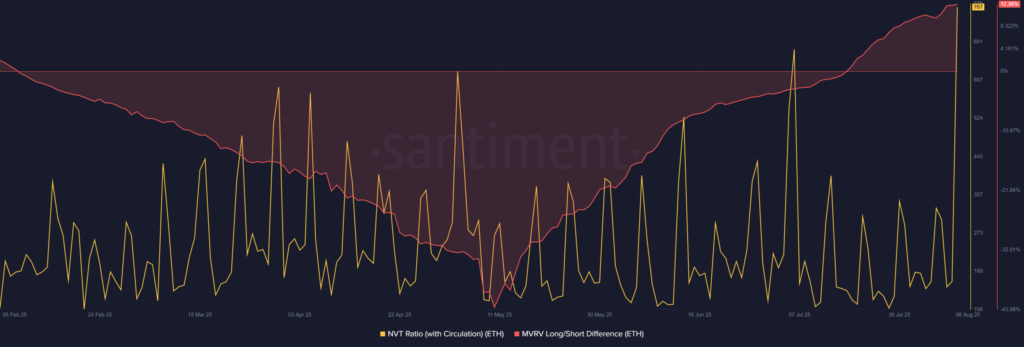

While short-term indicators show signs of overvaluation—reflected by a rising NVT Ratio—long-term holders are standing firm. The MVRV Long/Short Difference remains above 12%, showing that many investors still sit on healthy gains.

This continued confidence may offer a supportive cushion against deeper declines. If bulls can regain momentum and reclaim $3,950, ETH could re-enter a bullish trajectory.

Comments are closed.