Featured News Headlines

AIXBT Price: AIXBT’s Breakout May Just Be the Beginning

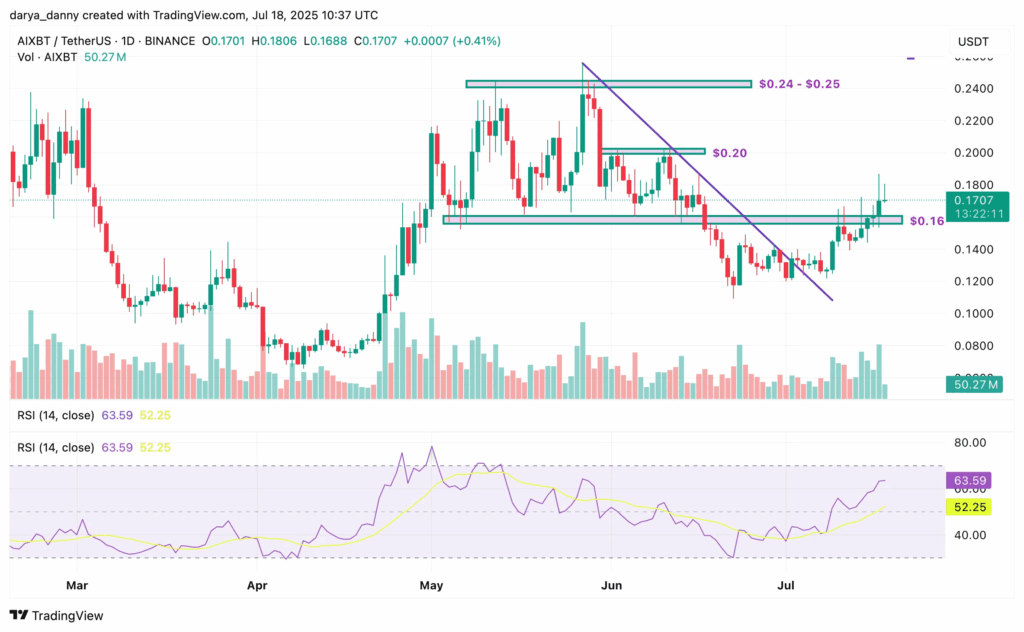

AIXBT Price– AIXBT has mounted an impressive recovery, rebounding more than 50% from its June 22 low of $0.11. The token now trades at $0.17, marking a key breakout above the 20-day exponential moving average (EMA) and the critical $0.16 resistance level — a price point that acted as a ceiling for nearly six weeks.

This price resurgence signals a significant shift in sentiment as bulls take control. The short-term roadmap now includes targets at $0.20 and $0.22, with a long-term focus on $0.25 — the May high where selling pressure previously intensified.

Technical Indicators Support Bullish Outlook

The technical setup remains favorable. The Relative Strength Index (RSI) has climbed from the neutral 50 zone to 63, indicating growing bullish momentum while still avoiding overbought levels. This suggests that the token has room to rally before hitting significant resistance from profit-taking traders.

Moreover, AIXBT reclaiming the $0.16 level — which acted as a strong support in May before flipping into resistance — reinforces the idea of a healthy reversal pattern.

Fundamentals Fuel Confidence: Exchange Listings and Institutional Interest

Beyond the charts, several fundamental catalysts are adding fuel to the fire. AIXBT’s Binance.US listing in early May significantly increased exposure to the North American retail market. This was followed by a KRW trading pair listing on Coinone, a major South Korean exchange, on June 20 — expanding access in one of Asia’s most active crypto markets.

Even more notably, in June, asset management giant Grayscale added AIXBT to its Assets Under Consideration list for inclusion in its AI sector index. This move marks a key institutional signal, suggesting that AIXBT is now being evaluated alongside major tokens in the emerging AI-driven blockchain space.

Outlook: A Break Above $0.20 Could Spark Further Gains

With both technical and fundamental narratives aligning, AIXBT is well-positioned to test higher levels. A break and hold above $0.20 could open the door to $0.22 and $0.25, where the market will likely reassess valuation in light of increased institutional visibility.

If buying pressure continues and long-term holders stay firm, analysts expect AIXBT to remain on an upward trajectory through Q3 2025.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrencies and stocks, particularly in micro-cap companies, are subject to significant volatility and risk. Please conduct thorough research before making any investment decisions.

Comments are closed.