Bitcoin Entering Extreme Greed Phase: What Comes Next?

According to anonymous Bitcoin expert apsk32, Bitcoin has risen 10% in July, hitting all-time highs of $118,600. This could be the start of a parabolic boom. If history repeats itself, Bitcoin might be worth up to $258,000, according to the analyst.

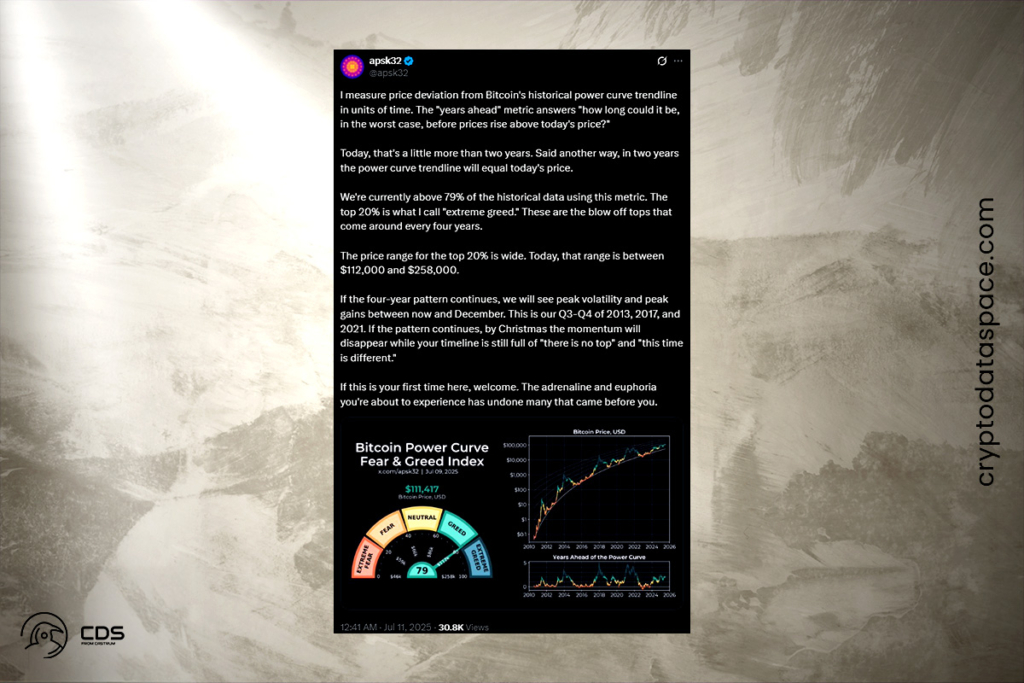

A long-term power curve trendline, a mathematical model that depicts Bitcoin’s exponential growth over time, has been the path taken by the price action of the cryptocurrency, according to apsk32. Using a method called Power Law Time Contours, it calculates price departure from this trendline in both monetary and temporal units. According to the analyst, Bitcoin is a little over two years ahead of its power curve. So, if the price remained unchanged, it would take more than two years for the long-term trendline to cross it once more.

We’re currently above 79% of the historical data using this metric. The top 20% is what I call “extreme greed.” These are the blow-off tops that come around every four years.

apsk32

Rails CEO: Fed Policy and Tariff Shifts Could Fuel Bitcoin Rally in 2025

The extreme greed zone, which was observed during the euphoric peaks of Bitcoin in 2013, 2017, and 2021, is between $112,000 and $258,000. Before the bullish momentum starts to wane at the beginning of 2026, the analyst suggested that Bitcoin might be between $200,000 and $300,000 by Christmas if the four-year pattern holds true.

The CEO of the perpetual trading platform Rails, Satraj Bambra, also said that a few macroeconomic factors might push Bitcoin much higher in 2025. Key catalysts, according to Bambra, are the Federal Reserve’s growing balance sheet and a shift toward lower interest rates, possibly under new Fed leadership in response to the economic drag caused by increased tariffs. When combined, these changes may spark a widespread increase in risk-on assets, which would be advantageous for Bitcoin.

I see Bitcoin going parabolic in the region of $300K–500K driven by two key forces.

Bambra

Bitcoin ETFs Outshine Gold as Institutional Demand Surges

Spot Bitcoin ETFs are catching up to gold, accounting for 70% of its net inflows so far this year, according to Ecoinometrics. Growing institutional interest and confidence in Bitcoin as a reliable store of value are indicated by its robust recovery from a sluggish 2025 start.

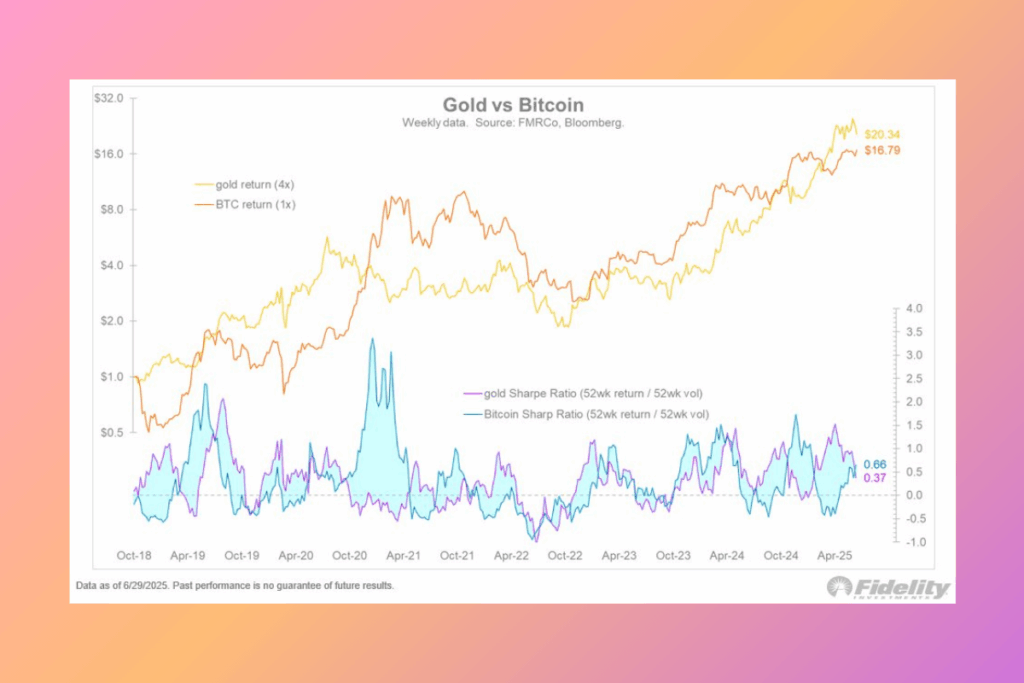

In line with its five-year average, Bitcoin has maintained a moderate connection with the Nasdaq 100 during the last 12 months, indicating that it is still a risk-on asset. Its distinct portfolio role is emphasized by its low correlation with gold and bonds. In line with that opinion, Jurrien Timmer, Director of Global Macro at Fidelity, recently said that the focus has returned to Bitcoin. Timmer claims that Bitcoin is providing better risk-adjusted returns since the difference between its Sharpe ratios and those of gold is closing.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.