HYPER Sees Massive Gains, Then Dips: What’s Next?

The interoperability protocol, Hyperlane (HYPER), surpassed the $0.18-0.2 highs from May to reach $0.67 yesterday. The coin’s value increased by about 445% in less than two days after it was announced that it would be listed on the popular South Korean exchanges Upbit and Bithumb. This incident was the catalyst for the HYPER rally. But as of this writing, HYPER is currently trading at $0.4765, having fallen 9.26%.

At the time of writing, HYPER‘s daily trading volume was $952.13M, according to CoinMarketCap data. The token, which had a market value of only $83.57 million, was quite popular and may expand significantly in the near future.

HYPER’s Bullish Reversal: From $0.46 Lows to a Steady Uptrend

On June 22, over two weeks ago, the comeback from the April and May slump started. On this day, HYPER formed its low at $0.4675. In early July, the token started to establish higher lows. By the first week of July, the pattern of higher highs and lower lows had been established. The uptrend that was created earlier in the month led to the most recent gain. Naturally, the listing news’s bullishness cannot be downplayed.

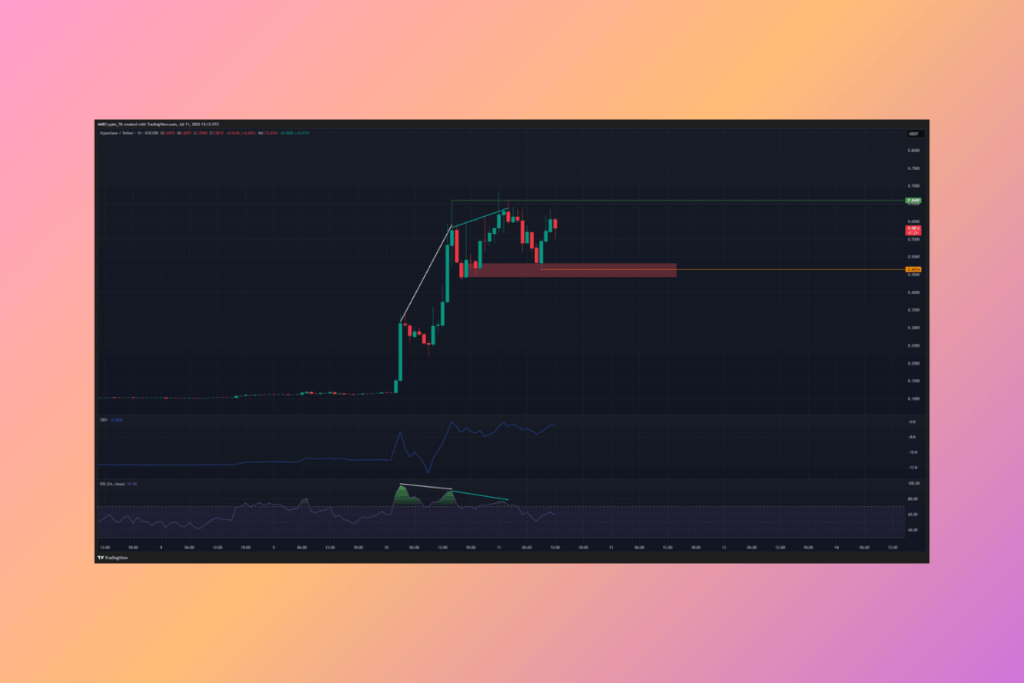

HYPER’s Price Action Defies Bearish Divergences Amid Volatility

The one-hour price movement from yesterday demonstrated how divergences might not be as effective in extremely volatile circumstances. White and cyan were used to indicate two bearish momentum divergences between the price and the RSI. Over the next eight hours, the price charts showed a 42% comeback after the first one saw a 23.1% decline.

The price increased throughout this rally, but the RSI continued to decline. HYPER has again retraced to the $0.45 demand zone because of the divergence. An order block from the initial retreat is bullish. Over the last day, the OBV has increased, indicating market demand.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.