Featured News Headlines

Bitcoin Exchange Balances Fall as Tether Moves 8,889 BTC Off Bitfinex

Bitcoin’s on-chain dynamics continue to shift as large entities quietly reduce exchange-held supply. Most recently, Tether withdrew 8,889 BTC from Bitfinex, a transfer valued at approximately $779 million at the time of execution. Following this move, Tether’s total Bitcoin holdings reached roughly 96,370 BTC, with an estimated value of $8.46 billion.

This transaction fits into a broader market trend where major holders increasingly move assets off exchanges. Such behavior steadily reduces liquid supply, reinforcing Bitcoin’s structural price sensitivity without triggering immediate volatility.

Exchange Outflows Signal Strategic Accumulation

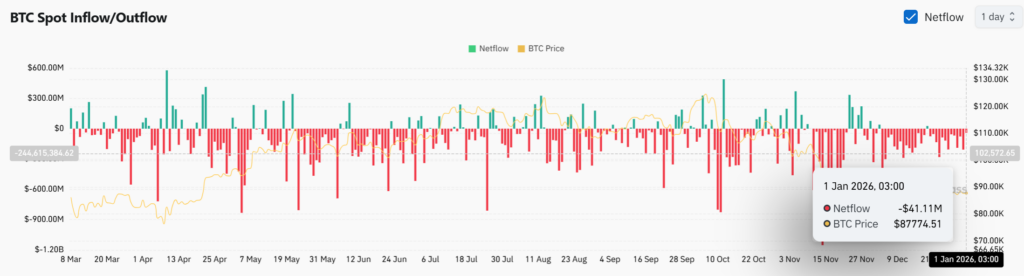

Spot exchange netflows remain firmly negative, indicating that accumulation extends beyond isolated whale activity. At the time of writing, netflows stood at -$41.11 million, reflecting sustained withdrawals during mixed market conditions.

Notably, demand continues to absorb this reduced supply without urgency. This suggests methodical positioning rather than speculative buying. As a result, exchange balances decline gradually, weakening sell-side depth over time and increasing Bitcoin’s responsiveness to future demand shifts.

Leverage Builds Beneath the Surface

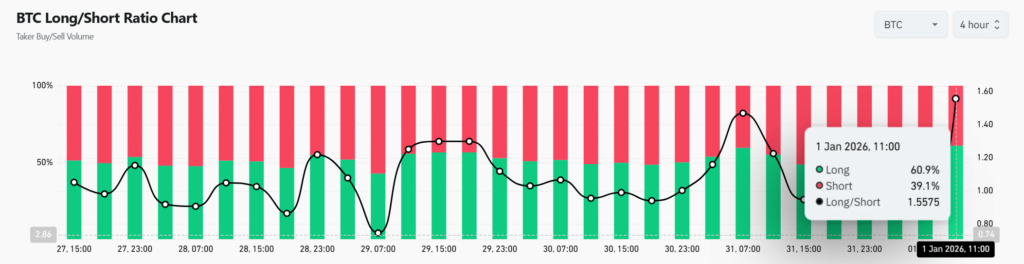

While spot participation remains controlled, derivatives markets show growing bullish positioning. The BTC Long/Short Ratio recently climbed to 1.56, with long positions accounting for nearly 61% of total exposure on the four-hour timeframe.

This leverage-heavy structure often precedes volatility rather than stability. Repeated dip-buying reinforces directional bias without forcing resolution, leaving the market vulnerable to sudden adjustments if momentum stalls.

Liquidity Concentrates Below Price

Liquidation data highlights dense downside liquidity between $86,000 and $88,000, with deeper clusters extending toward $84,000. These zones align with recent structural lows, increasing the likelihood of short-term liquidity sweeps.

Meanwhile, upside liquidation pressure remains comparatively thin, limiting forced buying. Combined with elevated funding rates, this imbalance suggests heightened sensitivity to rapid price movement.

Volatility Risk Increases as Structure Tightens

Bitcoin currently reflects tightening exchange supply, persistent accumulation, elevated leverage, and concentrated liquidity zones. While these conditions support long-term structural strength, they also raise short-term fragility.

Historically, such setups rarely persist without resolution. As a result, volatility expansion appears increasingly likely, making upcoming sessions critical for directional clarity—without implying any guaranteed outcome.

Comments are closed.