Featured News Headlines

Crypto vs Traditional Assets: Bitcoin Trails Gold, but Recovery Signs Emerge

The crypto market continues to struggle as it heads toward 2026, even while other major asset classes show signs of recovery. However, analysts at market intelligence platform Santiment believe the current divergence may set the stage for crypto to eventually play catch-up in the new year.

Bitcoin Trails Gold and Stocks

In a post on X on Tuesday, Santiment analysts noted that Bitcoin (BTC) has significantly underperformed both gold and the S&P 500 following a market crash in November. Since the start of that month, gold has climbed 9%, the S&P 500 is up 1%, while Bitcoin has fallen roughly 20%, trading near $88,000 as of Wednesday.

“The correlation between Bitcoin & crypto compared to other major sectors is still lagging behind,” Santiment said, adding that “heading to 2026, there will remain an opportunity for crypto to play catch-up.”

Whales Remain on the Sidelines—for Now

One key factor to watch is whale behavior. According to Santiment, large holders slowed their accumulation during the second half of 2025, while smaller wallets aggressively bought. Large wallets rose into Bitcoin’s October all-time high before selling, leaving accumulation largely flat afterward.

Historically, Santiment noted, market reversals often occur when large wallets begin accumulating while retail investors sell. Encouragingly, long-term Bitcoin holders have stopped selling for the first time in six months, after reducing holdings from 14.8 million BTC in mid-July to 14.3 million in December.

Signs of Capital Rotating Back to Crypto

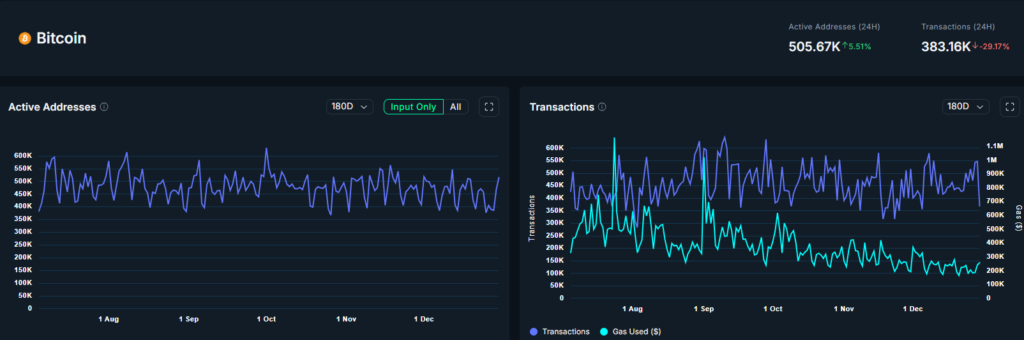

Some observers believe a shift back into crypto may already be starting. Garrett Jin, former CEO of BitForex, suggested traders are rotating out of precious metals and back into digital assets. Data from Nansen shows active Bitcoin addresses rising 5.51% in the past 24 hours, though transaction counts are down nearly 30%.

“The short squeeze in metals is over as expected. Capital is beginning to flow into crypto,” Jin said.

Meanwhile, market analyst CyrilXBT described current conditions as “classic late-cycle positioning,” suggesting markets may move before the broader narrative shifts.

For now, crypto remains under pressure—but beneath the surface, signs of a potential transition are beginning to emerge.

Comments are closed.