Featured News Headlines

Ethereum Quietly Rebounds as Smart Contract Deployments Hit Record Highs

Ethereum appears to be quietly rebuilding momentum after months of sluggish price action and uneven ETF flows. While ETH has struggled to break out on the charts, underlying on-chain and institutional data suggest a shift may be underway, pointing to renewed confidence in the network’s long-term outlook.

Staking and Supply Dynamics Begin to Shift

One of the clearest signals comes from Ethereum’s staking activity. For the first time in six months, staking inflows have turned positive. More than 745,000 ETH is currently queued to enter staking, compared to roughly 360,000 ETH waiting to exit. At the same time, exchange balances are falling at the fastest pace of this cycle, indicating reduced sell-side supply.

Supporting this trend, the 90-day Spot Taker CVD has moved into neutral territory, showing that aggressive selling pressure is easing. Together, these metrics suggest growing confidence among long-term holders, even as broader market sentiment remains cautious.

On-Chain Usage Hits New Highs

Despite continued weakness in ETF flows, Ethereum’s on-chain fundamentals are strengthening. Smart contract deployments have reached record highs, highlighting sustained developer activity. In parallel, real-world asset (RWA) value on Ethereum has climbed to nearly $19 billion, reinforcing the narrative that real usage is backing the network’s growth.

These developments point to demand that goes beyond speculation, rooted instead in infrastructure and adoption.

Institutions Quietly Increase Exposure

Institutional behavior is also telling. BlackRock’s Spot Ethereum ETF (ETHA) has seen steady accumulation, with holders now heavily positioned long—486 long positions versus just one short. Ownership of ETHA has continued to grow through late 2025, despite fragile market sentiment.

Direct accumulation is also evident. Trend Research recently purchased 46,000 ETH, bringing its total exposure to approximately 626,000 ETH, signaling conviction while prices remain compressed.

Price Stalls, but Support Holds

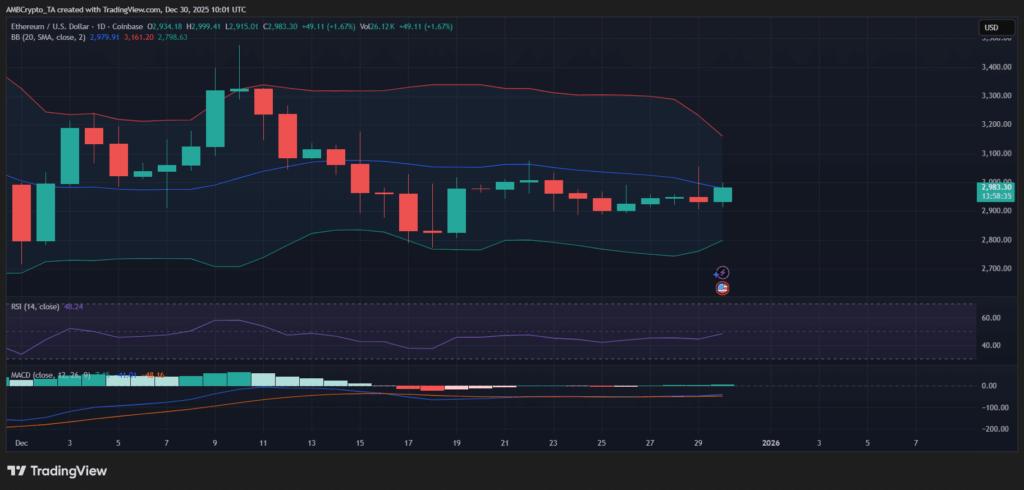

On the price front, Ethereum remains range-bound. ETH is trading just below the mid-Bollinger Band, with RSI near neutral and MACD showing fading momentum. Crucially, downside moves continue to be absorbed above the lower Bollinger Band, keeping the $2,800–$2,900 zone intact as short-term support.

For now, Ethereum may be consolidating—but with improving fundamentals, the groundwork for its next move appears to be taking shape.

Comments are closed.