Featured News Headlines

Ethereum Sees All-Time High Smart Contract Deployments in Q4

Ethereum’s long-term fundamentals are showing renewed strength, even as its market price struggles. While speculative volatility continues to weigh on Ether (ETH), the network’s developer ecosystem is quietly reaching new milestones—highlighting a growing divide between price action and on-chain growth.

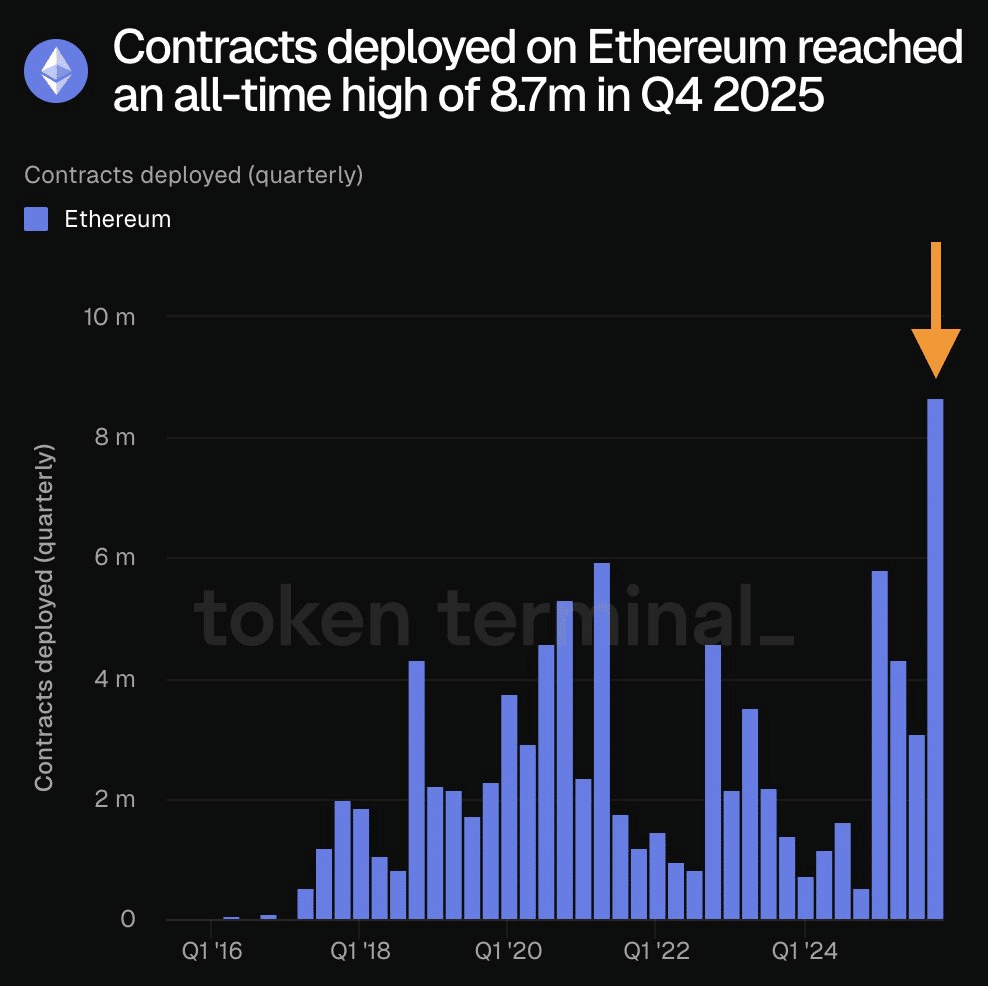

Smart Contract Deployments Reach All-Time High

According to Token Terminal, the number of smart contracts deployed on Ethereum surged to a record 8.7 million in Q4, marking the highest level ever recorded. In simple terms, more applications are being built directly on the Ethereum blockchain than at any other point in its history.

This trend reflects a broader shift within crypto markets toward infrastructure-level development, as layer-1 blockchains compete to establish themselves as the backbone of the expanding Web3 ecosystem, where decentralization and scalability remain key themes.

DeFi Projects Push Ethereum Utility Forward

One example of this growth is Mutuum Finance (MUTM), a new DeFi lending and borrowing protocol built on Ethereum. The project has now entered stage two of its roadmap, with 18,500 investors already participating, underscoring continued interest in Ethereum-based applications.

This surge in development comes at a time when ETH’s price performance tells a very different story.

ETH Price Falls as Fundamentals Strengthen

Despite accelerating on-chain activity, ETH is down roughly 25% in Q4, falling below the $3,000 level. The contrast between declining prices and rising development has fueled discussion around whether Ethereum may be undervalued relative to its fundamentals.

Unlike traditional equities, blockchains don’t rely on earnings reports. Instead, network adoption, developer engagement, and real-world use cases are key indicators of long-term health.

Adoption and Falling Reserves Signal Long-Term Confidence

Ethereum’s expanding utility is already visible. Ferrari now accepts Ethereum payments across the U.S. and Europe, highlighting growing real-world adoption. Meanwhile, data cited by AMBCrypto shows Ethereum reserves dropping from 20 million ETH at the start of the year to 16 million, suggesting long-term holders are keeping ETH off exchanges.

This decline in reserves, combined with rising developer activity, supports a narrative of long-term holding over short-term speculation.

As developers continue building and adoption expands, Ethereum’s fundamentals appear resilient—raising questions about whether current prices fully reflect the network’s underlying strength.

Comments are closed.