Featured News Headlines

Bitcoin Long-Term Holders Halt Selling, Signaling Potential Relief Rally

Bitcoin Long-Term Holders Stop Selling – A notable shift is unfolding across the crypto market, with long-term Bitcoin holders easing off selling pressure for the first time in six months, while Ether whales aggressively add to their positions. The contrasting moves are drawing attention as traders assess whether a broader market reset could be underway.

Long-Term Bitcoin Holders Hit the Brakes

Wallets holding Bitcoin (BTC) for at least 155 days—often viewed as conviction-driven investors—have significantly slowed their selling activity. These long-term holdings declined from 14.8 million BTC in mid-July to 14.3 million BTC by December, but the pace of distribution has now tapered off.

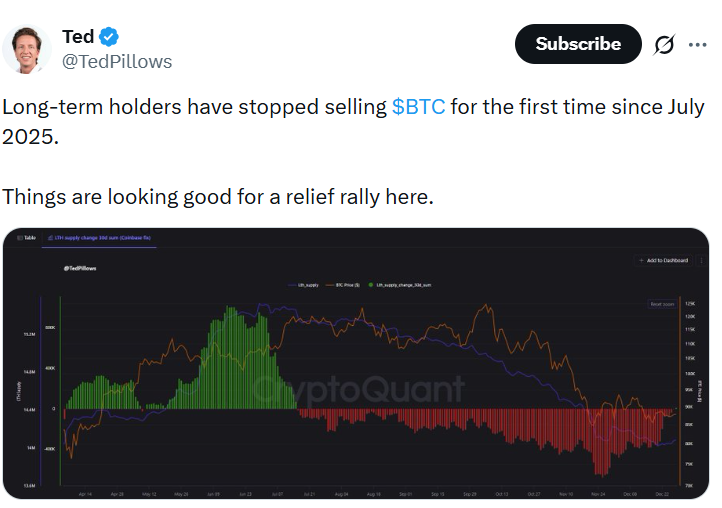

Crypto investor and entrepreneur Ted Pillows highlighted the shift in a post on X, noting that long-term holders have stopped selling Bitcoin for the first time since July 2025. According to Pillows, the slowdown could open the door to a potential relief rally. Historically, large holders and whales are seen as market movers, with their behavior often influencing liquidity, sentiment, and short-term price action.

Ether Whales Increase Accumulation

While Bitcoin selling pressure cools, Ether (ETH) whales appear to be doing the opposite. Citing CryptoQuant data, analysts at crypto investor newsletter Milk Road reported that large ETH holders added approximately 120,000 Ether since Dec. 26.

Addresses holding 1,000 ETH or more now control roughly 70% of the total ETH supply, a share that has been steadily rising since late 2024. Milk Road analysts suggested the market may not yet be fully pricing in where “smart money” expects Ethereum to head next.

Former BitForex CEO Garrett Jin echoed the sentiment, predicting further inflows into both Bitcoin and Ether as capital rotates away from silver, palladium, and platinum, which have recently seen sharp moves.

Traders Stay Cautious After Holiday Volatility

Despite whale accumulation, broader trader sentiment remains cautious. Bitcoin has traded between $86,744 and $90,064 over the past week. Analysts at Santiment observed that a spike in fear, uncertainty, and doubt (FUD) coincided with price strength around Christmas, a pattern often seen when markets move against prevailing sentiment.

US Selling Pressure Lingers

Some downside pressure may be coming from US-based traders. CoinGlass’s Coinbase Bitcoin Premium Index remains negative, signaling continued selling pressure in the US market and a more risk-averse stance among investors.

Together, these signals paint a complex picture—one where long-term conviction and whale accumulation contrast with cautious short-term sentiment.

Comments are closed.