Featured News Headlines

Global Crypto Derivatives Market Nears $86 Trillion Amid Rising Complexity

Cryptocurrency derivatives trading volume surged to nearly $85.7 trillion in 2025, averaging about $264.5 billion per day, according to a new report from liquidation data tracker CoinGlass. The figures highlight how derivatives have become a dominant force in the crypto market, driven increasingly by institutional participation and more sophisticated trading strategies.

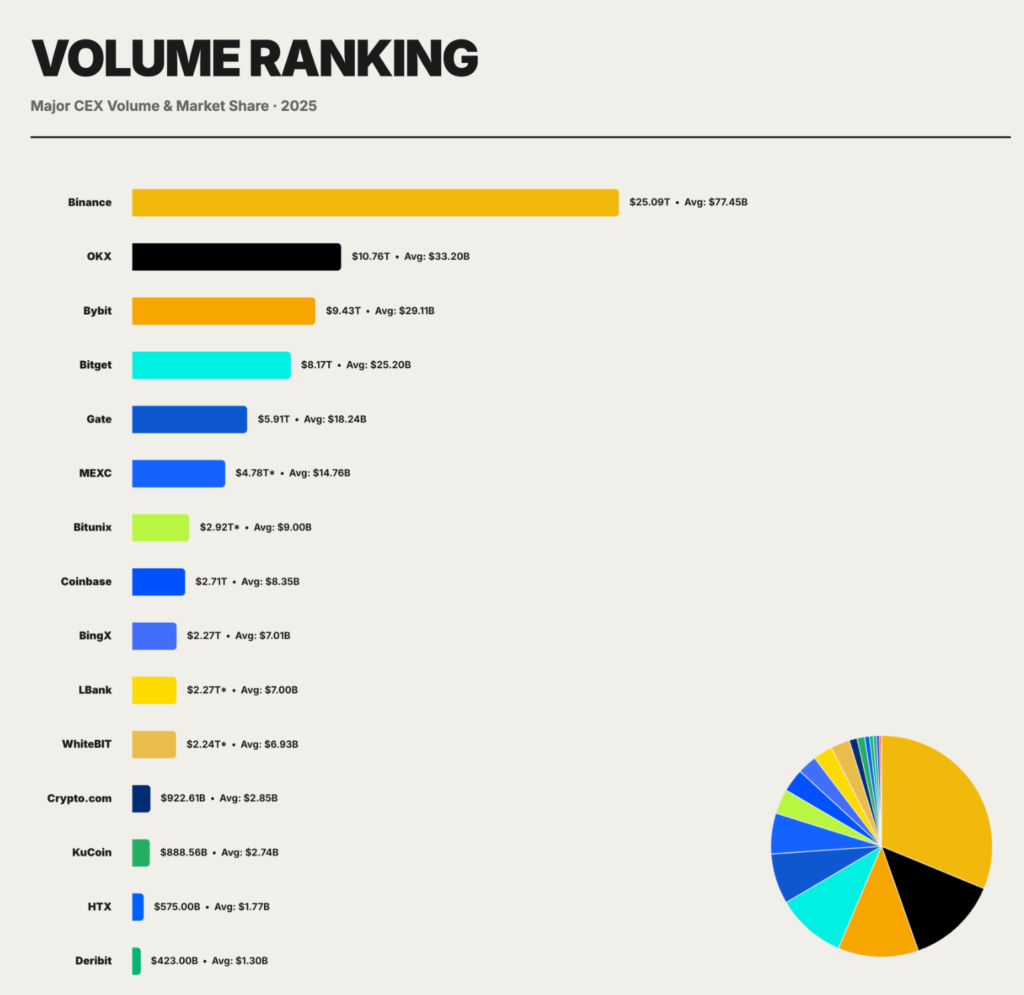

Binance Dominates Global Derivatives Volume

Binance led the market with approximately $25.09 trillion in cumulative derivatives trading volume, accounting for 29.3% of global activity. In practical terms, CoinGlass noted that nearly $30 of every $100 traded in crypto derivatives flowed through Binance during the year.

Trailing behind were OKX, Bybit, and Bitget, each posting between $8.2 trillion and $10.8 trillion in annual volume. Combined, these four exchanges controlled about 62.3% of total market share, underscoring the concentration of liquidity among a handful of major platforms.

Institutional Pathways Reshape the Market

CoinGlass reported that institutional access expanded significantly through spot exchange-traded funds (ETFs), options, and compliant futures products. This trend supported the continued rise of the Chicago Mercantile Exchange (CME), which had already overtaken Binance in Bitcoin futures open interest in 2024 and further consolidated its position in 2025.

At the same time, derivatives trading grew more complex. The market shifted away from a retail-driven, high-leverage boom-and-bust model toward a mix of institutional hedging, basis trading, and ETF-related activity.

Rising Complexity Brings New Risks

This structural shift came with increased risk. CoinGlass warned that deeper leverage chains and tighter cross-platform connections amplified “tail risks.” Global derivatives open interest dropped to a yearly low of $87 billion after first-quarter deleveraging, before climbing to a record $235.9 billion on October 7.

October Liquidation Shock Tests Market Plumbing

CoinGlass estimated $150 billion in forced liquidations during 2025, with the most severe stress occurring on October 10 and 11, when liquidations exceeded $19 billion. Roughly 85%–90% of losses came from long positions, triggered after U.S. President Donald Trump announced 100% tariffs on Chinese imports, pushing markets into a sharp risk-off phase.

Comments are closed.