Featured News Headlines

Stablecoin Growth Outpaces Risk Assets as Investors Favor Flexibility

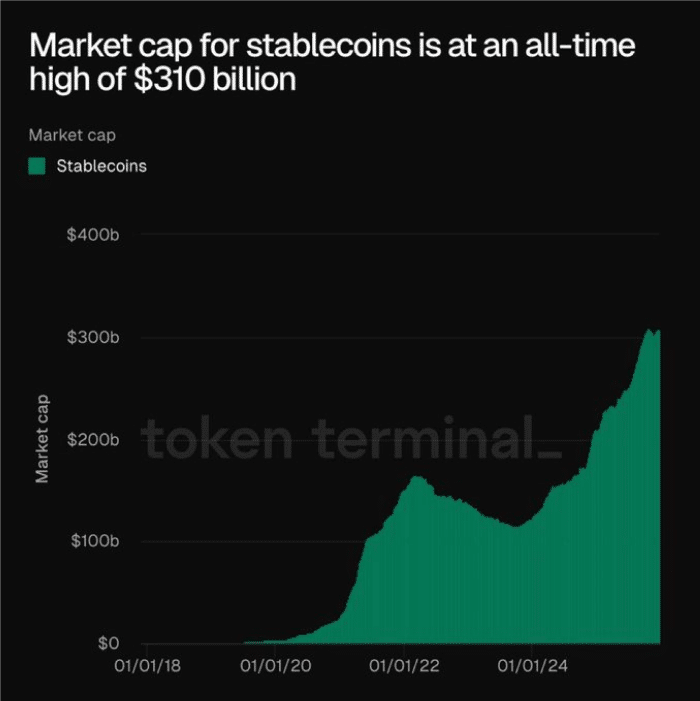

The global stablecoin market has entered a new phase of growth, signaling a shift in investor behavior across crypto markets. Data from Token Terminal shows stablecoin market capitalization rising from under $5 billion in 2018 to nearly $309–310 billion by December 24, according to DeFiLlama. This sharp expansion unfolded during a period of relatively muted volatility among major crypto assets, pointing to structural change rather than speculative excess.

Liquidity Builds During Market Consolidation

Instead of chasing price momentum, investors appeared to prioritize capital stability and optionality. Stablecoin supply increased while risk assets failed to absorb that liquidity, suggesting patience rather than fear. TradingView data reinforced this view, showing liquidity remaining sidelined yet ready, without signaling expectations of a sharp correction.

This pattern reflected deliberate positioning, with market participants preparing for future opportunities rather than executing aggressive rotations.

USDT Reinforces Crypto’s Liquidity Backbone

Among stablecoins, USDT strengthened its dominance. On December 24, 2025, USDT’s market capitalization reached a historic $187 billion, accounting for more than 60% of total stablecoin supply. The milestone confirmed USDT’s role as the primary liquidity vehicle across centralized exchanges and DeFi platforms.

On the infrastructure side, Ethereum hosted roughly 54% of stablecoin supply, maintaining its position as the leading settlement layer. Tron followed with about 26%, driven by demand for low-cost, high-throughput transfers. Other networks held smaller shares, reflecting controlled multi-chain expansion.

Tokenized Assets Deepen On-Chain Dollar Demand

Token Terminal data also showed tokenized asset market capitalization reaching an all-time high near $325 billion. Stablecoins dominated this figure, far outweighing tokenized commodities, equities, and funds. Tokenized U.S. Treasuries climbed toward $7.5 billion, highlighting growing interest in yield-bearing, blockchain-native instruments.

What Global Scaling Could Mean

Bitwise analysts noted on December 17 that stablecoin supply could approach $500 billion by 2026, potentially placing stablecoins firmly within global macroeconomic debates. As adoption spreads, they suggested policymakers may scrutinize stablecoins more closely—reflecting shifting financial power toward users seeking on-chain dollar exposure outside traditional banking systems.

Comments are closed.