Bitcoin’s Inverse Head and Shoulders Holds Strong Amid Whale Pullback

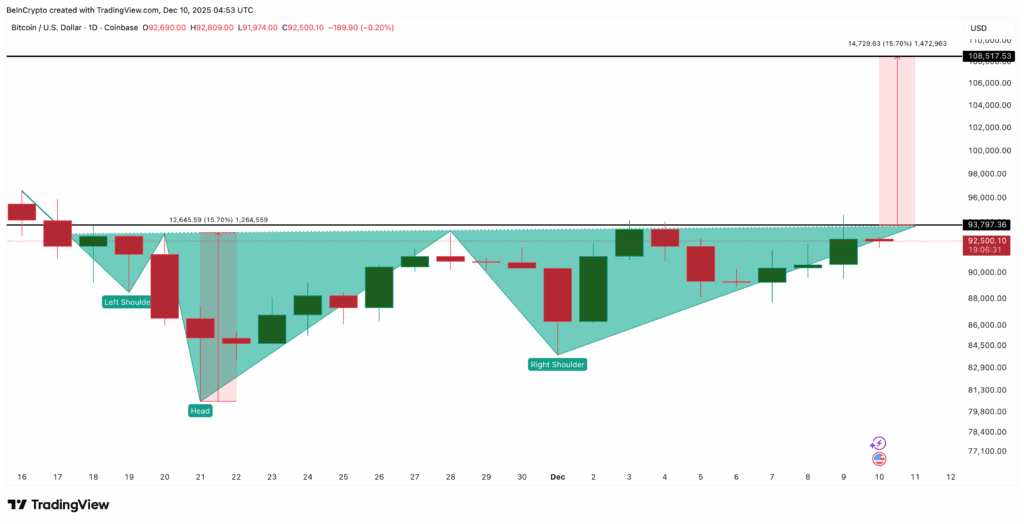

Bitcoin is trading near $92,500 after gaining 2.8% in the past 24 hours, but its latest breakout attempts continue to stall beneath a key resistance level. Despite a clean inverse head and shoulders structure still pointing toward $108,500, the market has failed to push higher — and two clear factors explain why.

$93,700 Resistance and Weak Whale Support Block the Breakout

Bitcoin has respected the inverse head and shoulders pattern that formed on November 16, but the neckline at $93,700 has rejected every attempt at a decisive breakout. Until BTC records a daily close above this zone, the pattern cannot fully activate.

Compounding the issue is hesitant whale positioning. Holders with 1,000 BTC or more have been reducing their balances since November 19, with the number of such entities falling to a monthly low of 1,303 on December 3 and remaining near that level. This lack of large-holder conviction weakens each breakout attempt.

A recent example highlights the impact: between December 2–3, Bitcoin touched $93,400, but whales dropped from 1,316 to 1,303. BTC soon corrected to $89,300, a 4.4% decline. When prices rise while whales lighten exposure, momentum often fades quickly.

Short Squeeze Conditions Offer a Fixable Path Higher

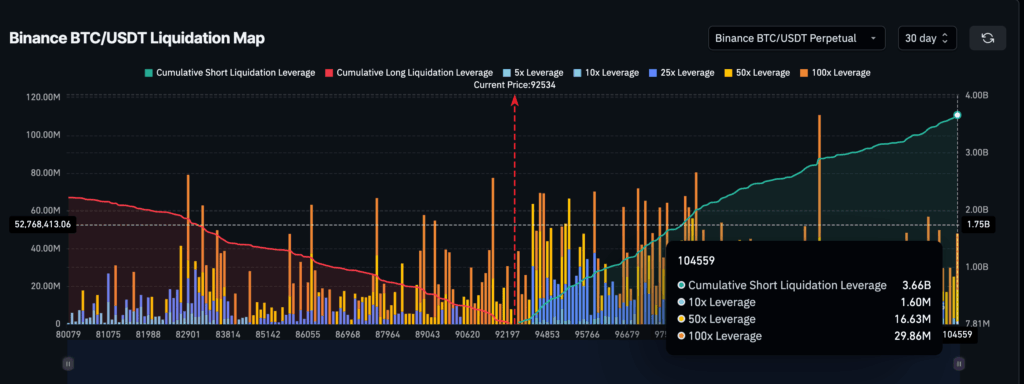

Despite these roadblocks, Bitcoin has a powerful short squeeze setup forming beneath the surface. On Binance, short liquidation leverage over the past 30 days has reached $3.66 billion, far higher than the $2.22 billion on the long side. With shorts roughly 50% higher, even a modest push above $93,700 could trigger rapid liquidations.

Multiple times this month, small 1–2% moves have already snowballed into larger rallies as short positions unwound. A clean breakout above $93,700 could open the door to $94,600, a crucial gateway level. Beyond that, momentum alone may drive BTC toward $105,200, and potentially the full pattern target at $108,500, representing a 15.7% move from the neckline.

The inverse head and shoulders remains valid above $83,800, while a drop below $80,500 would invalidate the structure and increase the risk of deeper downside.

For now, Bitcoin’s outlook is defined by a simple equation: stubborn resistance plus cautious whales — and a short squeeze that could still flip the entire picture bullish.

Comments are closed.