Bitcoin Year-End Trends: Santa Rally and Price Analysis

Bitcoin (BTC) showed renewed volatility heading into the weekly close, a recurring pattern observed throughout the quarter. After dipping near $87,000, BTC/USD closed the week around $90,000, followed by further fluctuations on shorter timeframes, data from Cointelegraph Markets Pro and TradingView show. Traders remained cautious of false moves in both directions.

In his recent X thread, trader CrypNuevo highlighted the 50-day exponential moving average (EMA) as a potential retest point. “For shorts I’m looking for a 1D50EMA retest and I’m thinking that it’ll adjust around $95.5k and be the range highs,” he wrote. CrypNuevo added that Bitcoin lacks a “clear base” for going long, keeping the low $80,000 zone in focus.

Analyst Michaël van de Poppe offered a more optimistic view, noting “intense” buying pressure at local lows. He told X followers, “Given that there’s such an intense buying pressure taking place, I would assume we’ll be breaking upwards and holding above $92K in the coming days. That would result in a rally towards $100K pre-2026.”

FOMC Week Puts Spotlight on the Fed

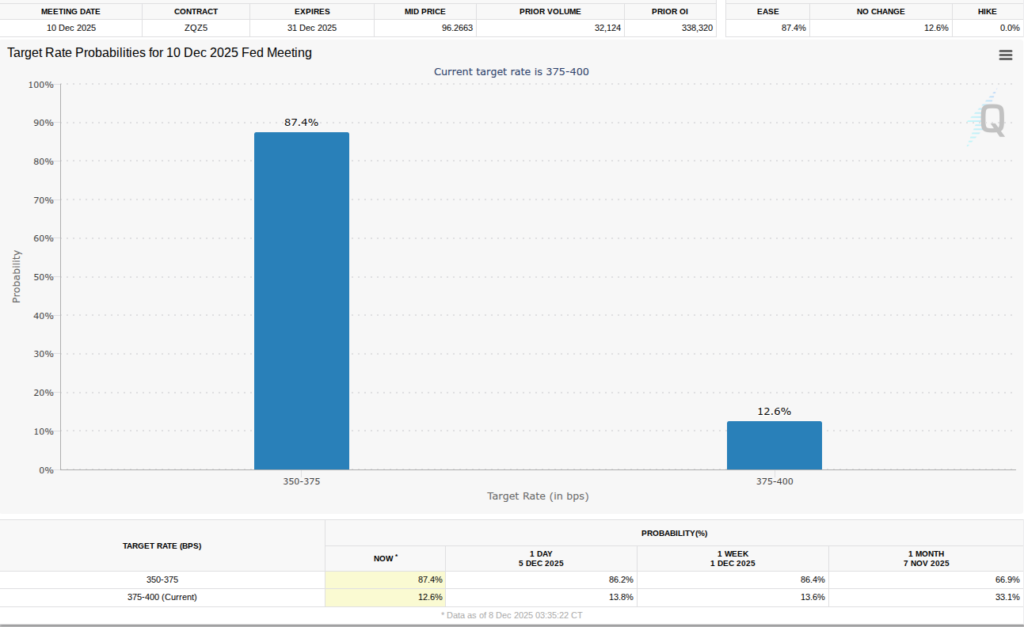

This week, attention in the markets turns to the Federal Reserve as the FOMC meets to discuss interest rates. Markets currently anticipate a 0.25% cut. Recent U.S. jobs data indicate deterioration in the labor market, creating a delicate scenario for the Fed, as inflation remains a concern. The Kobeissi Letter noted, “Nonfarm payrolls have now posted 5 declines over the last 7 months, the worst streak in at least 5 years.”

Meanwhile, Mosaic Asset Company suggested favorable conditions for risk assets. “With inflation above target, the economy holding up fine, and the S&P 500 near all-time highs, the Fed looks set to cut rates for a third consecutive meeting,” it said. Market watchers will also monitor Fed Chair Jerome Powell’s comments for insights on future policy direction.

Bitcoin Year-End Trends and Open Interest

As the year-end approaches, analysts debate a potential “Santa rally” in both stocks and crypto. Timothy Peterson noted that historical patterns often favor Bitcoin near year-end, while Joao Wedson suggested 2025 may close in a sideways range, with accumulated negative trading days supporting that view.

Peterson also compared BTC/USD this year to 2022-23, stating, “$89,000 is the new $16,000,” highlighting historical parallels in price cycles. Open interest (OI) data from CryptoQuant shows BTC exchange OI at its lowest since April, signaling either investor apathy or capitulation. COINDREAM wrote, “Excessive leverage usually acts as a drag on market direction. However, as prices have recently rebounded, leverage levels have normalized, reducing systemic risk.”

Comments are closed.