Featured News Headlines

Vanguard Opens Doors to Solana ETFs: A New Crypto Era

The crypto market is entering what many analysts describe as one of its most aggressive adoption cycles to date. With back-to-back ETF launches, momentum is no longer limited to Bitcoin alone. Institutions are increasingly widening their exposure to altcoins—particularly Solana—despite the absence of a confirmed “altcoin season.”

Institutional Demand Broadens Beyond Bitcoin

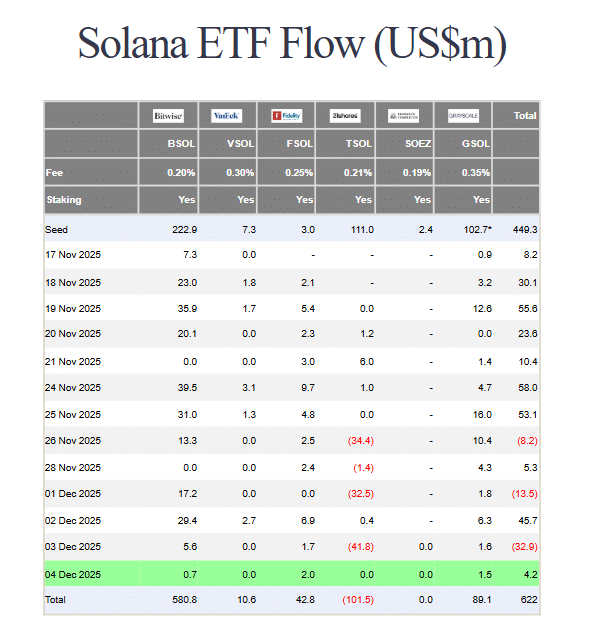

Recent inflow data shows steady institutional appetite for alternative crypto assets. Solana has emerged as the standout performer, supported by the launch of six spot SOL ETFs in Q4 and attracting roughly $622 million in inflows so far. Nearly 95% of that capital has gone into Bitwise’s BSOL ETF, which some market watchers now describe as “the BlackRock-tier heavyweight of the Solana ecosystem.”

This expansion of institutional exposure sets the stage for a deeper shift, and one of the most notable participants in this wave is Vanguard Group.

Vanguard Opens Its Doors to Crypto ETFs

Vanguard—managing more than $11 trillion in assets and serving over 50 million investors—announced on 2 December a major reversal of its long-held stance against crypto ETFs. The firm confirmed that its platform will now support crypto-related ETF products, signaling a strong acknowledgment of institutional demand.

In the words of the announcement, the move represents a “significant policy shift” for a company that previously avoided direct crypto exposure. Among the major digital assets gaining traction on the platform, Solana is included in the mix.

Why Vanguard Is Embracing Solana Now

Vanguard’s decision to allow a SOL ETF carries broader implications. Until late 2025, Ethereum had been the only altcoin approved for a spot ETF in the United States. That landscape is now changing quickly as institutional strategies evolve.

This shift comes during a period of heightened volatility for Solana. On longer-term charts, SOL remains one of the “worst-performing assets” across multiple timeframes, and on a year-to-date basis it is down approximately 28%, its weakest showing since the major drawdown of 2022.

Given these conditions, investors have questioned what institutions like Vanguard see in Solana’s long-term potential—especially when short-term returns look unremarkable. The answer appears rooted in fundamentals rather than short-term price action.

Solana’s Fundamental Strengths Drive Long-Term Interest

Despite price turbulence, Solana continues to deliver strong performance at the protocol level. Chainspect data highlights notable improvements in network scalability, stating:

“Solana’s real-time TPS [1H] rose 4.78% to 798.5 transactions per second, with transaction finality improving to 12.8 seconds.”

These metrics place Solana among the most efficient high-cap blockchains in operation today.

The network’s upcoming Alpenglow upgrade, scheduled for Q1 2026, is also expected to enhance its performance further. When combined with growing institutional participation, these fundamental developments help explain why large asset managers are paying closer attention.

Comments are closed.