Silver Hits 46-Year High: Is Tokenized Silver the Next Big Crypto Play?

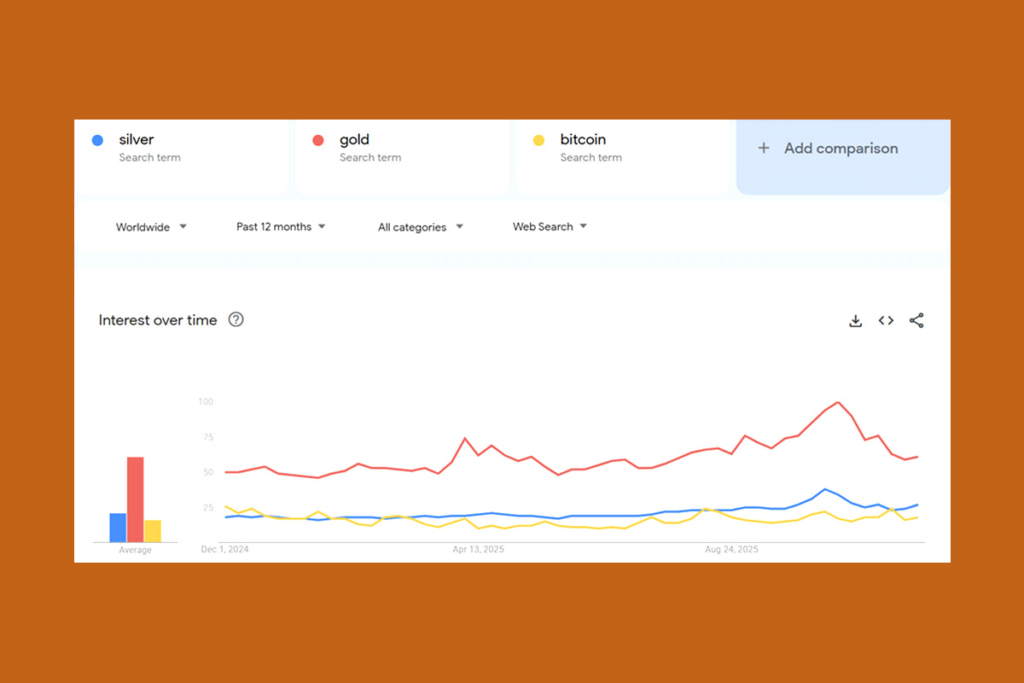

Silver (XAG) reached its highest monthly closing level in 46 years at $58. Thus, retail interest in silver outpaced that of Bitcoin on global Google Trends. Tokenized silver is a new frontier that investors are investigating as a result of this development. Analysts predict that digital silver might emerge as the next significant on-chain asset class as precious-metal availability increases.

Silver just hit $58 and gave its highest monthly close after 46 years. We can see a massive amount of liquidity in US stocks, gold, and now silver. Sooner or later, this will likely flow into riskier assets, such as Bitcoin and cryptocurrencies. The bull market is not over, it’s delayed,

analyst Ash Crypto

The spike is indicative of a general move of capital toward hard assets as supply restrictions, industrial demand, and worldwide inflation increase. The silver-to-Bitcoin ratio has also reversed a ten-year downward trend. This indicates a significant change in the way institutional and individual investors assess store-of-value assets. As a result, it paved the way for the ascent of tokenized silver.

The Future of Silver Is Tokenized, Transparent, and Always Accessible

The tokenized silver market is still in its infancy despite the increase in the price of XAG. CoinGecko only lists a small number of projects, including Kinesis Silver (KAG) and Gram Silver (GRAMS). However, the basics are getting stronger. Tokenized silver is quickly changing how investors access and engage with the precious metals market, according to Commodity Block research. These days, it provides several benefits that traditional silver markets find difficult to match, such as the following:

- Silver fractional ownership

- 24-hour global trading

- Unchangeable traceability and provenance

- Use in DeFi as collateral

Economic Uncertainty Spurs Interest in Tokenized Silver

The movement of real-world assets (RWAs) onto blockchain is a larger trend that is consistent with the allure of tokenized silver. Silver is in a unique position to be adopted digitally because of its twin function as an industrial metal and an investment hedge. Important motivators include:

- Increasing interest in fractional investing

- Rising acceptance of silver-backed collateral in DeFi networks

- Growing concern over ethical sourcing, which is supported by blockchain transparency

- Widespread interest in alternative stores of value during uncertain economic times

Interest in silver is growing as key ratios break out and prices soar. Tokenized silver might be poised to emerge as the next significant RWA category in cryptocurrency as retail demand keeps rising. The question for 2025 is not whether tokenized silver will see growth, but rather how quickly, as liquidity shifts from metals to digital assets.

For more up-to-date crypto news, you can follow Crypto Data Space.

Comments are closed.